- United States

- /

- Leisure

- /

- NasdaqGM:MBUU

Malibu Boats (MBUU) Returns to Profitability Despite $8.5M One-Off Loss, Testing Bullish Narratives

Reviewed by Simply Wall St

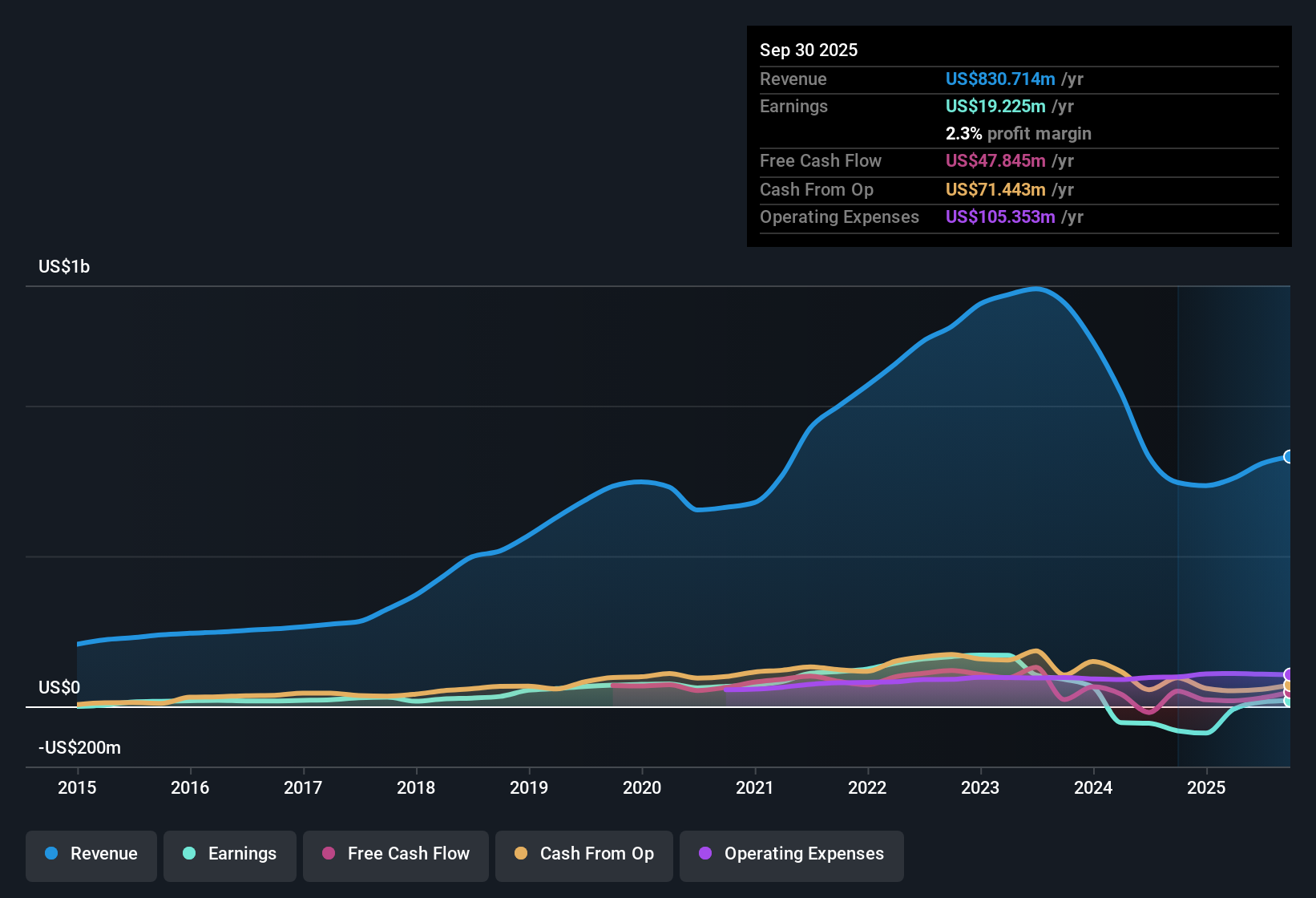

Malibu Boats (MBUU) has returned to profitability in the past year, with a noticeable improvement in net profit margin. The company absorbed a one-off loss of $8.5 million during the last 12 months ending September 2025; this non-recurring item aside, Malibu Boats saw average earnings decline at a rate of 37.1% per year over the last five years. Looking ahead, analysts expect a dramatic turnaround, with annual earnings projected to grow 33.9% per year and revenue projected to rise 7.5% per year, which is somewhat slower than the broader US market’s 10.3% rate. Despite the recent earnings volatility, the setup is raising eyebrows among investors keen to see if the forecasted acceleration in profit growth and attractive valuation will drive renewed interest in the stock.

See our full analysis for Malibu Boats.The next section looks at how the latest numbers stack up against the market narratives. Some long-held views will get reinforced, while others may face new questions.

See what the community is saying about Malibu Boats

Margins Climb From 1.8% to 11.0%: Profitability Leverage in Focus

- Analysts see profit margins rising sharply from 1.8% today to 11.0% within three years, a nearly sixfold expansion driven by product innovation and ongoing vertical integration.

- Consensus narrative highlights that Malibu’s strategy relies on advanced boat designs and efficient supply chain upgrades. Analysts believe these support a path to higher margins despite softer retail demand.

- Proactive capital spending discipline and $29 million in free cash flow give the company more resilience to weather input cost fluctuations and invest for future margin upside.

- Recent capacity expansion, alongside new model rollouts, is designed to capture premium pricing and counteract industry weakness. The consensus expects this to play a pivotal role in sustaining profitability gains.

Consensus analysts see the latest margin trend as a test. Will Malibu turn good tech and cash flow into lasting profits? 📊 Read the full Malibu Boats Consensus Narrative.

Inventory Pressures and Sluggish Demand: Margin Risks Under the Microscope

- Industry-wide retail softness continues, with recent management guidance for wholesale declines in the mid- to high-single digits, signaling that both Malibu and peers face inventory-driven promotional pressure weighing on net margins.

- Bears argue that persistent inventory destocking and need for aggressive discounting could erode recovery. The consensus narrative warns that intensifying promotional activity limits Malibu’s ability to capitalize on operating leverage.

- Elevated costs from input inflation and ongoing price increases may also stretch affordability, a key risk as “payment buyers” are still absent from the market.

- Analysts are watching for any pickup in consumer demand and an inventory rightsizing inflection before declaring these risks under control.

Undervalued by 317% vs. DCF Fair Value: Valuation Gap Widens

- At a current share price of $28.23, Malibu Boats trades at a substantial discount to its $117.97 DCF fair value and below the analyst price target of $36.64. This deepens the valuation gap for value-focused investors.

- According to the consensus narrative, analysts are split. Some see the discount as justified by previously declining earnings, while others highlight the potential for rapid profit growth and margin rebound to close the valuation gap.

- Malibu’s expected drop in shares outstanding by 2.38% per year, combined with higher margins, positions the company to achieve a PE ratio of 7.8x on 2028 earnings, well below the industry’s current 23.9x.

- Long-term demographic trends and portfolio strength in areas like luxury, surf, and saltwater segments are flagged as possible catalysts for outperformance if market conditions stabilize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Malibu Boats on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if the figures tell a different story to you? Take a moment to craft and share your own take. Change the narrative in under three minutes. Do it your way

A great starting point for your Malibu Boats research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Malibu Boats shows progress on margins, ongoing inventory pressures and patchy consumer demand threaten the sustainability of its recovery.

If you want companies with more predictable results, use our stable growth stocks screener (2111 results) to discover stocks showing steadier revenue and earnings regardless of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MBUU

Malibu Boats

Designs, engineers, manufactures, markets, and sells various recreational powerboats.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives