- United States

- /

- Consumer Durables

- /

- NYSE:BLD

TopBuild (BLD) Margin Decline Challenges Bullish Narrative on Profit Resilience

Reviewed by Simply Wall St

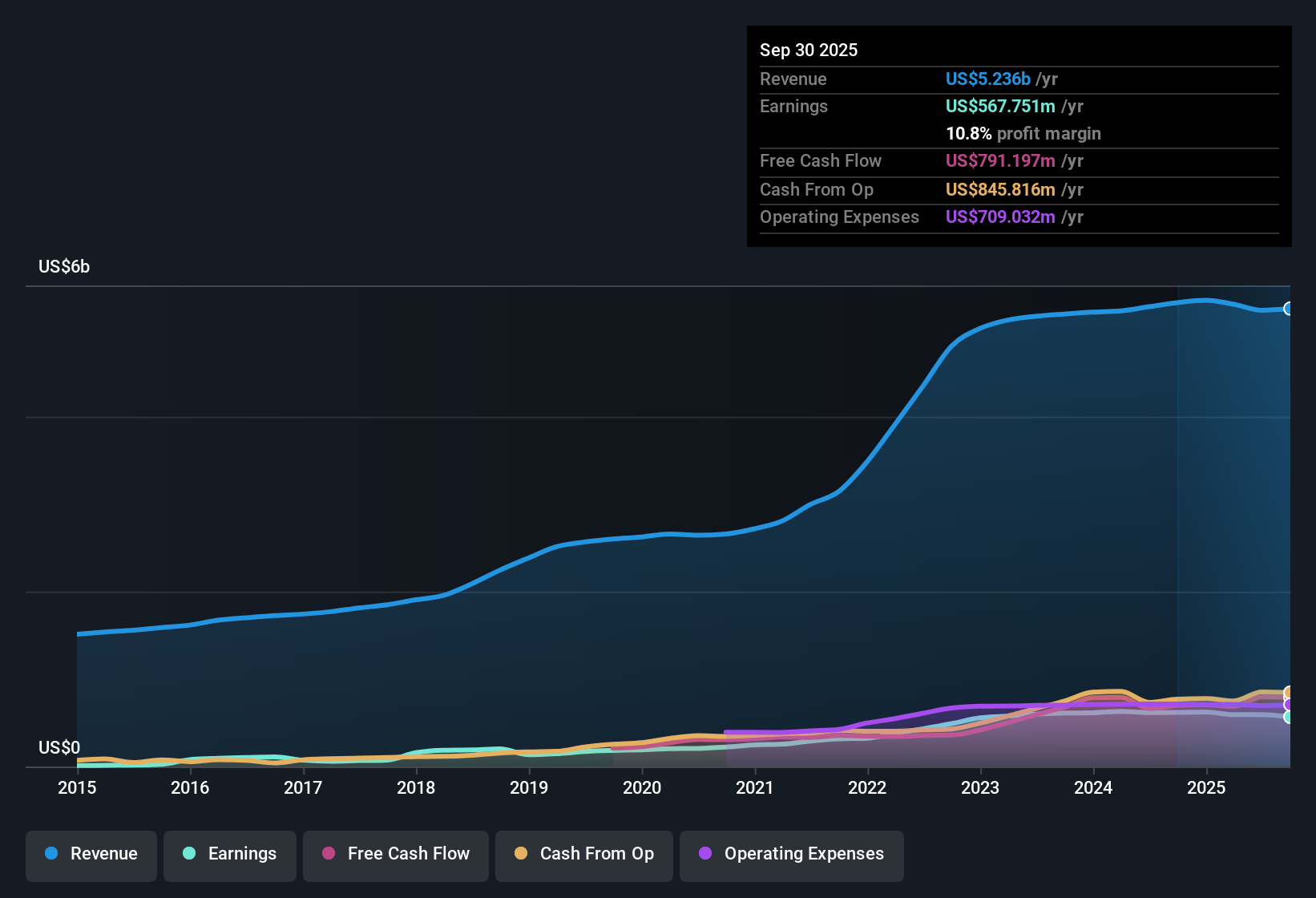

TopBuild (BLD) posted a net profit margin of 10.8%, down from 11.7% the previous year, while the company’s earnings have grown at an annualized rate of 18% over the past five years. However, recent momentum has slowed, with negative earnings growth reported for the most recent period, and forward-looking expectations point to just 2.5% annual earnings growth and 9.9% revenue growth, both trailing behind US market averages. The stock trades at a price-to-earnings ratio of 20.6x, which is a premium to peers and the industry. This sets up investors to weigh a strong long-term record against softer near-term prospects.

See our full analysis for TopBuild.The next section compares these headline numbers with the current narrative from the Simply Wall St community, highlighting where sentiment matches up or diverges from the latest results.

See what the community is saying about TopBuild

Share Count Set to Drop Nearly 5% Annually

- Analysts expect TopBuild’s shares outstanding to shrink by 4.58% each year over the next three years, which could help boost earnings per share even as overall profit growth stays modest.

- According to the analysts' consensus view, this pace of share repurchases supports the company’s push for margin resilience and shareholder returns, especially as revenue growth is predicted at 3.7% annually (slightly behind the US market rate of 10.5%).

- The narrative also ties the reduction in share count to TopBuild’s disciplined M&A strategy in a fragmented market. This approach is intended to complement organic growth and help keep income streams stable even when construction activity is soft.

- At the same time, the path to higher per-share figures through buybacks depends on maintaining balance sheet strength and integrating new acquisitions smoothly. Any missteps could limit the benefit of these capital returns.

- Consensus sees TopBuild’s buyback ambitions as a key lever for growth, but there’s debate on whether this offsets slower profit momentum. See what’s driving the full consensus view. 📊 Read the full TopBuild Consensus Narrative.

Profit Margins Face Cost and Competition Pressures

- Margins are projected to contract from 11.4% now to 10.4% within three years, reflecting both cost headwinds and competitive threats that may not be fully offset by pricing power or M&A synergies.

- Analysts' consensus narrative highlights several challenges:

- Persisting material and labor cost inflation is expected to put sustained pressure on gross and EBITDA margins, as management has already guided for roughly $30 million in near-term price and cost headwinds.

- Rising competition from new building technologies and industry players intensifies the risk that TopBuild’s traditional installation services could lose market share, potentially undermining the long-term bullish thesis of stable or growing profitability.

Premium Valuation Even After Slower Growth

- TopBuild trades at a price-to-earnings ratio of 20.6 times, which is well above both the peer average (14.6 times) and the broader industry (10.4 times), even though its forecasted earnings growth (2.5% per year) trails the US market (16%).

- The analysts' consensus narrative notes that the share price of $418.84 is just 1% above the DCF fair value of $414.11 and 12% below the official analyst price target of $475.41, suggesting that most of the optimism is already reflected in the current stock price.

- Consensus points out that TopBuild’s current premium relates to its long-term record, but with near-term growth lagging the market, the share price may not have much further to run unless the company outpaces these modest projections.

- Investors are encouraged to double-check these numbers against their own expectations, as the narrow gap between the analyst price target and current price signals a balanced risk and reward trade-off, unlike more undervalued peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for TopBuild on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Shape your perspective into a unique narrative in just a few minutes: Do it your way

A great starting point for your TopBuild research is our analysis highlighting 2 important warning signs that could impact your investment decision.

See What Else Is Out There

With TopBuild’s slower earnings growth, narrowing margins, and premium valuation, investors may worry about falling behind stronger US market trends.

If you want to find companies poised for more reliable expansion, use our stable growth stocks screener (2077 results) for stocks that consistently deliver steady growth no matter the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives