- United States

- /

- Leisure

- /

- NYSE:MODG

How Investors May Respond To Topgolf Callaway Brands (MODG) Expanding Into Midwest With New High-Tech Venues

Reviewed by Sasha Jovanovic

- Topgolf Callaway Brands recently announced the completion of construction on its first Wisconsin venue in Monona and revealed the opening of a second Minnesota venue in Woodbury, with modern features like climate-controlled hitting bays and Toptracer technology.

- These expansions not only introduce Topgolf's interactive golf and entertainment experience to new regional markets, but also signal the company's ongoing commitment to broadening its footprint in the active leisure space.

- We’ll now explore how Topgolf’s entry into new Midwest markets could influence its investment narrative and future growth outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Topgolf Callaway Brands Investment Narrative Recap

To be a shareholder in Topgolf Callaway Brands, you need to believe in the company’s ability to expand its experiential leisure brand and capture new regional audiences, even amidst ongoing margin pressures and executive changes. The latest Midwest openings highlight continued growth, but do not materially alter the immediate challenges of declining same venue sales and exposure to discretionary spending shifts, which remain the most important near-term catalyst and risk factors.

Among recent announcements, the resignation of CEO Artie Starrs stands out as the most relevant, given its proximity to key venue launches and potential implications for management stability during a critical growth phase. Success in scaling new locations could help buffer the pressures affecting comps, but ongoing strategic uncertainty heightens the importance of leadership continuity for navigating both growth and integration initiatives.

However, investors should be aware that despite expanding into new markets, leadership uncertainty during this transition period could...

Read the full narrative on Topgolf Callaway Brands (it's free!)

Topgolf Callaway Brands' outlook anticipates $4.1 billion in revenue and $209.7 million in earnings by 2028. This projection reflects a -0.5% annual revenue decline and a $1.7 billion increase in earnings from current earnings of -$1.5 billion.

Uncover how Topgolf Callaway Brands' forecasts yield a $10.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

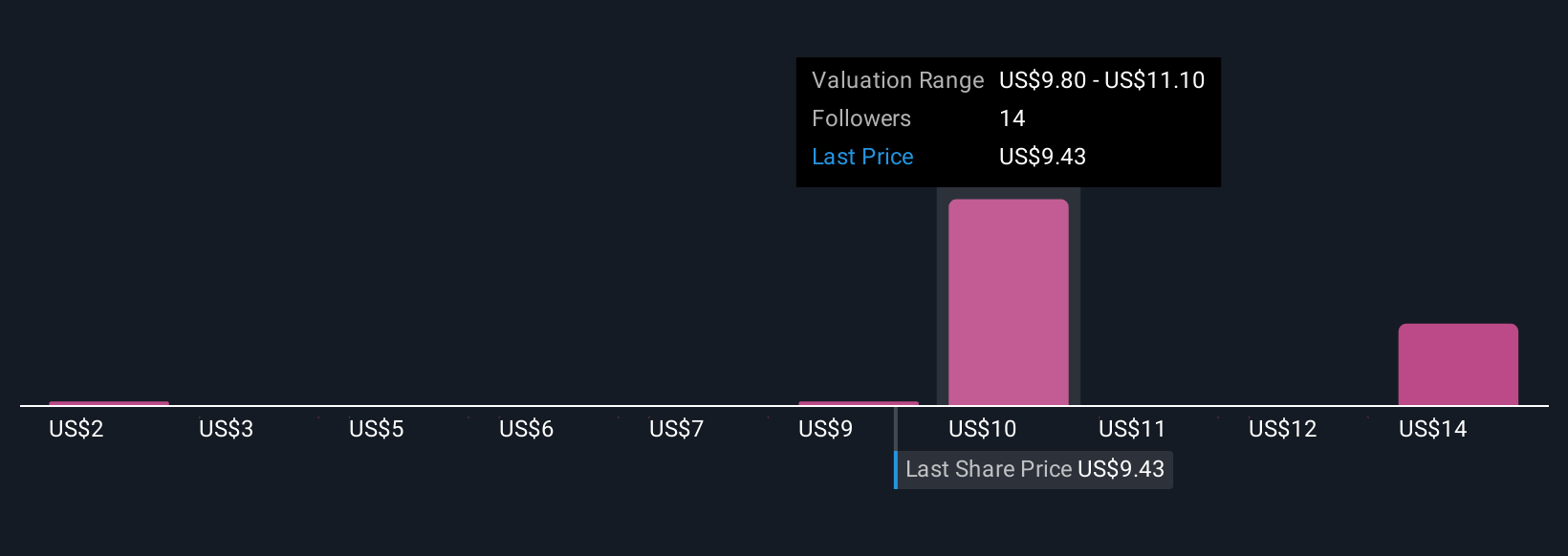

Simply Wall St Community members suggest fair values for Topgolf Callaway Brands spanning US$2.00 up to US$15.00, based on five independent assessments. While some see deep value, concerns around declining same venue sales remain central to the stock’s investment outlook, be sure to consider multiple perspectives before forming your view.

Explore 5 other fair value estimates on Topgolf Callaway Brands - why the stock might be worth as much as 62% more than the current price!

Build Your Own Topgolf Callaway Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Topgolf Callaway Brands research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Topgolf Callaway Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Topgolf Callaway Brands' overall financial health at a glance.

No Opportunity In Topgolf Callaway Brands?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topgolf Callaway Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MODG

Topgolf Callaway Brands

Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives