- United States

- /

- Luxury

- /

- NasdaqGS:LULU

How Lululemon’s (LULU) NFL Launch and Incentives Could Shape Investor Sentiment

Reviewed by Sasha Jovanovic

- In recent weeks, Lululemon Athletica has faced slowing North American sales and earnings pressure from tariffs, prompted by announcements of new licensed NFL apparel, leveraged ETFs tied to its stock, and executive share sales.

- New incentives like the American Express Platinum card quarterly credit at Lululemon present an interesting tension between the potential to grow sales and the challenge to maintain its premium brand image and profitability.

- We’ll now explore how the NFL product launch could influence Lululemon’s outlook and reshape its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

lululemon athletica Investment Narrative Recap

To be a shareholder in Lululemon Athletica, you need to believe in the company’s ability to reignite core product innovation and drive international growth, despite mounting margin headwinds and competitive pressures. Recent news, especially slower North American sales combined with executive share sales, puts near-term focus firmly on whether new initiatives like the NFL apparel launch can quickly shift momentum, while the biggest risk remains ongoing margin compression from tariffs and weakening US demand.

Of all the recent updates, the launch of Lululemon's five-year NFL apparel partnership is most relevant. This move responds directly to the urgent need for fresh product cycles that could re-energize US sales and offset some of the competitive and category fatigue risks that have weighed on performance and sentiment.

Yet, in contrast, investors should also be aware of looming risks from promotional pressure and the challenge of maintaining premium pricing if these product resets do not...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's narrative projects $12.8 billion revenue and $1.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $0.1 billion earnings increase from $1.8 billion today.

Uncover how lululemon athletica's forecasts yield a $194.36 fair value, a 16% upside to its current price.

Exploring Other Perspectives

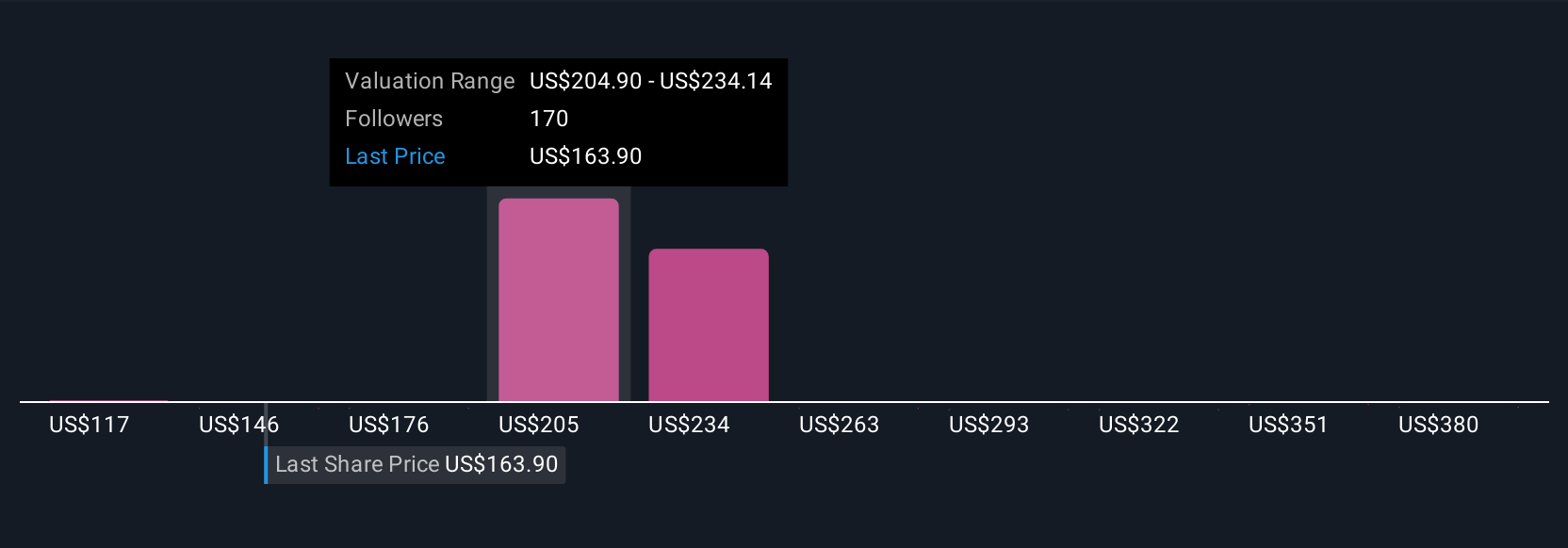

Forty-six fair value estimates from the Simply Wall St Community span a wide range from US$117 to US$410 per share. While some foresee significant upside, others signal caution given current US demand softness and margin risks, encouraging you to weigh these different viewpoints carefully.

Explore 46 other fair value estimates on lululemon athletica - why the stock might be worth 30% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives