- United States

- /

- Leisure

- /

- NYSE:MODG

Topgolf Callaway Brands Corp. (NYSE:MODG) Held Back By Insufficient Growth Even After Shares Climb 26%

Despite an already strong run, Topgolf Callaway Brands Corp. (NYSE:MODG) shares have been powering on, with a gain of 26% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

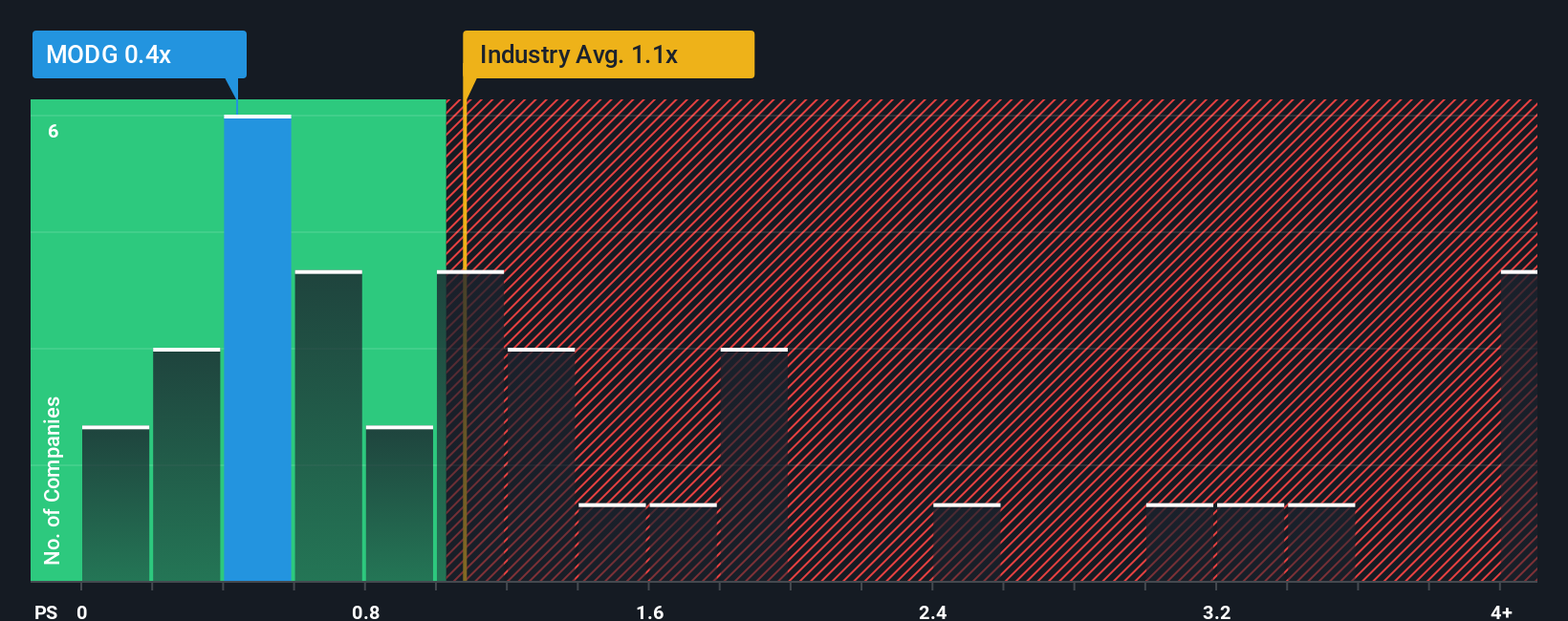

Although its price has surged higher, considering around half the companies operating in the United States' Leisure industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Topgolf Callaway Brands as an solid investment opportunity with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Topgolf Callaway Brands

What Does Topgolf Callaway Brands' P/S Mean For Shareholders?

With only a limited decrease in revenue compared to most other companies of late, Topgolf Callaway Brands has been doing relatively well. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Topgolf Callaway Brands.Is There Any Revenue Growth Forecasted For Topgolf Callaway Brands?

The only time you'd be truly comfortable seeing a P/S as low as Topgolf Callaway Brands' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.7%. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 8.1% over the next year. That's not great when the rest of the industry is expected to grow by 2.1%.

With this information, we are not surprised that Topgolf Callaway Brands is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Topgolf Callaway Brands' P/S Mean For Investors?

Despite Topgolf Callaway Brands' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Topgolf Callaway Brands' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Topgolf Callaway Brands' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Topgolf Callaway Brands that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Topgolf Callaway Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MODG

Topgolf Callaway Brands

Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives