- United States

- /

- Leisure

- /

- NYSE:RGR

Sturm, Ruger & Company, Inc.'s (NYSE:RGR) Popularity With Investors Under Threat As Stock Sinks 27%

Sturm, Ruger & Company, Inc. (NYSE:RGR) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 17% share price drop.

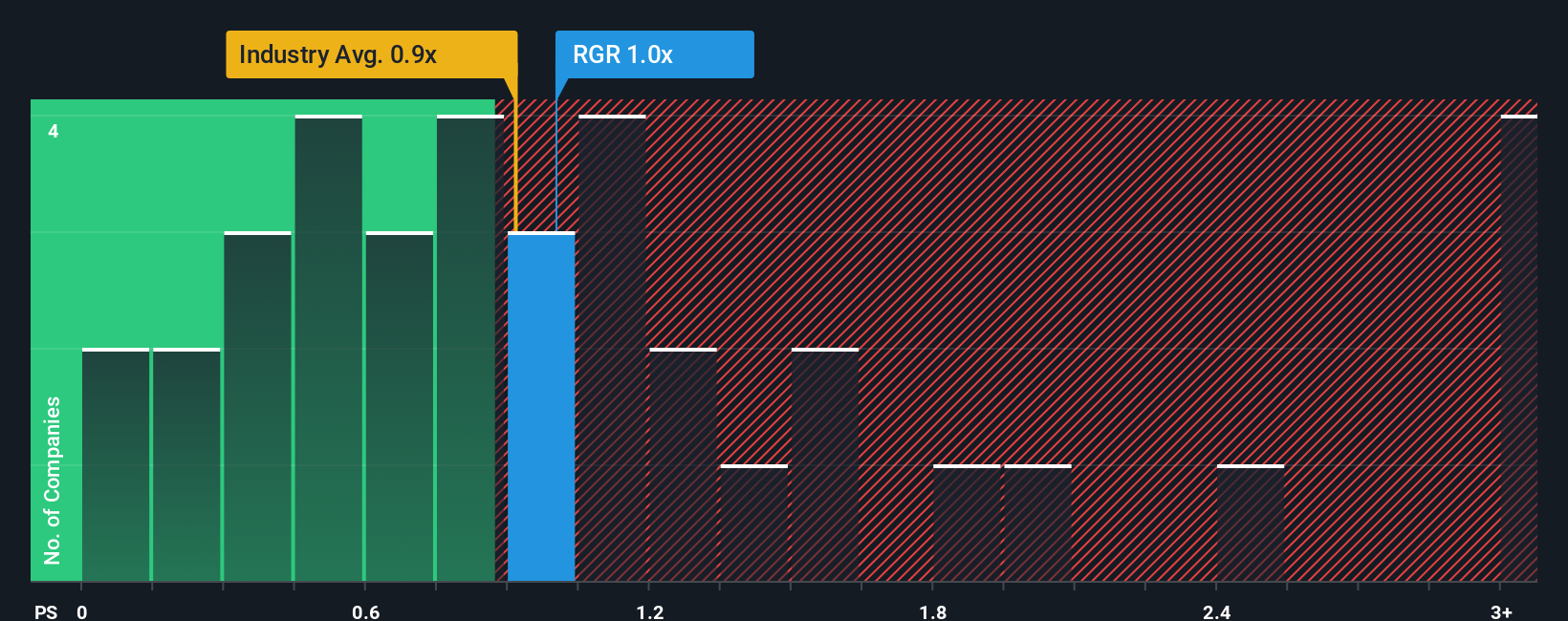

In spite of the heavy fall in price, there still wouldn't be many who think Sturm Ruger's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in the United States' Leisure industry is similar at about 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Sturm Ruger

How Sturm Ruger Has Been Performing

Recent times have been pleasing for Sturm Ruger as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Sturm Ruger will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Sturm Ruger will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Sturm Ruger's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 12% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 0.4% as estimated by the dual analysts watching the company. With the industry predicted to deliver 4.8% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Sturm Ruger's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Sturm Ruger's P/S?

With its share price dropping off a cliff, the P/S for Sturm Ruger looks to be in line with the rest of the Leisure industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Sturm Ruger's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Sturm Ruger (at least 1 which is significant), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RGR

Sturm Ruger

Designs, manufactures, and sells firearms under the Ruger name and trademark in the United States.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives