Stock Analysis

- United States

- /

- Leisure

- /

- NYSE:MPX

Improved Earnings Required Before Marine Products Corporation (NYSE:MPX) Stock's 25% Jump Looks Justified

Those holding Marine Products Corporation (NYSE:MPX) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 3.0% isn't as attractive.

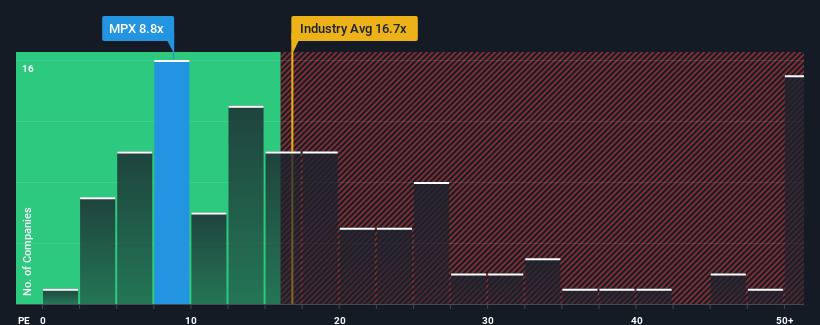

Even after such a large jump in price, Marine Products may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 34x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Marine Products as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Marine Products

How Is Marine Products' Growth Trending?

In order to justify its P/E ratio, Marine Products would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 29%. The latest three year period has also seen an excellent 196% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 4.4% over the next year. With the market predicted to deliver 10% growth , that's a disappointing outcome.

In light of this, it's understandable that Marine Products' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Marine Products' P/E

Marine Products' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Marine Products maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Marine Products has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Marine Products is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MPX

Marine Products

Marine Products Corporation designs, manufactures, and sells recreational fiberglass powerboats for the sport boat and sport fishing boat markets worldwide.

Flawless balance sheet established dividend payer.