- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Will Hasbro’s (HAS) Retail Tie-Up With Duluth Trading Co. Advance Its Brand Growth Strategy?

Reviewed by Sasha Jovanovic

- Duluth Trading Co. recently announced a collaboration with Hasbro to launch a limited-time, nostalgia-themed holiday collection featuring classic Hasbro toys and playful apparel across U.S. retail stores and online.

- This partnership showcases Hasbro's ongoing commitment to leveraging its well-known toy brands to capture new audiences and drive seasonal sales growth through creative cross-industry collaborations.

- We’ll examine how Hasbro’s collaboration with Duluth Trading Co. supports its strategy of brand portfolio diversification and retail expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hasbro Investment Narrative Recap

To be a Hasbro shareholder today, you need to have confidence in the company’s ability to expand its iconic brands across new consumer touchpoints while managing ongoing disruptions in its core toy business. The newly announced Duluth Trading Co. collaboration highlights Hasbro’s strength in activating nostalgic brands, but its near-term impact on the company’s key catalysts, growth in digital gaming and franchise monetization, remains limited. Consumer Products headwinds and reliance on major franchises still represent the most meaningful risks right now.

Among recent announcements, Hasbro’s move to begin developing its own video games stands out. This pivot draws on the same brand strength showcased in the Duluth partnership and directly addresses the most important growth catalyst: expanding the reach and loyalty of Hasbro’s franchises in higher-margin, recurring digital channels. Despite these moves, lingering concerns about franchise concentration risk should remain top of mind for investors, especially if...

Read the full narrative on Hasbro (it's free!)

Hasbro's narrative projects $4.9 billion in revenue and $773.5 million in earnings by 2028. This requires 4.7% yearly revenue growth and a $1.34 billion increase in earnings from -$568.3 million today.

Uncover how Hasbro's forecasts yield a $90.67 fair value, a 18% upside to its current price.

Exploring Other Perspectives

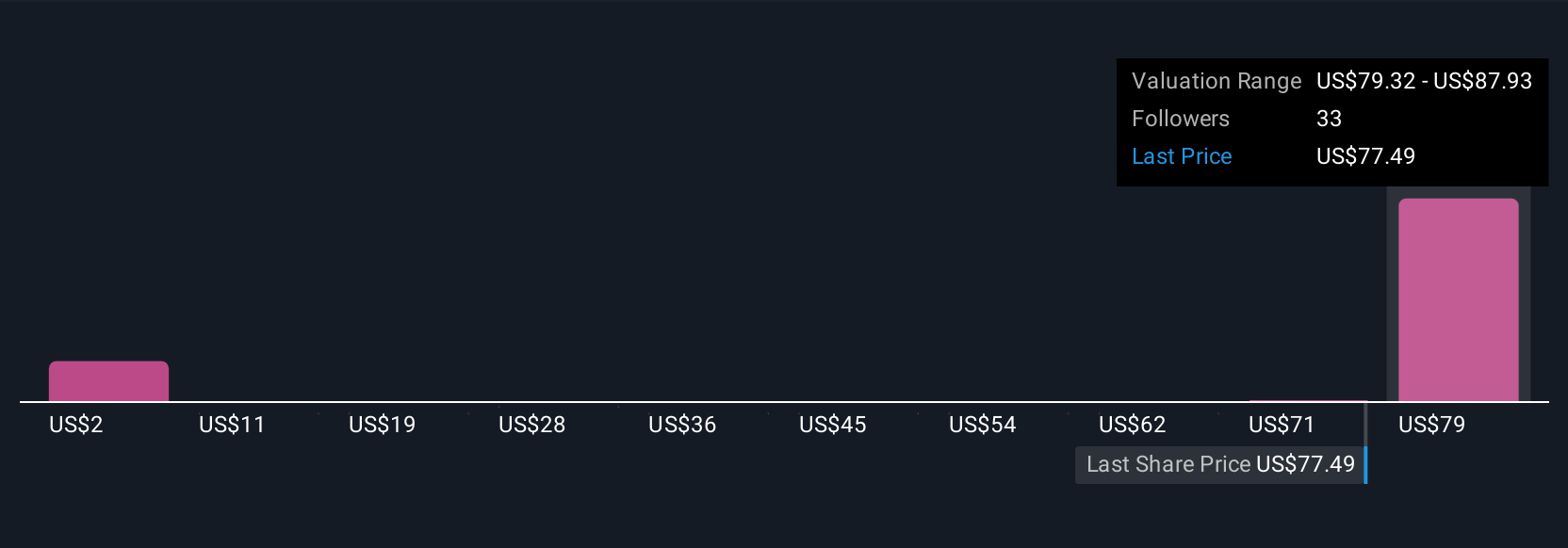

Six different fair value estimates from the Simply Wall St Community place Hasbro stock anywhere from US$1.90 to US$90.67 per share. While some see headroom for digital-driven growth, others point to the ongoing risk of significant revenue swings if major franchises lose momentum.

Explore 6 other fair value estimates on Hasbro - why the stock might be worth less than half the current price!

Build Your Own Hasbro Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hasbro research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Hasbro research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hasbro's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives