- United States

- /

- Consumer Durables

- /

- NYSE:KBH

Will Analyst Downgrade After New Openings Challenge KB Home's (KBH) Competitive Positioning?

Reviewed by Sasha Jovanovic

- Earlier this month, KB Home announced the grand openings of new residential communities in locations including Kuna, Idaho and Escondido, California, featuring energy-efficient designs and homeowner personalization options.

- An analyst downgrade followed, raising concerns that government supply-side housing policies could challenge homebuilders like KB Home amid broader sector uncertainties.

- We'll examine how analyst concerns over supply-focused policies following these community expansions impact the company's broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

KB Home Investment Narrative Recap

Owning shares in KB Home means believing in the company’s ability to execute efficient build times and manage inventory while balancing potential demand fluctuations in the US housing market. The recent wave of new community launches, such as in Idaho and California, is unlikely to materially change the biggest catalyst, KB Home’s improved construction cycle, or to ease the current risk of softer home purchase demand tied to macroeconomic uncertainty and updated revenue guidance.

Among several recent announcements, the grand opening of Journeys End in Kuna, Idaho, best highlights KB Home’s ongoing expansion into growing regions with personalized, energy-efficient home designs. These launches appeal to value-seeking buyers and align with the company’s focus on targeted community growth, which supports the most important near-term catalyst, efficient home delivery cycles and quicker sales that could boost revenue and margins.

But for investors, it is important to note that, in contrast to these expansion efforts, there is another risk tied to…

Read the full narrative on KB Home (it's free!)

KB Home's outlook forecasts $6.8 billion in revenue and $496.4 million in earnings by 2028. This is based on a 0.2% annual decrease in revenue and a decline of $125.1 million in earnings from the current $621.5 million.

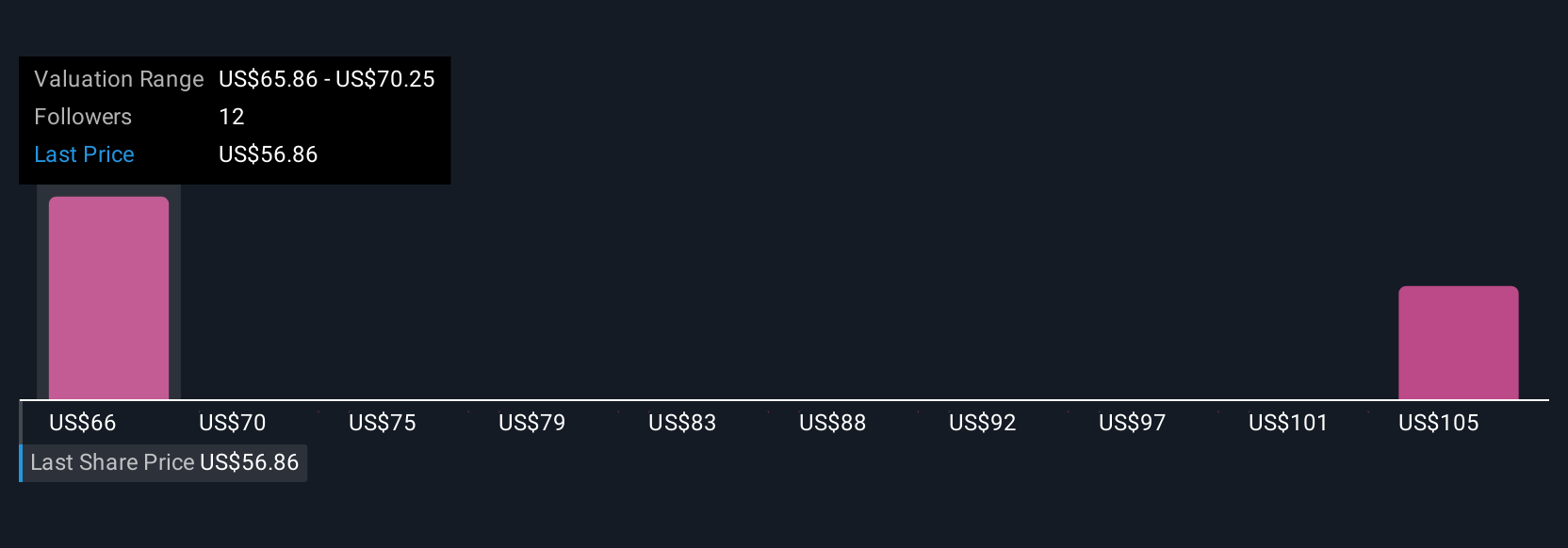

Uncover how KB Home's forecasts yield a $64.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

With four fair value opinions from the Simply Wall St Community spanning from US$46,921 up to a striking US$172,746, you see a broad spectrum of investor views. While opinions differ widely, many are keeping a close eye on risks tied to consumer confidence and fluctuating home purchase demand, both of which could have far-reaching implications for KB Home’s outlook.

Explore 4 other fair value estimates on KB Home - why the stock might be a potential multi-bagger!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives