- United States

- /

- Consumer Durables

- /

- NYSE:BLD

TopBuild (BLD) Valuation in Focus After New Analyst Ratings and Insider Selling

Reviewed by Simply Wall St

TopBuild stock has caught fresh attention after RBC Capital issued its first rating on the company. A new analyst perspective from Wells Fargo has also contributed to the renewed interest. Recent insider selling has played into shifting investor sentiment this week.

See our latest analysis for TopBuild.

TopBuild’s share price is showing clear momentum, jumping 5.86% in the last trading session and regaining ground after a muted month. Despite recent insider selling and a wave of fresh analyst coverage, the year-to-date share price return stands at an impressive 38.95%. It is a stock that has kept long-term shareholders happy as well, with a three-year total shareholder return of 186.57%, signaling sustained growth and continued investor confidence.

If TopBuild’s recent surge has you looking for more, now is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With recent analyst upgrades and a strong multi-year return catching investor eyes, the key question remains: is TopBuild still undervalued at current levels, or is the market already pricing in all of its future growth potential?

Most Popular Narrative: 11% Undervalued

According to the most followed narrative, TopBuild's fair value is set above its last close of $431.15, hinting at overlooked upside even after recent gains. Fresh buybacks, raised earnings targets, and a resilient market backdrop power this outlook.

The company's disciplined M&A strategy in a highly fragmented industry, along with investments in operational efficiencies and supply chain optimization, is expected to unlock synergies, expand scale, and drive incremental EBITDA margin improvements. These factors could contribute to stronger future earnings growth.

Want to see what assumptions make this valuation possible? It comes down to a handful of bullish growth bets and a premium profit multiple, usually reserved for high-fliers. Only the full narrative reveals just how ambitious this forecast really is.

Result: Fair Value of $485.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. residential construction or challenges with integrating new acquisitions could undermine TopBuild’s growth story and valuation optimism.

Find out about the key risks to this TopBuild narrative.

Another View: Price vs. Value Gaps Widen

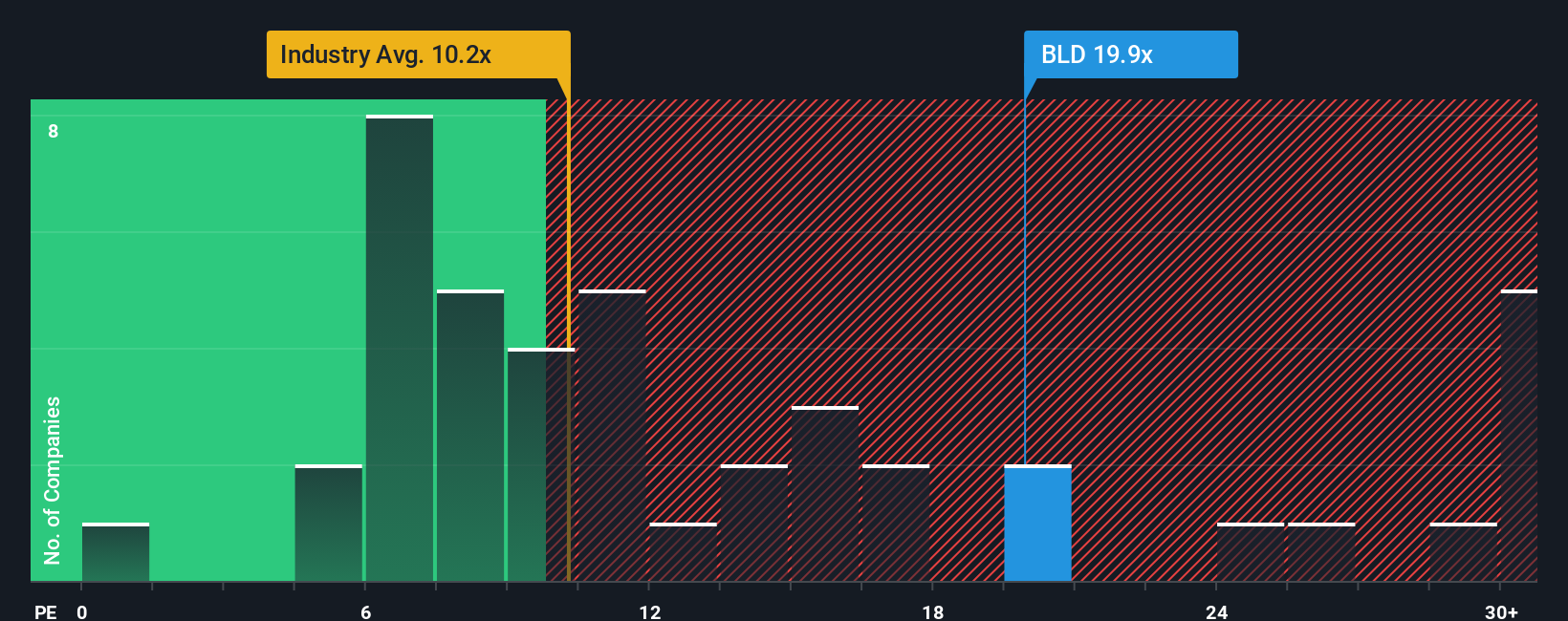

While the first view points to upside, a closer look at TopBuild’s price-to-earnings ratio tells a more expensive story. The company trades at 21.2x earnings, which is well above both peer (15x) and fair ratio (15.9x) levels. This signals the market is pricing in a lot of future growth, raising the stakes if expectations falter. Could this premium become a risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TopBuild Narrative

If these perspectives do not fully capture your own view, you can dig into the numbers yourself and shape your own take in just minutes. All it takes is Do it your way.

A great starting point for your TopBuild research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Time your next move with precision. Expand your horizons using unique stock lists curated by Simply Wall Street and never let a hidden winner pass you by.

- Strengthen your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% offering attractive yields above 3 percent.

- Spot tomorrow’s breakout stocks in artificial intelligence by exploring these 26 AI penny stocks that are transforming industries through automation and advanced analytics.

- Capitalize on market mispricings right now with these 928 undervalued stocks based on cash flows to potentially boost your returns from undervalued gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives