- United States

- /

- Luxury

- /

- NYSE:RL

Is Ralph Lauren Still Attractive After 54% Rally and Global Expansion Headlines?

Reviewed by Bailey Pemberton

- Wondering whether Ralph Lauren stock is still a value opportunity, especially after such a big run? You are not alone. Let's get into why today's price could be just the start of the story.

- The stock has surged an impressive 53.9% over the past year, with a 40.2% gain year-to-date and a 4.9% climb just in the last month. This signals fresh optimism from investors.

- Much of that enthusiasm appears linked to stronger momentum for the Ralph Lauren brand and investor excitement around the company’s strategic international expansion moves. Recent headlines have focused on Ralph Lauren's growing presence in new markets and positive sentiment in the broader consumer sector.

- Based on our criteria, Ralph Lauren scores just 2 out of 6 on our undervaluation checks. This suggests there is more to uncover than headline numbers reveal. Up next, we will break down how the numbers stack up using different valuation methods and share an approach savvy investors rely on at the end of the article.

Ralph Lauren scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ralph Lauren Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model aims to estimate the true value of a company by projecting its future cash flows and then discounting those amounts to today's dollars. This approach provides investors with an intrinsic value to compare with the current market price.

For Ralph Lauren, the current Free Cash Flow is $800.41 million, with projections showing steady growth over the next decade. By 2030, Free Cash Flow is estimated to reach approximately $1.35 billion. It is important to note that while analysts provide estimates up to five years out, beyond that, platforms such as Simply Wall St extrapolate the data.

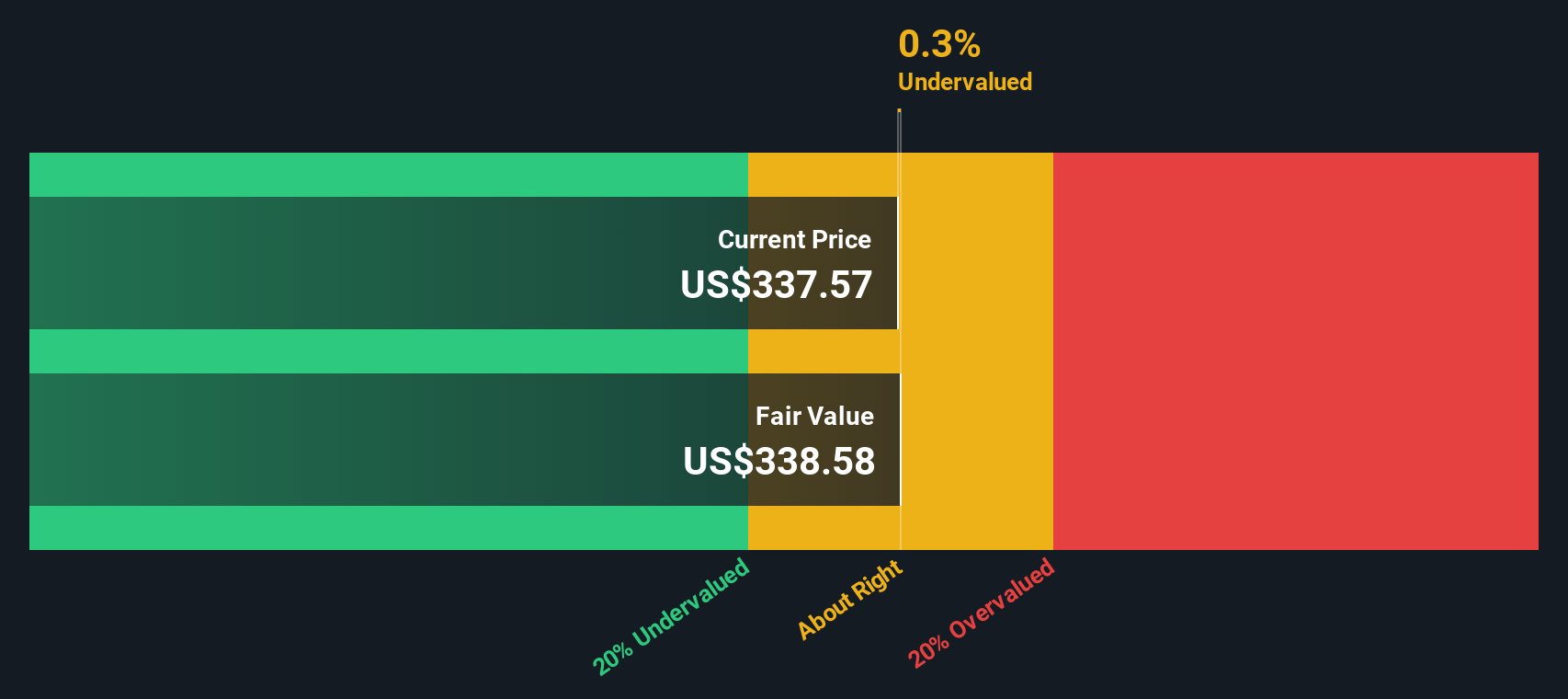

Using this two-stage DCF model, Ralph Lauren's fair value is calculated at $375.37 per share. This calculation suggests the stock is trading at a 13.5% discount to its intrinsic value, indicating it may be undervalued based on future cash flow potential and current market pricing.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ralph Lauren is undervalued by 13.5%. Track this in your watchlist or portfolio, or discover 881 more undervalued stocks based on cash flows.

Approach 2: Ralph Lauren Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Ralph Lauren. This metric offers a quick snapshot of what investors are willing to pay today for each dollar of company earnings. When a business is generating strong and predictable profits, the PE ratio helps investors compare value across similar companies.

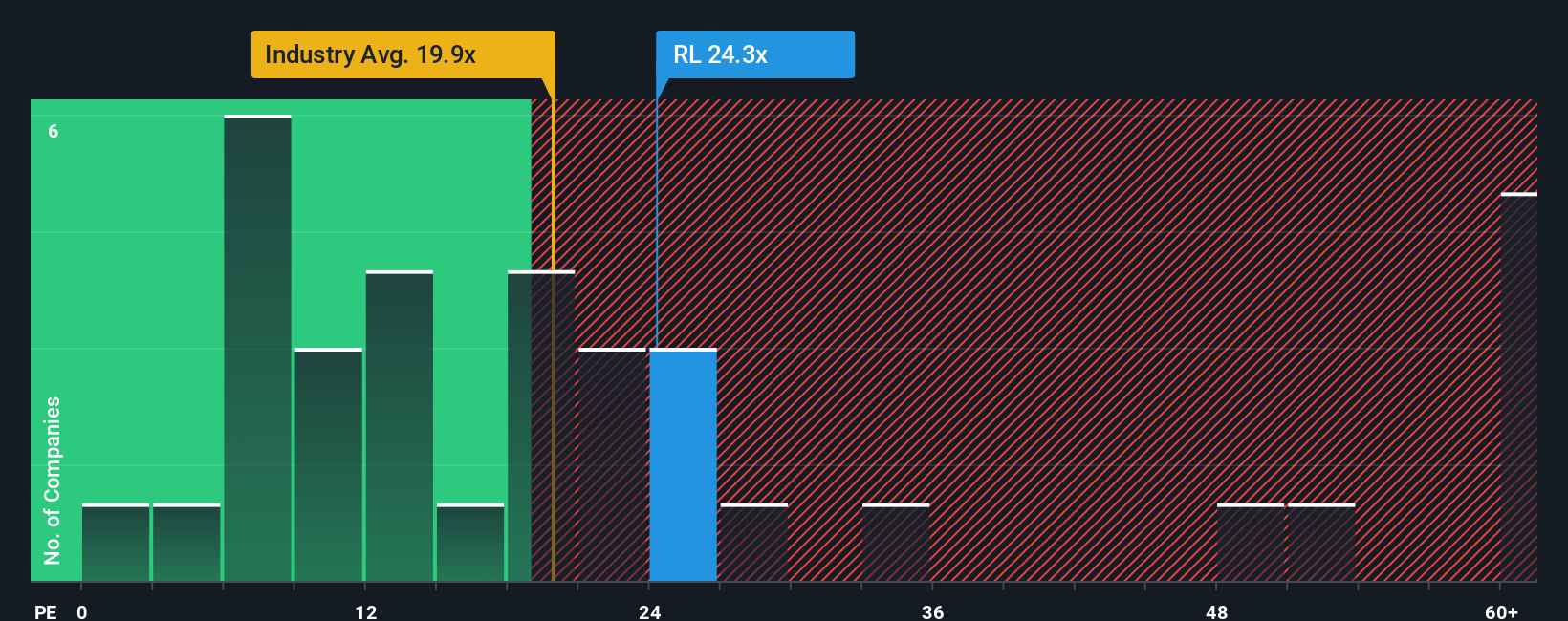

A company’s PE ratio is influenced by the market’s expectations for its future growth and the risks involved. Businesses with higher expected growth typically command higher PE ratios, while those seen as riskier tend to trade at a discount. Balancing these factors, industry benchmarks provide useful context for understanding what a “normal” or “fair” PE might look like.

At present, Ralph Lauren trades at a PE of 23.05x. This is higher than the luxury industry average of 18.43x, but significantly below the peer group average of 44.37x. While these comparisons give some perspective, Simply Wall St’s proprietary Fair Ratio goes a step further. This Fair Ratio of 17.50x is a calculation tailored to Ralph Lauren, factoring in its unique growth outlook, profit margins, market cap, industry position, and specific business risks. Unlike headline comparisons, the Fair Ratio aims to pinpoint what investors should expect to pay given all these attributes.

Compared to its Fair Ratio, Ralph Lauren’s actual PE is higher (23.05x vs 17.50x). This suggests that the stock is trading at a premium based on its current earnings profile and risk-adjusted outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

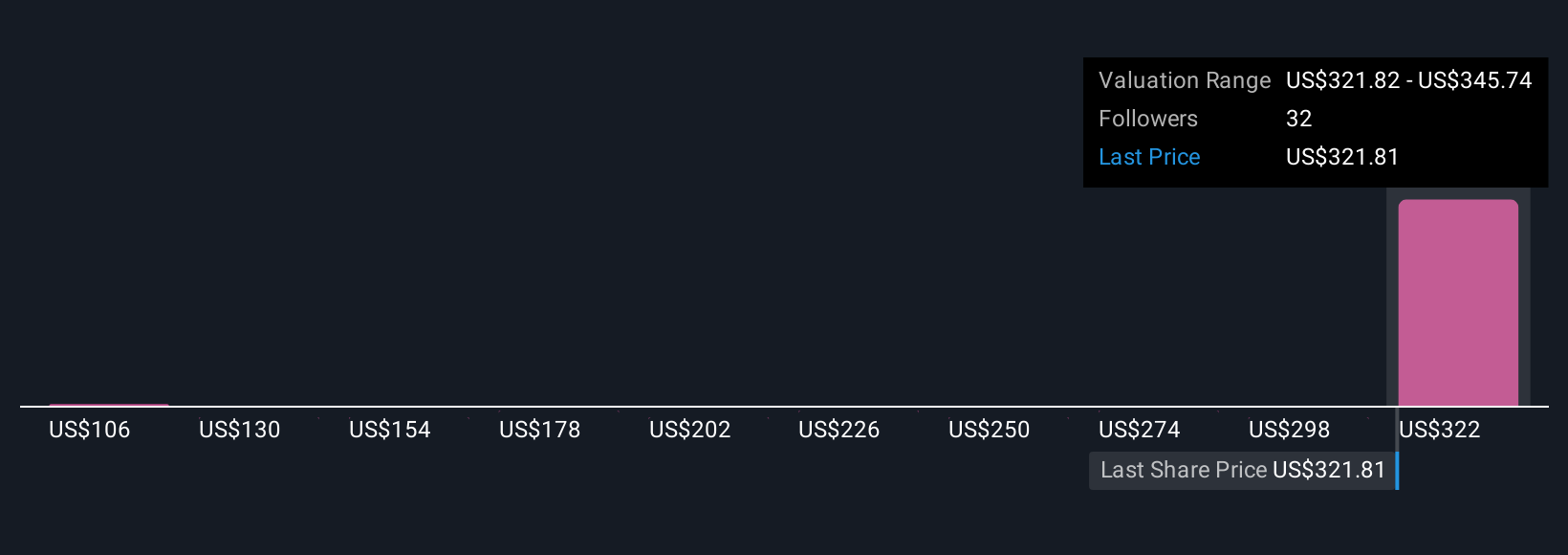

Upgrade Your Decision Making: Choose your Ralph Lauren Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company—a way to connect what you know and believe (from recent news, earnings, strategy, and risks) to hard numbers like future revenue, earnings, and fair value. Instead of relying solely on standard metrics, a Narrative gives you the power to explain why Ralph Lauren might outpace, meet, or fall short of expectations, grounding your perspective in both the company's outlook and your own insights.

Narratives on Simply Wall St’s Community page make this process easy and accessible for investors at any level, allowing you to see how your view stacks up against thousands of others. Each Narrative links the company’s latest story to an updated financial forecast and a calculated fair value, helping you decide whether the current price is attractive. You might view the stock as undervalued if it’s below your fair value, or potentially overvalued if it’s above. As new information comes in, Narratives are automatically refreshed, so your assumptions and conclusions stay current in real time.

For Ralph Lauren, for example, some investors use Narratives to justify bullish fair values as high as $423, banking on global expansion and digital strength. Others set more cautious targets around $185 due to margin risks and uncertain macro conditions. Narratives put your voice in the valuation equation and empower smarter, story-driven investment decisions.

Do you think there's more to the story for Ralph Lauren? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives