- United States

- /

- Luxury

- /

- NasdaqCM:DOGZ

Investors push Dogness (International) (NASDAQ:DOGZ) 17% lower this week, company's increasing losses might be to blame

Dogness (International) Corporation (NASDAQ:DOGZ) shareholders might be concerned after seeing the share price drop 17% in the last week. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 153%. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for Dogness (International)

Because Dogness (International) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Dogness (International) actually shrunk its revenue over the last year, with a reduction of 28%. We're a little surprised to see the share price pop 153% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

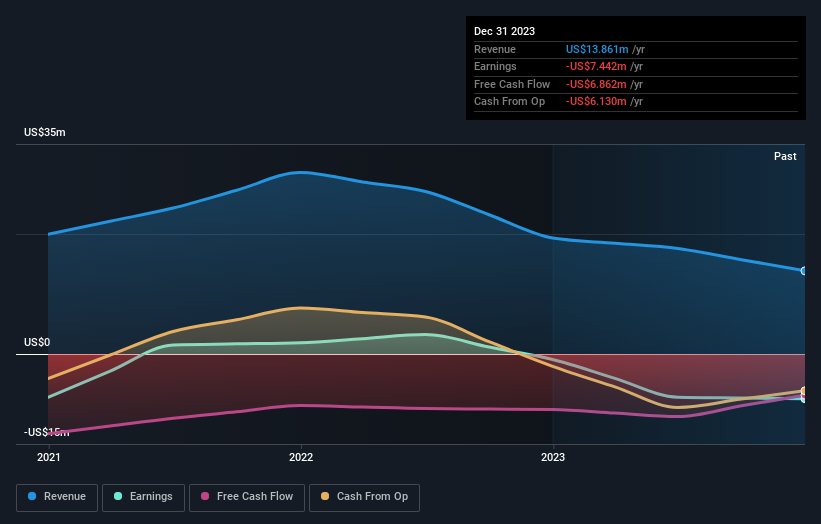

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Dogness (International) shareholders have received a total shareholder return of 153% over one year. That certainly beats the loss of about 8% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Dogness (International) (2 are a bit concerning) that you should be aware of.

But note: Dogness (International) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DOGZ

Dogness (International)

Through its subsidiaries, designs, manufactures, and sells fashionable products for dogs and cats worldwide.

Low with imperfect balance sheet.