- United States

- /

- Consumer Durables

- /

- NYSE:GRMN

Garmin (GRMN): How Recent CES 2026 Innovation Awards Spotlight Its Valuation

Reviewed by Simply Wall St

Garmin (GRMN) has captured industry attention after winning five CES 2026 Innovation Awards, recognizing groundbreaking products across fashion tech, digital health, sports and pet tech categories. The accolades arrive just before the company's anticipated product showcase at CES 2026.

See our latest analysis for Garmin.

These award wins follow a busy quarter for Garmin, with new product launches, robust financial results, and continued shareholder returns via buybacks and dividends. Even as revenue and net income have climbed, recent market momentum has faded, with a 30-day share price return of -18.9%. However, Garmin’s three-year total shareholder return stands out at 134.9%, which affirms substantial long-term wealth creation for investors even amid near-term volatility.

If Garmin’s innovation story sparked your curiosity, this could be a great moment to expand your investing search and explore fast growing stocks with high insider ownership.

Yet with analyst ratings mixed and recent momentum in the stock lagging, the key question is whether Garmin shares now offer hidden value for long-term investors or if the market has already priced in all that future growth.

Most Popular Narrative: 13% Undervalued

With the most followed narrative pointing to a fair value above the last close of $201.16, all eyes are on Garmin’s growth trajectories, margin resiliency, and forward multiples to see if the current price represents rare upside. Let’s hear what stands out in the reasoning behind this estimate.

The launch of the Garmin Connect+ premium service, which offers AI-based health and fitness insights, is likely to boost subscription-based revenue growth and improve overall margins through higher-margin services. The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Want to know which aggressive growth assumptions are driving this eye-catching fair value? There is a prediction of supercharged recurring revenue streams and higher profits. Garmin’s future, according to this narrative, hinges on bold numbers that only a deep dive will reveal. Hit the link to see just how high these projections go.

Result: Fair Value of $231.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, global trade disruptions or prolonged market softness in Garmin’s Marine and Outdoor segments could quickly challenge these positive projections for future growth.

Find out about the key risks to this Garmin narrative.

Another View: Is Garmin Actually Overpriced?

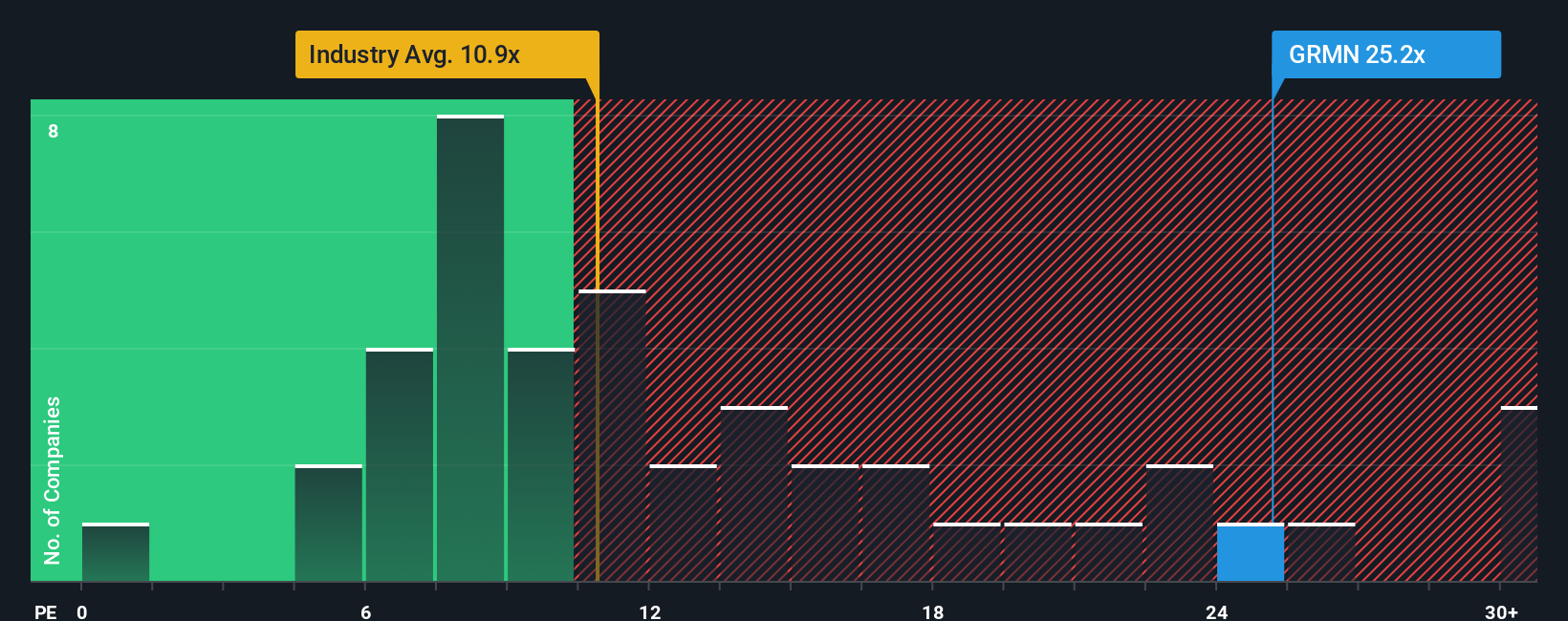

While fair value estimates suggest Garmin is undervalued, a different perspective emerges when looking at its price-to-earnings ratio. Garmin trades at 24.6 times earnings, which is much higher than both the US Consumer Durables industry average of 11 times and its peer average of 23.3 times. The fair ratio, which the market could eventually adjust to, is 18.4 times earnings. This premium spells possible downside risk if sentiment changes. Could the excitement about growth be pushing the stock too far above what is typical?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If these perspectives don’t match your outlook, dive into the data for yourself and shape your own take on Garmin’s future. Do it your way.

A great starting point for your Garmin research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on some of the most exciting opportunities shaping the market. There is a world of potential beyond Garmin. Put your strategy to work with these hand-picked ideas from the Simply Wall Street Screener:

- Find undervalued gems and unlock hidden potential with these 884 undervalued stocks based on cash flows screening for attractive prices based on real cash flow metrics.

- Boost your passive income by targeting reliable yields through these 16 dividend stocks with yields > 3%, spotlighting companies offering strong dividend payouts above 3%.

- Tap into the artificial intelligence wave with these 25 AI penny stocks, featuring forward-thinking businesses fueling breakthroughs in machine learning and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRMN

Garmin

Designs, develops, manufactures, markets, and distributes a range of wireless devices worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives