- United States

- /

- Consumer Durables

- /

- NYSE:SGI

Somnigroup International (NYSE:SGI): Revisiting Valuation After a Notable Rally and Recent Pullback

Reviewed by Simply Wall St

Somnigroup International (NYSE:SGI) has caught the attention of investors lately, with its stock experiencing a modest dip over the past week. Share performance now invites a closer look at what is driving this movement.

See our latest analysis for Somnigroup International.

After a standout rally this year, Somnigroup International’s share price has cooled recently, losing some short-term steam while still boasting an impressive year-to-date share price return above 50%. Its one-year total shareholder return of nearly 58% highlights continued long-term momentum as the company adapts to new opportunities and challenges.

If you’re keen to see what other stocks are catching momentum, this is a smart time to broaden your search and discover fast growing stocks with high insider ownership

But with shares hovering near record highs and analysts setting targets well above the current price, the question remains: is Somnigroup International trading at a discount, or is the market already factoring in the company’s future growth?

Most Popular Narrative: 14% Undervalued

Somnigroup International's most followed narrative sets its fair value at $97.50, which is well above its last close of $83.88. This signals that analysts see potential for further upside if forecasts are realized.

The ongoing integration of Mattress Firm is viewed as a strategic advantage that could enhance both operational efficiency and market reach. Solid international growth trends and encouraging back-to-school indicators suggest potential upside for the upcoming Holiday period and beyond.

Want to see what’s fueling this bold price target? The full story includes ambitious assumptions on rapid earnings growth, surging margins, and a multiple reserved for market leaders. Interested in the details? Find out what’s really driving analyst optimism in the complete narrative.

Result: Fair Value of $97.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high input costs or a lasting shift in consumer demand away from durable goods could quickly challenge Somnigroup International’s upbeat outlook.

Find out about the key risks to this Somnigroup International narrative.

Another View: What Do the Numbers Really Say?

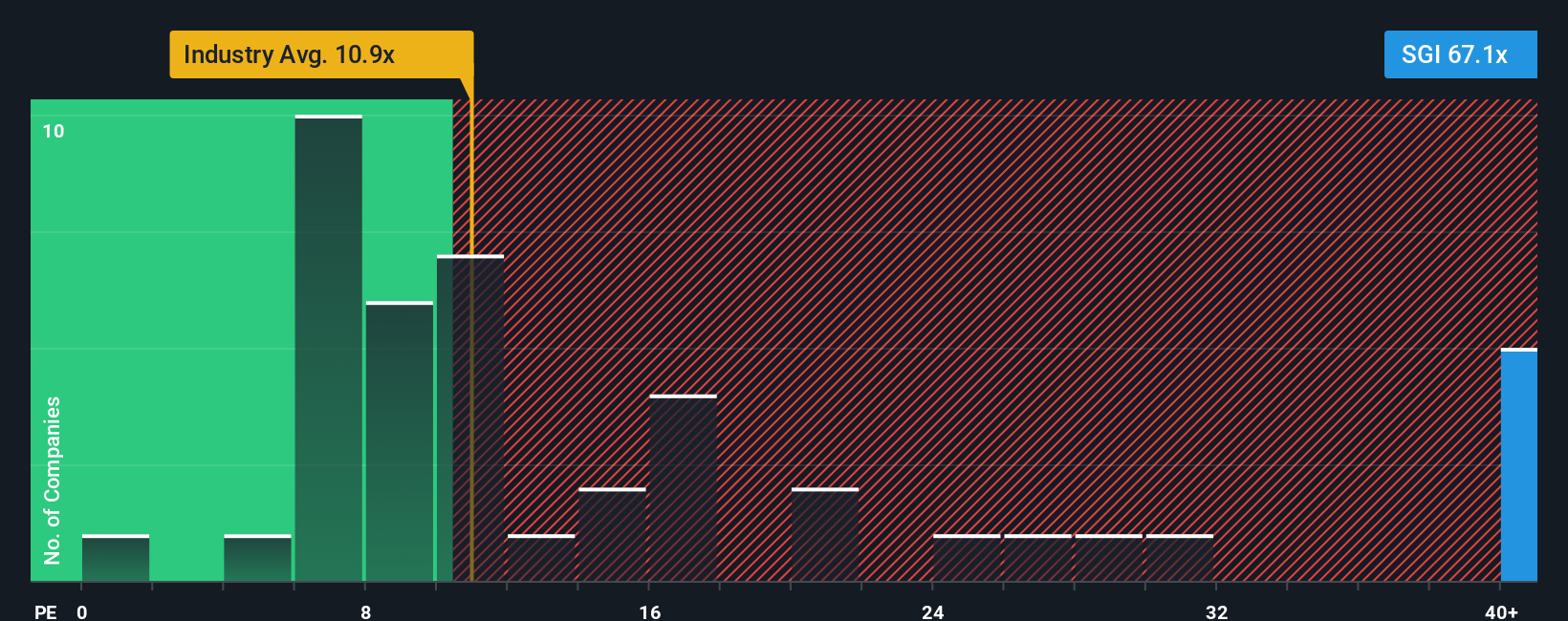

While analyst forecasts point to upside, Somnigroup International’s price-to-earnings ratio stands at 55.9x, which is far higher than the industry average of 11x and a fair ratio of 25.6x. This premium price suggests investors are banking on continued outperformance, but it also raises big questions about future risks if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Somnigroup International Narrative

Keep in mind, if you have a different perspective or want to dig into the numbers on your own, you can easily craft your own take in just a few minutes with Do it your way.

A great starting point for your Somnigroup International research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investing Ideas?

Taking action now means you won’t miss the latest trends or hidden gems. These handpicked stock ideas can help you level up your portfolio in minutes.

- Uncover big yield opportunities and boost your income stream with these 18 dividend stocks with yields > 3%, which consistently deliver strong dividends above 3%.

- Catch the wave of cutting-edge innovation by backing these 27 AI penny stocks, poised to lead in artificial intelligence growth and disruption.

- Strengthen your investments with these 901 undervalued stocks based on cash flows, primed for value and potential upside based on powerful cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SGI

Somnigroup International

Designs, manufactures, distributes, and retails bedding products in the United States and internationally.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives