- United States

- /

- Consumer Durables

- /

- NasdaqGS:VIOT

Investors Continue Waiting On Sidelines For Viomi Technology Co., Ltd (NASDAQ:VIOT)

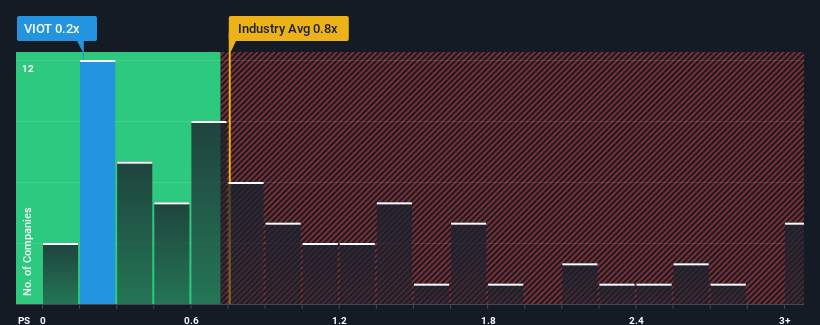

When you see that almost half of the companies in the Consumer Durables industry in the United States have price-to-sales ratios (or "P/S") above 0.8x, Viomi Technology Co., Ltd (NASDAQ:VIOT) looks to be giving off some buy signals with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Viomi Technology

How Viomi Technology Has Been Performing

While the industry has experienced revenue growth lately, Viomi Technology's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Viomi Technology.How Is Viomi Technology's Revenue Growth Trending?

In order to justify its P/S ratio, Viomi Technology would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 45% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 4.3% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 0.8%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Viomi Technology's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Viomi Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Viomi Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VIOT

Viomi Technology

Through its subsidiaries, develops and sells Internet-of-things-enabled (IoT-enabled) smart home products in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success