- United States

- /

- Luxury

- /

- NasdaqGS:LULU

How Lululemon's Executive Shake-Up and Leadership Consolidation (LULU) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Lululemon athletica inc. recently announced the departure of Celeste Burgoyne, President of the Americas and Global Guest Innovation, and the immediate appointment of André Maestrini as President and Chief Commercial Officer, consolidating global leadership roles.

- This executive transition occurs as the company continues to face operational pressures, including slowing growth in the Americas, heightened competition, and evolving consumer preferences.

- We'll examine how this significant leadership change could influence lululemon's investment narrative given ongoing challenges in its core North American market.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

lululemon athletica Investment Narrative Recap

To be a lululemon shareholder right now, you need confidence that the company’s product innovation and international expansion can eventually offset slowing growth and mounting challenges in North America. While the consolidation of global leadership under André Maestrini brings a fresh perspective, its immediate impact on the most important catalyst, an upcoming product reset in 2026, appears limited. The core risk remains: persistent sales declines in the U.S. could weigh on future revenue and operating margins if not swiftly addressed.

Among recent announcements, lululemon’s launch of its redesigned Team Canada Olympic kit stands out. This partnership not only elevates brand visibility on a global stage but also signals the company’s ongoing investment in innovation, inclusivity, and performance, all key themes underlying its efforts to refresh core categories and reignite consumer interest.

However, even with these new initiatives, investors should keep in mind the impact of rising tariffs and the removal of the de minimis exemption, as...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica is projected to reach $12.8 billion in revenue and $1.9 billion in earnings by 2028. This outlook assumes a 5.4% annual revenue growth rate, with earnings increasing by $0.1 billion from current earnings of $1.8 billion.

Uncover how lululemon athletica's forecasts yield a $193.54 fair value, a 15% upside to its current price.

Exploring Other Perspectives

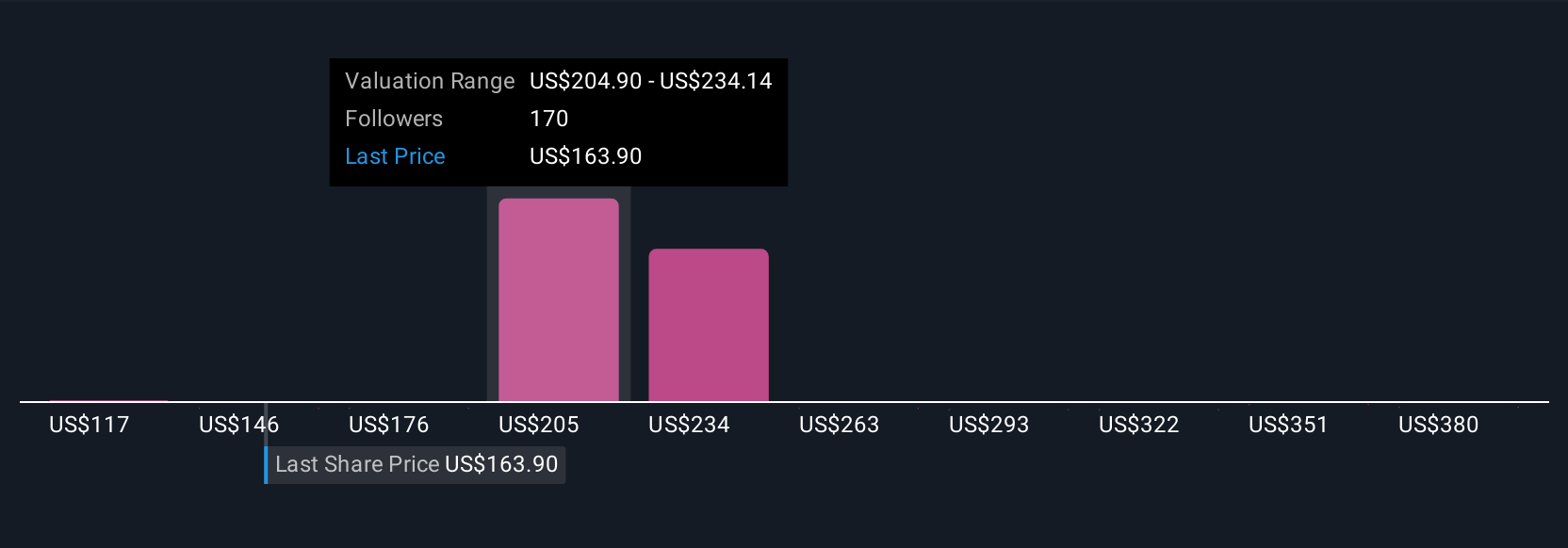

Forty-six members of the Simply Wall St Community estimate lululemon’s fair value from as low as US$117 up to US$410 per share. Amid these varied views, many participants are focused on the risk that core U.S. sales softness could limit margin recovery and future performance, highlighting why it pays to compare several outlooks when evaluating the company.

Explore 46 other fair value estimates on lululemon athletica - why the stock might be worth 30% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LULU

lululemon athletica

Designs, distributes, and retails technical athletic apparel, footwear, and accessories for women and men under the lululemon brand in the United States, Canada, Mexico, China Mainland, Hong Kong, Taiwan, Macau, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives