- United States

- /

- Leisure

- /

- NasdaqGS:MAT

Mattel (MAT): Valuation Perspective as New Hot Wheels Formula 1 and Matchbox Collaborations Drive Brand Buzz

Reviewed by Simply Wall St

Mattel (MAT) recently grabbed the spotlight with fresh product launches, including the rollout of a full Hot Wheels Formula 1 collection and a partnership with RealTruck for a custom Matchbox Jeep Wrangler. These moves are designed to increase brand engagement and broaden appeal among collectors and car enthusiasts.

See our latest analysis for Mattel.

Mattel's latest launches come as the share price has gained 9% over the past three months, reflecting renewed positive momentum. Longer term, the company has delivered a solid 36% total shareholder return over five years, even while the one-year total return sits slightly in the red. With recent product buzz and a shelf registration filing that could provide balance sheet flexibility, investors are weighing new growth prospects against lingering questions about near-term returns.

If you want to see what else is shifting in the auto and toy world, now’s a perfect time to discover See the full list for free.

With shares trading nearly 28% below analyst price targets and fundamentals showing steady growth, the real question for investors is whether Mattel is undervalued right now or if the market has already factored in its next moves.

Price-to-Earnings of 13.4x: Is it justified?

Mattel’s stock trades at a price-to-earnings (P/E) ratio of 13.4x, noticeably below both its own industry and peer benchmarks. This suggests the market may be undervaluing its earnings power relative to competitors. With a last close price of $18.67, this lower multiple points to a potential disconnect between Mattel’s current market value and its underlying financial performance.

The price-to-earnings ratio measures what the market is willing to pay today for a company’s current earnings. In the toy and leisure sector, a lower P/E can imply that investors have muted expectations for future profit growth, or that the stock itself is attractively priced compared to its peers or the broader market.

Mattel’s P/E stands well below both its direct competitors, which have a 24.4x average, and the wider global leisure industry, which has a 21.1x average. The company’s ratio is also slightly below our estimate of a fair market price-to-earnings level of 15x. This highlights further upside potential if sentiment shifts. If this valuation gap narrows, it could fuel a meaningful move in the share price.

Explore the SWS fair ratio for Mattel

Result: Price-to-Earnings of 13.4x (UNDERVALUED)

However, muted one-year returns and the persistence of profit growth uncertainty could challenge investor enthusiasm if trends fail to improve in coming quarters.

Find out about the key risks to this Mattel narrative.

Another View: What Does the SWS DCF Model Say?

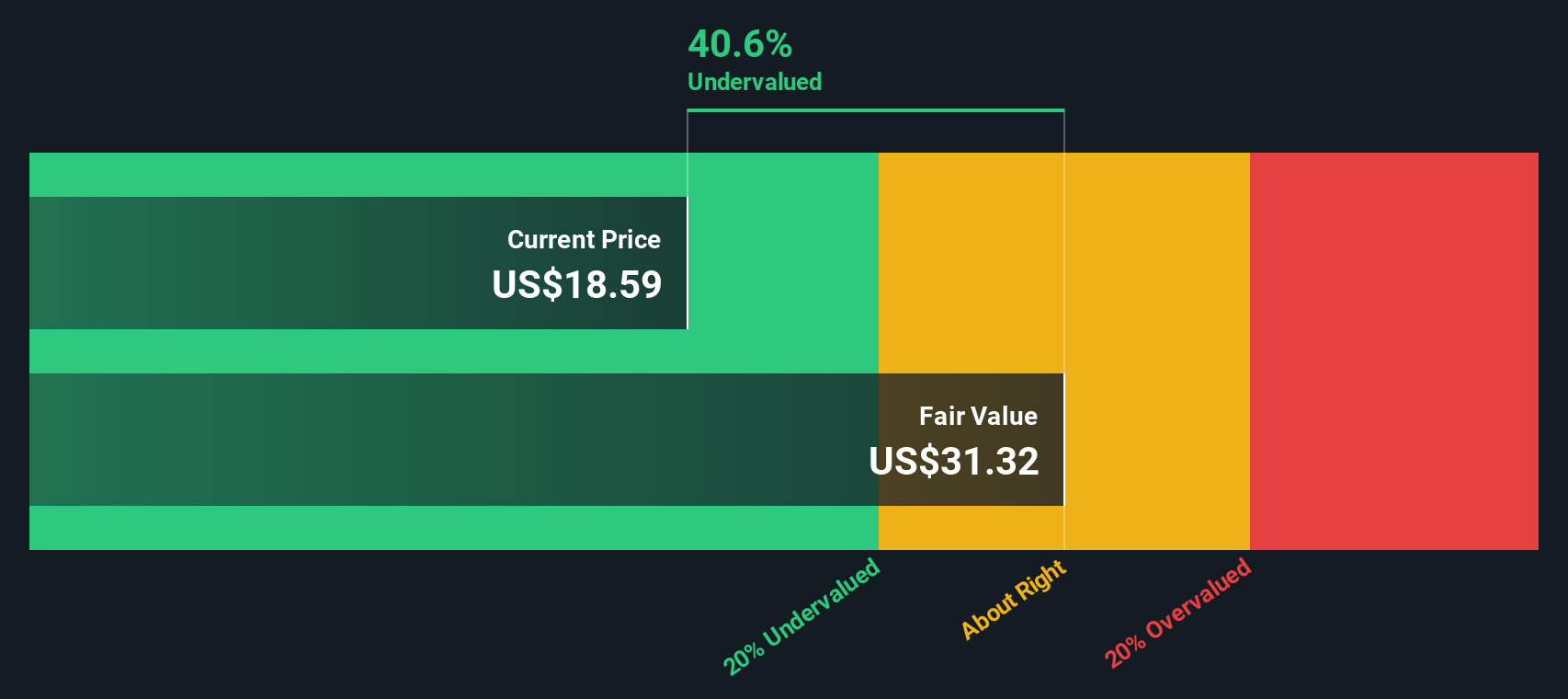

Taking a different approach, our DCF model values Mattel at $32.11 per share, which is notably higher than today's market price. This suggests the stock could be undervalued by nearly 42%. But are the assumptions behind cash flow forecasts too optimistic, or is there real upside waiting to be unlocked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mattel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mattel Narrative

If you'd rather draw your own conclusions or dig deeper into Mattel's numbers, you can tailor your own view in just a few minutes, and Do it your way.

A great starting point for your Mattel research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself when opportunity is everywhere. Unlock exciting ways to grow your portfolio by trying these proven strategies in the Simply Wall St Screener.

- Tap into the explosive potential of emerging companies by finding these 3586 penny stocks with strong financials with solid financials before they are on everyone’s radar.

- Maximize your returns with consistent income by targeting high-yield plays through these 17 dividend stocks with yields > 3% and give your portfolio a steady boost.

- Stay ahead of market shifts by spotting undervalued gems using these 860 undervalued stocks based on cash flows and find prospects the market is missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAT

Mattel

A toy and family entertainment company, designs, manufactures, and markets toys and consumer products in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives