- United States

- /

- Consumer Durables

- /

- NYSE:MTH

Does Meritage Homes’ (MTH) Steady Dividend Amid Softer Earnings Reveal a Shifting Growth Strategy?

Reviewed by Sasha Jovanovic

- Meritage Homes recently announced a quarterly dividend of US$0.43 per share, payable on December 31, 2025, matching previous dividends, with an ex-date and record date of December 17, 2025.

- Despite missing analysts' expectations on both earnings per share and revenue, the company projected Q4 2025 home closing revenue supported by an increased community count, signaling a continued focus on growth in homebuilding activity.

- We'll explore how maintaining the dividend amid softer earnings and increased community count could impact Meritage Homes' broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Meritage Homes Investment Narrative Recap

To be a shareholder in Meritage Homes, one would need to believe in the company's capacity to capture new-home demand through its expanding community count, despite ongoing margin and earnings pressures tied to housing affordability. The consistent dividend announcement does not materially change the most important short-term catalyst, community count growth, or the biggest risk, which is persistent margin compression from affordability challenges and competitive pressures.

Among recent company actions, the maintained quarterly dividend of US$0.43 per share stands out. This persistence, even with softer earnings, highlights management's approach to financial stability while the company seeks to unlock value from its ongoing build-out of new communities, which remains central to driving future revenue opportunities.

Yet, in contrast, investors should be aware of ongoing margin risk if affordability headwinds and buyer hesitation continue to persist as...

Read the full narrative on Meritage Homes (it's free!)

Meritage Homes' outlook projects $7.1 billion in revenue and $549.0 million in earnings by 2028. This requires 4.8% annual revenue growth but a decrease in earnings of $89.3 million from the current $638.3 million.

Uncover how Meritage Homes' forecasts yield a $82.62 fair value, a 13% upside to its current price.

Exploring Other Perspectives

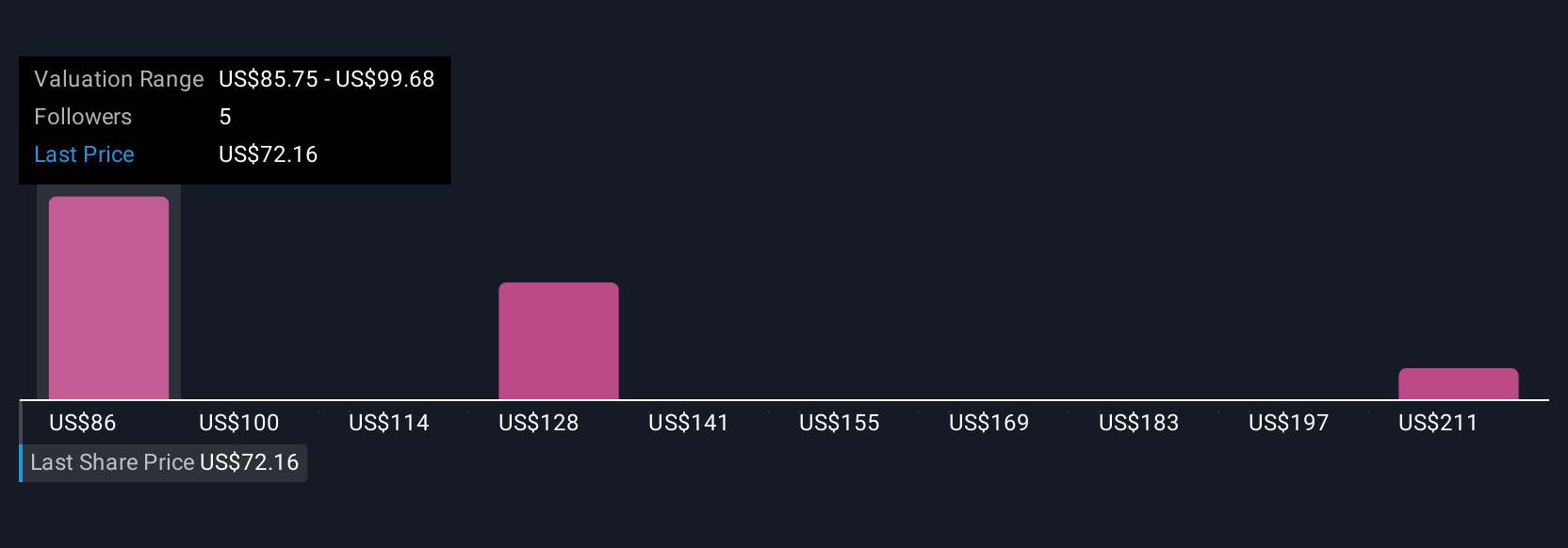

The Simply Wall St Community has published four fair value estimates for Meritage Homes, ranging from US$60 to US$324.98 per share. While many see opportunity in the company's growing footprint, some remain focused on the challenge of protecting margins as affordability pressures linger, inviting you to compare these varied viewpoints for yourself.

Explore 4 other fair value estimates on Meritage Homes - why the stock might be worth over 4x more than the current price!

Build Your Own Meritage Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meritage Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meritage Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meritage Homes' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTH

Meritage Homes

Designs and builds single-family attached and detached homes in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success