- United States

- /

- Consumer Durables

- /

- NYSE:BLD

TopBuild (BLD): Examining Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

TopBuild (BLD) shares saw movement today, sparking interest from investors who have been watching the company’s performance over the past month. The stock posted a 7% gain during this period. This has attracted attention to its recent trading momentum.

See our latest analysis for TopBuild.

TopBuild’s share price rally over the past month stands out in a year that has already seen a 36% gain year-to-date, with the latest moves suggesting momentum is still building. Investors watching the company’s long-term track record will note a strong 19% total shareholder return over the past year, with even more remarkable growth over the last three and five years. This may be a signal that market sentiment is shifting toward growth potential.

If today’s surge sparks your curiosity, it’s a great opportunity to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with TopBuild’s impressive run, investors are left to weigh whether the stock’s fundamentals back up its continued rise, or if enthusiasm has already factored in all future upside. Is there a real buying opportunity here, or is the market already pricing in those growth prospects?

Most Popular Narrative: 11.5% Undervalued

TopBuild’s last close of $420.96 sits well below the most popular narrative’s fair value estimate of $475.41. This suggests notable upside and has fueled bullish sentiment among followers of this outlook.

The company's disciplined M&A strategy in a highly fragmented industry, along with investments in operational efficiencies and supply chain optimization, is expected to unlock synergies, expand scale, and drive incremental EBITDA margin improvements. These actions may contribute to stronger future earnings growth.

What’s behind this gap between price and value? The fair value hinges on ambitious growth targets and a bold margin outlook that could shift the market’s perception. Want to see the detailed forecasts and numbers that are moving this target?

Result: Fair Value of $475.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lasting weakness in U.S. residential construction and challenges integrating new acquisitions could quickly change the outlook for TopBuild's growth narrative.

Find out about the key risks to this TopBuild narrative.

Another View: Multiples Tell a Different Story

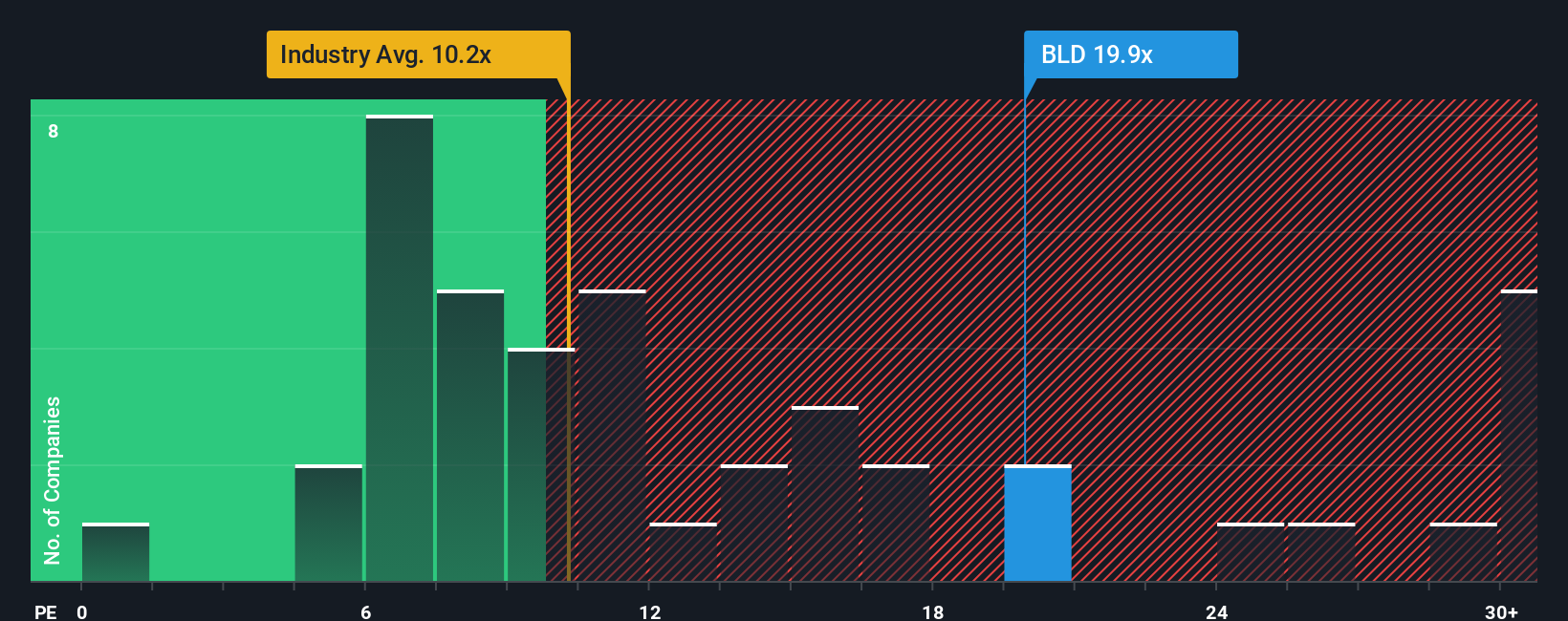

Looking at valuation through the lens of the price-to-earnings ratio, TopBuild trades at 19.8 times earnings, significantly higher than both the industry average of 10.6x and its peer average of 15.1x. The fair ratio also sits lower at 15.8x. This signals TopBuild shares are not a bargain on this measure, and the market may be pricing in quite a bit of optimism. Could the premium be justified, or is there valuation risk if expectations do not play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TopBuild Narrative

If you’d rather follow your own path or want to dig deeper into the numbers, you can generate a fresh TopBuild narrative in just minutes: Do it your way

A great starting point for your TopBuild research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit your opportunities. Give yourself an edge by uncovering stock ideas others might miss using the Simply Wall Street Screener. More growth, income, and innovation await savvy investors like you.

- Power up your portfolio with reliable income choices by checking out these 24 dividend stocks with yields > 3% offering attractive yields and long-term stability.

- Catch the momentum in emerging technology by tapping into these 26 AI penny stocks, where the brightest artificial intelligence players are fueling rapid gains.

- Seize hidden value opportunities in overlooked markets by reviewing these 848 undervalued stocks based on cash flows based on robust cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TopBuild might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLD

TopBuild

Engages in the installation and distribution of insulation and other building material products to the construction industry.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives