Stock Analysis

- United States

- /

- Consumer Durables

- /

- NYSE:IBP

Can You Imagine How Chuffed Installed Building Products's (NYSE:IBP) Shareholders Feel About Its 160% Share Price Gain?

Installed Building Products, Inc. (NYSE:IBP) shareholders have seen the share price descend 27% over the month. But that doesn't change the fact that the returns over the last five years have been very strong. We think most investors would be happy with the 160% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Ultimately business performance will determine whether the stock price continues the positive long term trend.

See our latest analysis for Installed Building Products

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

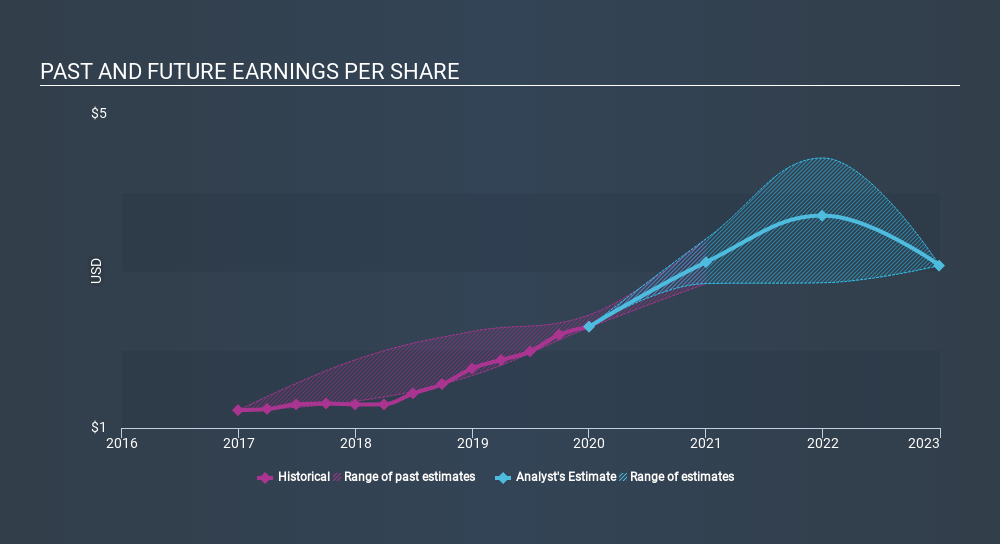

During the five years of share price growth, Installed Building Products moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Installed Building Products share price is up 9.1% in the last three years. Meanwhile, EPS is up 23% per year. This EPS growth is higher than the 3.0% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Installed Building Products has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's nice to see that Installed Building Products shareholders have received a total shareholder return of 26% over the last year. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Installed Building Products is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:IBP

Installed Building Products

Engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States.

Excellent balance sheet with proven track record.