- United States

- /

- Luxury

- /

- NYSE:TPR

What Does Tapestry’s 123.7% Rally and Acquisition Buzz Mean for Its Valuation in 2025?

Reviewed by Bailey Pemberton

- Curious if Tapestry stock is a deal or just dazzling from afar? Let's take a closer look at what the current price might really mean for you.

- Tapestry has had a wild ride, with shares up 66.6% so far this year and a jaw-dropping 123.7% gain over the past 12 months, despite a more recent dip of -3.2% in the past week.

- Shares surged earlier this year after reports of a strategic acquisition and continued speculation about the company's evolving brand portfolio, keeping investor optimism high. Headlines about potential synergies and market expansion have added fuel to the fire and driven sentiment around the stock’s growth potential.

- However, according to our valuation checks, Tapestry only scores 1 out of 6 on the undervalued criteria. This suggests there is more to the story here than just the numbers on the screen. Before you decide if the price is right, let's dig into how these valuations are calculated. We will also cover an even deeper approach before we wrap up.

Tapestry scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tapestry Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the present value of a company by projecting its future cash flows and discounting them back to today's dollars. For Tapestry, this involves forecasting how much cash the company may generate in the coming years and determining what that is worth today.

Currently, Tapestry generates $1.07 billion in free cash flow. Analyst projections and further extrapolations indicate that Tapestry's annual free cash flow could increase steadily over the next decade, reaching approximately $2.12 billion by 2035. These forecasts are partially based on analyst estimates for the next five years, with long-term figures extrapolated using Simply Wall St's modeling.

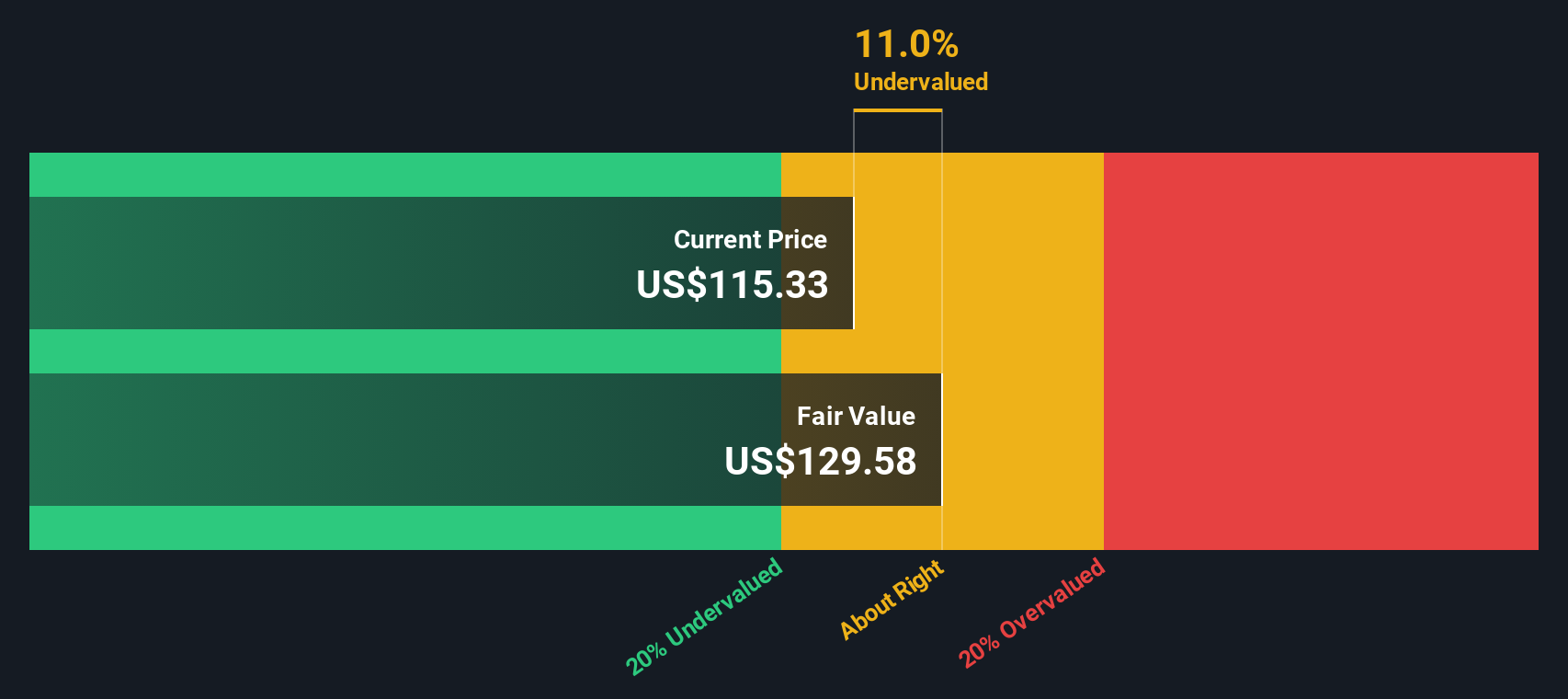

Based on this comprehensive cash flow projection, the DCF analysis estimates a fair value of $129.48 per share for Tapestry. This figure reflects a 15.6% discount to the current share price, suggesting the stock is notably undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tapestry is undervalued by 15.6%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Tapestry Price vs Earnings

For established, profitable companies like Tapestry, the price-to-earnings (PE) ratio is one of the most widely used valuation measures. It tells investors how much they are paying for each dollar of current earnings and is especially relevant since it reflects the market’s sentiment about future profit growth and risk.

What is considered a "fair" PE ratio can differ depending on how fast a company is expected to grow and the certainty of those prospects. Companies with higher expected growth or lower risk tend to command higher PE ratios, while slow growers or those with more business risks typically trade at lower multiples.

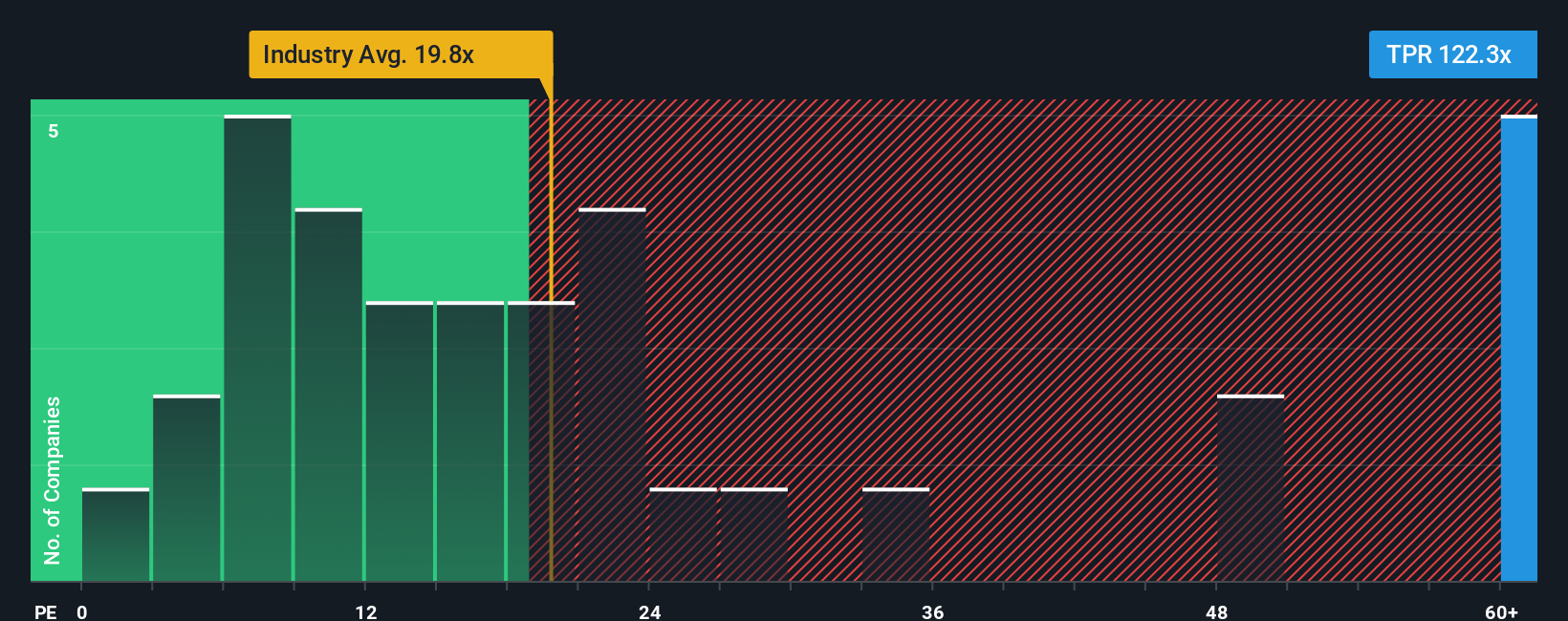

Right now, Tapestry trades at a PE ratio of 123.5x. That is far above the broader luxury industry average of 20.6x, and also noticeably higher than the company’s peer average of 31.9x. On the surface, this could suggest Tapestry is aggressively priced compared to its sector and competitors.

However, Simply Wall St’s "Fair Ratio" provides a more tailored benchmark by taking into account not just industry and peers, but also Tapestry’s unique business profile. This includes earnings growth, profit margins, market cap, and risk factors. For Tapestry, the Fair PE Ratio is calculated at 25x. This number is a more precise estimate of the multiple Tapestry deserves right now, making it more meaningful than simple apples-to-apples comparisons.

Given Tapestry’s current PE (123.5x) is much higher than its Fair Ratio (25x), the stock appears significantly overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tapestry Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your personal investment story for a company like Tapestry. It lets you choose your own expectations around future revenue, earnings, and profit margins, then instantly converts those beliefs into a projected fair value per share, placing your perspective at the center of the investment process, not just the market's average view.

Narratives work by linking your unique outlook on Tapestry’s future, such as international expansion, risk of changing consumer tastes, or margin improvements, to a dynamic financial forecast and a fair value, updating automatically as fresh news or earnings are released. This makes Narratives an accessible and powerful tool for smarter investing, right on Simply Wall St's Community page, where millions of investors share their perspectives.

By comparing your Narrative’s fair value with the current price, you can decide more confidently when to buy or sell, knowing your logic is grounded in both the company’s story and the hard numbers. For example, some investors are especially optimistic about Coach’s global growth, assigning fair values as high as $139 per share, while others take a more cautious stance, perhaps due to brand mix risks or tariffs, and arrive at values as low as $66. Narratives let you see these viewpoints, pressure-test your own, and invest with greater clarity and conviction.

Do you think there's more to the story for Tapestry? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tapestry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPR

Tapestry

Provides accessories and lifestyle brand products in North America, Greater China, rest of Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives