- United States

- /

- Leisure

- /

- NYSE:GOLF

Acushnet Holdings (GOLF): What the Latest Pullback Means for Its Current Valuation

Reviewed by Simply Wall St

Acushnet Holdings (GOLF) shares have drifted lower over the past week, showing a 7% drop. For investors eyeing the stock’s longer-term trend, performance remains positive with a 23% gain over the past year.

See our latest analysis for Acushnet Holdings.

Acushnet Holdings’ recent dip has taken some steam out of its short-term momentum, but the bigger story is its resilient long-term growth with a notable 23.4% total shareholder return over the past year. The latest share price pullback may simply reflect a pause after a strong run rather than a shift in fundamentals.

If you’re interested in finding more companies with both rapid growth and management skin in the game, consider discovering fast growing stocks with high insider ownership.

With shares off their highs and long-term growth intact, investors face a crucial question: is Acushnet Holdings undervalued after this recent pullback, or has the market already accounted for the company’s future prospects?

Most Popular Narrative: Fairly Valued

Acushnet Holdings’ last close of $76.38 virtually matches the most widely followed narrative fair value of $75.86. The stock’s current price is right in line with consensus, yet the numbers behind this match may surprise you.

The market appears to be pricing in sustained high revenue growth for Acushnet, driven by the global trend toward greater health and wellness. Expectations are that golf's reputation as a low-impact, lifelong sport will fuel ongoing increases in participation rates. If future participation growth underwhelms or reverses, top-line growth could disappoint.

Wondering what assumptions prop up this almost perfect price match? The narrative hinges on sharply defined targets for revenue, earnings, and future profit multiples. Want to know exactly what the consensus is factoring in for Acushnet’s financial future? Dive into the full narrative to get the details.

Result: Fair Value of $75.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, surging global golf participation and resilient premium product launches could still defy expectations and support stronger revenue growth than currently forecast.

Find out about the key risks to this Acushnet Holdings narrative.

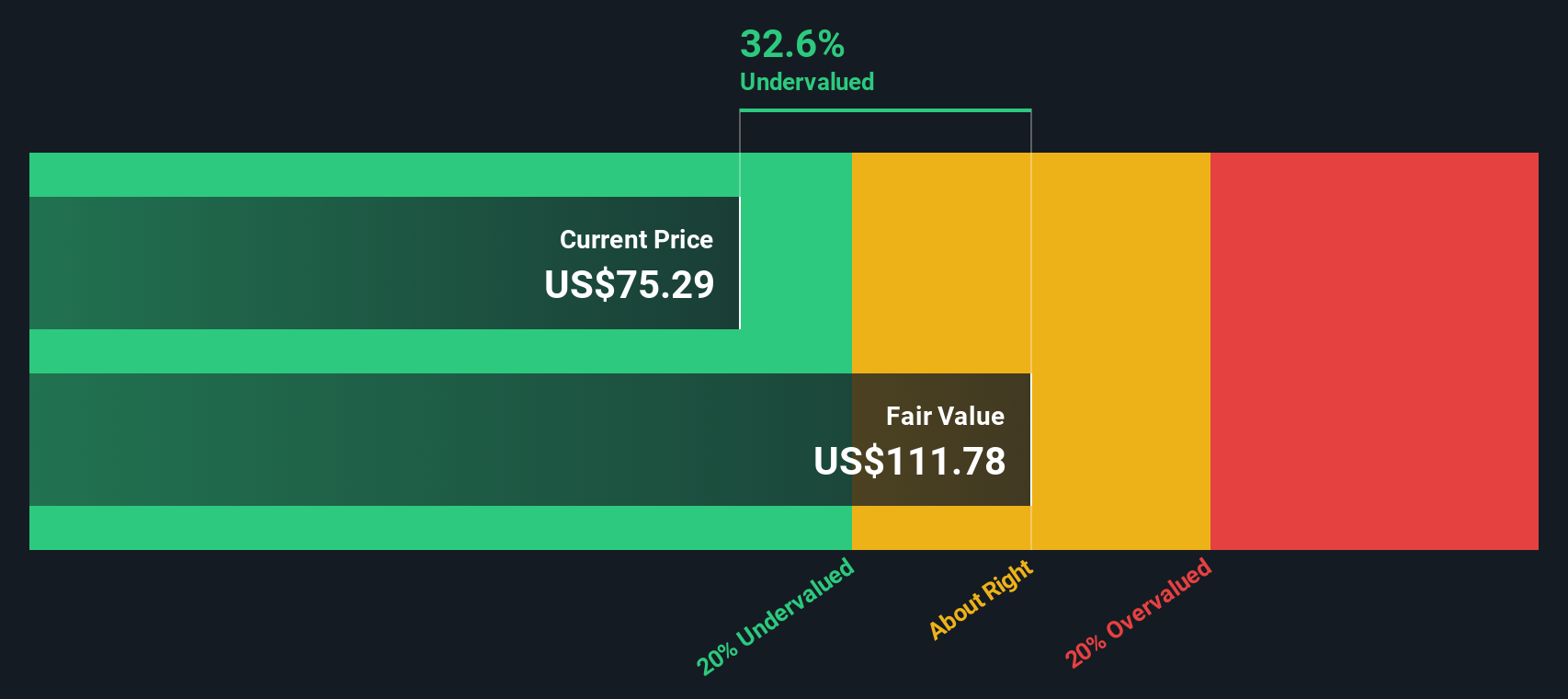

Another View: Discounted Cash Flow Signals Undervaluation

While consensus multiples suggest Acushnet Holdings is fairly valued, our SWS DCF model offers a different perspective. According to this approach, the company is trading 31.9% below its estimated fair value. Could the market be underestimating Acushnet’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acushnet Holdings Narrative

Feel free to dig into the underlying numbers and craft your own view. Exploring the data firsthand often reveals new insights and perspectives. Do it your way

A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and seize opportunities most investors overlook. Unlock smarter strategies with a hand-picked selection of stocks searched by thousands every week.

- Uncover reputable blue-chip opportunities alongside these 843 undervalued stocks based on cash flows for shares that may be trading below their real worth.

- Boost your portfolio’s income potential and stability when you choose these 18 dividend stocks with yields > 3% for solid companies with attractive, consistent yields over 3%.

- Power up your returns with exposure to the rise of digital assets by checking out these 82 cryptocurrency and blockchain stocks driving innovation in cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GOLF

Acushnet Holdings

Designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives