- United States

- /

- Luxury

- /

- NasdaqGS:COLM

Columbia Sportswear (COLM): Exploring Valuation Following Disappointing Q3 Earnings and Weak Outlook

Reviewed by Simply Wall St

Columbia Sportswear (COLM) just released its third quarter earnings, showing sales that were basically flat year over year but with a sharp drop in net income. The company also issued guidance that points to softer fourth quarter sales and margins, which may indicate that headwinds could persist into next year.

See our latest analysis for Columbia Sportswear.

After a steady stream of updates, including the third quarter’s earnings miss and less optimistic guidance for the months ahead, Columbia Sportswear’s share price has lost momentum, reflected in its year-to-date decline of 37.5%. With a one-year total shareholder return of -36.99%, the stock has struggled to build sustained positive momentum even as management aims to navigate margin pressure and softer sales.

If this shift in fortunes sparks your curiosity, you might want to see what else is out there. Now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares down sharply this year and the company’s guidance painting a challenging picture, investors are left to wonder whether Columbia Sportswear is undervalued at today’s levels or if the market is already pricing in a slower growth outlook.

Most Popular Narrative: 11.3% Undervalued

The most popular analyst-driven narrative suggests Columbia Sportswear is trading below its assessed fair value of $58.22, with shares last closing at $51.67. This frames the company as potentially offering value that the market has not fully recognized, setting the stage for a deeper analysis of what is underpinning this perspective.

Rising input and compliance costs, along with tariff uncertainty and climate impacts, threaten margins and earnings visibility while increasing inventory and revenue risks.

How could margin pressures and rising costs be offset in an industry crowded with competitors? The popular narrative contains a mix of financial assumptions and projections that could influence what is possible for Columbia’s future. Want to know the critical numbers behind this contrarian fair value? The answers lie just beneath the surface.

Result: Fair Value of $58.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong growth in international markets or successful digital transformation could spark a rebound and challenge the current undervaluation narrative.

Find out about the key risks to this Columbia Sportswear narrative.

Another View: What Do the Numbers Really Say?

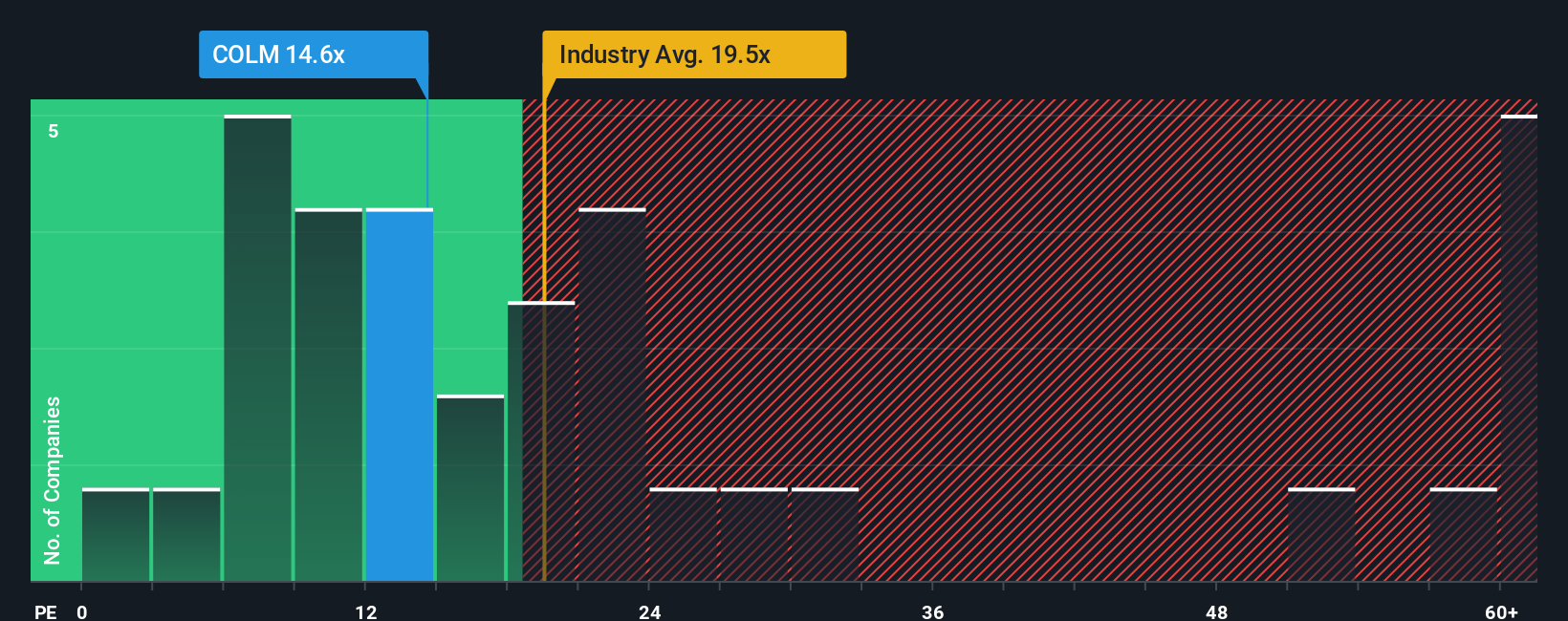

While analysts suggest Columbia Sportswear is undervalued compared to its fair value estimate, its price-to-earnings ratio of 15.2x looks higher than that of its peers (13.6x) and significantly below the US Luxury sector average (18.5x). Yet, the fair ratio, or what the figure could revert to over time, is only 12.2x, potentially pointing to valuation risk. Could the market adjust downward if results disappoint, or is there still room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Columbia Sportswear Narrative

If you have a different viewpoint or want to investigate the numbers yourself, you can craft your own narrative quickly and easily. Do it your way

A great starting point for your Columbia Sportswear research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for only one opportunity. Uncover new possibilities that could sharpen your portfolio and help you stay ahead of tomorrow's trends. Act now and don’t risk missing out.

- Unleash the potential for long-term passive income by checking out these 16 dividend stocks with yields > 3% with yields above 3% and robust fundamentals.

- Tap into the forefront of artificial intelligence by exploring these 24 AI penny stocks that are propelling rapid innovations and sector leadership.

- Capitalize on undervalued gems waiting to be noticed through these 870 undervalued stocks based on cash flows based on strong cash flow dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLM

Columbia Sportswear

Designs, develops, markets, and distributes outdoor, active, and lifestyle products in the United States, Latin America, the Asia Pacific, Europe, the Middle East, Africa, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives