- United States

- /

- Consumer Durables

- /

- NYSE:KBH

How KB Home's Aggressive Expansion and Debt Moves Could Reshape the KBH Investment Outlook

Reviewed by Sasha Jovanovic

- In recent days, KB Home announced the launch of multiple new residential communities across Texas, Florida, Arizona, California, and Colorado, alongside the successful refinancing and expansion of its revolving credit facility to up to US$1.7 billion and extension of a US$360.0 million term loan.

- This rapid expansion of both operational and financial capacity signals a concerted effort by KB Home to target growth opportunities while enhancing liquidity and flexibility in a changing housing market.

- We will explore how the simultaneous community launches and debt facility expansion shape KB Home's updated investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

KB Home Investment Narrative Recap

To be a KB Home shareholder today, you need to believe in the company’s ability to profitably expand its footprint, even as consumer confidence softens and regional housing markets vary in strength. The recent wave of community launches, together with refinancing and expansion of credit lines, bolsters short-term liquidity and capacity but does not materially alter the most immediate catalyst: whether improved build times and operational flexibility will counterbalance softer demand and regional pricing risks.

The grand opening of Saddlebrook in Texas is such an example of KB Home’s ongoing expansion, providing buyers with customization options and modern amenities. Its timing connects directly to the company’s focus on delivering homes faster, which could be pivotal if efficiency and appeal can drive sales volumes in tougher environments. In contrast, investors should be mindful that continued regional price adjustments and demand headwinds...

Read the full narrative on KB Home (it's free!)

KB Home's narrative projects $6.8 billion revenue and $496.4 million earnings by 2028. This requires a 0.2% yearly revenue decline and a $125 million decrease in earnings from $621.5 million today.

Uncover how KB Home's forecasts yield a $64.67 fair value, a 5% upside to its current price.

Exploring Other Perspectives

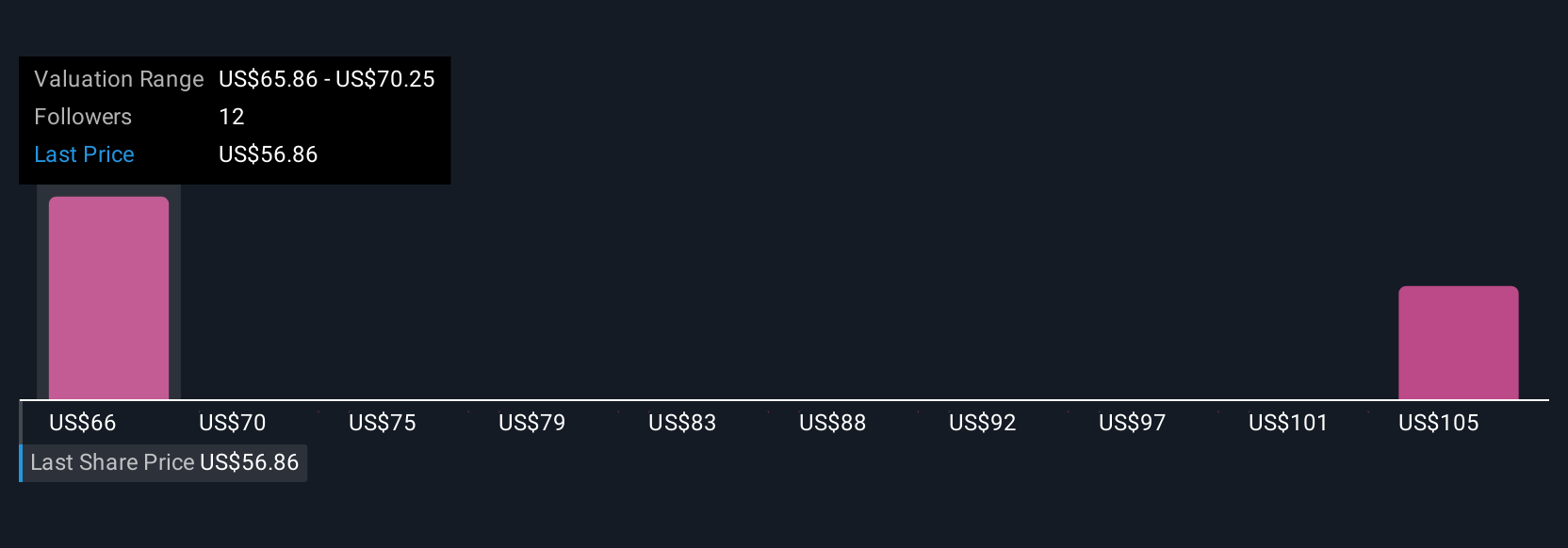

Simply Wall St Community members provided four fair value estimates for KB Home, with figures ranging from US$45.97 to US$172,746.41. While many see opportunity in operational efficiency and expansion, recent revenue softness and regional challenges remind you to consider multiple viewpoints before making any decisions.

Explore 4 other fair value estimates on KB Home - why the stock might be worth 25% less than the current price!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives