- United States

- /

- Leisure

- /

- NasdaqGS:HAS

Hasbro (HAS): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Hasbro.

Hasbro’s resurgence has caught plenty of attention, with a 1-month share price return of nearly 8% adding to momentum after a year marked by strong performance. The company’s 23.95% one-year total shareholder return suggests optimism around both its turnaround efforts and growth potential.

If Hasbro’s renewed momentum has you rethinking your watchlist, now is a good time to broaden your investing horizons and discover fast growing stocks with high insider ownership

The question now facing investors is whether Hasbro’s recent surge still leaves room for upside, or if the current share price already reflects expectations for further improvement. This could potentially limit future gains.

Most Popular Narrative: 15.6% Undervalued

Hasbro's most widely followed narrative sets a fair value that sits well above the last close and indicates strong grounds for continued investor optimism. The case for outperformance centers on high-margin digital growth, with the fair value tied to bold expectations about where key franchises can take future profit.

Rapidly growing cross-platform digital gaming and licensing revenue, exemplified by Wizards of the Coast (notably Magic: The Gathering's 23%+ YoY growth and MONOPOLY GO!), is expanding Hasbro's addressable market and recurring high-margin earnings streams. This positions the company to capitalize on the global rise of digital entertainment, which should drive outsized revenue and operating profit growth.

Curious what makes this price target tick? There is a hidden lever in these forecasts—think strong margin expansion and ambitious top-line growth that only a select set of franchises can unlock. The most surprising element is a projected turnaround in profitability that could put Hasbro in a league with high-growth peers. Only the full narrative reveals the blueprint for this double-digit upside.

Result: Fair Value of $90.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in Hasbro's core consumer products and an overreliance on key franchises mean that shifts in demand could quickly alter the growth outlook.

Find out about the key risks to this Hasbro narrative.

Another View: What About Multiples?

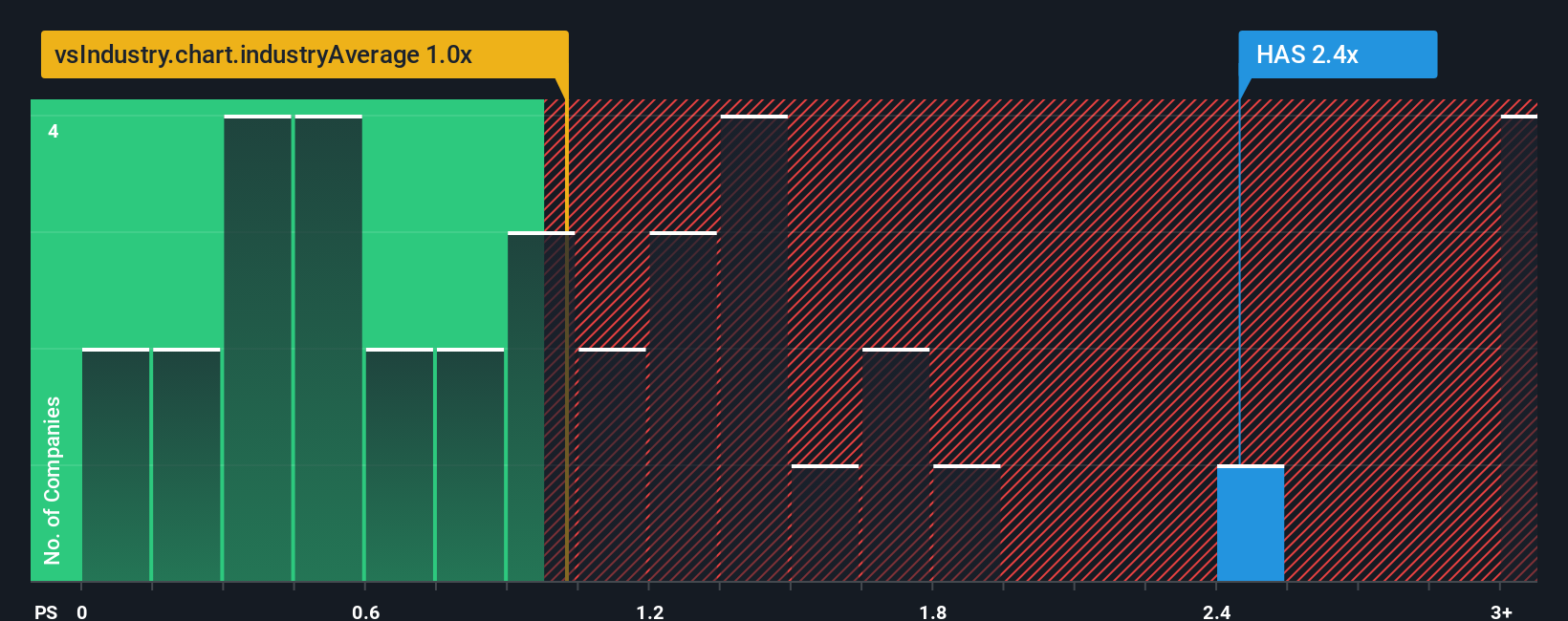

While the main narrative claims Hasbro is undervalued, a look at the price-to-sales metric tells a more cautious story. Hasbro’s valuation sits at 2.5x sales, well above both industry (0.9x) and peer (1.1x) averages, and even the fair ratio of 2x. This premium suggests limited margin for error. Could a pullback be around the corner, or is the story just beginning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hasbro Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build your own Hasbro narrative in just a few minutes. Do it your way.

A great starting point for your Hasbro research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step confidently into your next opportunity. Don’t limit your portfolio—unlock tomorrow’s winners using our targeted screens for high-potential stocks you might be missing.

- Tap into massive future trends by accessing these 25 AI penny stocks as these are powering the rapid ascent of artificial intelligence and transforming business across industries.

- Boost your income strategy with these 16 dividend stocks with yields > 3% offering consistent yields above 3% and helping you make the most of every dollar invested.

- Get ahead of the curve with these 28 quantum computing stocks and be among the first to spot technology pioneers building the next wave of quantum breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hasbro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAS

Hasbro

Operates as a toy and game company in the United States, Europe, Canada, Mexico, Latin America, Australia, China, and Hong Kong.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives