- United States

- /

- Commercial Services

- /

- NYSE:VLTO

Veralto (VLTO) Margin Expansion Reinforces Bullish Narrative for Shareholders

Reviewed by Simply Wall St

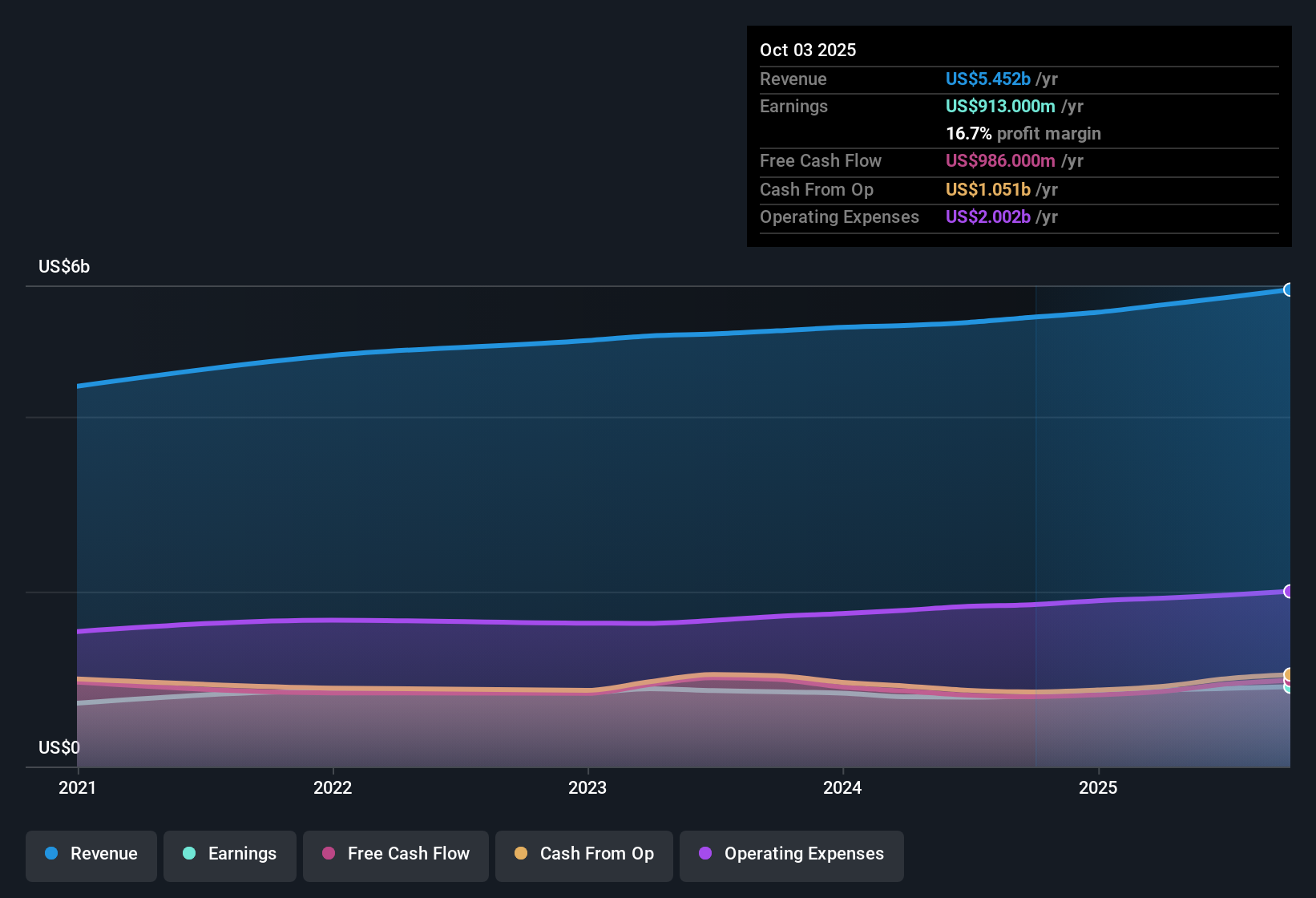

Veralto (VLTO) has posted a 13% EPS growth over the past year, far outpacing its five-year average of 2.2%. Net profit margins reached 16.7%, up from 15.7% a year ago, and revenue is forecast to expand at a 5.4% annual rate while earnings are projected to grow 7.75% per year. These results point to positive momentum for shareholders, with rising profits and firmer margins setting the tone for how investors may interpret the rest of the year.

See our full analysis for Veralto.The next step is to see how this momentum compares with the broader consensus and prevailing narratives in the market. Sometimes the numbers confirm the story, while other times they rewrite it.

See what the community is saying about Veralto

High-Margin Recurring Revenue Now 61% of Sales

- Recurring revenue streams account for 61% of Veralto's total sales, highlighting a growing base of predictable, high-margin income that outpaces many peers.

- Analysts' consensus view underlines that expanding digital workflow and connected software businesses, especially in PQI and Water Quality segments, are supporting this shift, with

- margin improvement projections: profit margins are expected to rise from 16.7% now to 17.7% in three years,

- and strong demand for water analytics and reuse solutions, which is translating into higher business predictability and sustained volume growth.

- For more on how analysts weigh these gains versus slower growth abroad, see the full narrative. 📊 Read the full Veralto Consensus Narrative.

Peer Valuation Discount Despite 27x Multiple

- Veralto trades at 27 times earnings, lower than the peer average of 36.4 but a bit above the US industry average of 26.2, while the share price of $99.50 sits well below the DCF fair value estimate of $132.38 and the consensus price target of $115.83.

- Consensus narrative points out that analysts expect earnings per share to reach $4.46 by September 2028

- assuming those numbers, Veralto would be trading at a future PE of 31.3, which remains above the projected industry PE of 25.7,

- and the current market price reflects a roughly 16% discount to DCF fair value and 16% discount to the price target, indicating room for re-rating if execution stays on track.

China Segment Weakness and Margin Headwinds

- The Water Quality segment in China is showing continued underperformance with no recovery expected in the near term, putting Veralto at a relative disadvantage versus competitors with stronger emerging market presence.

- Consensus narrative flags margin pressures in PQI and integration costs from deals like TraceGains

- cost headwinds from raw materials, labor, and supply chain shifts are cited as secular risks,

- and management's reliance on North America and Western Europe further exposes Veralto to slower-growth, mature markets if this pattern continues.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Veralto on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Share your outlook and shape the story in just a few minutes by participating: Do it your way.

A great starting point for your Veralto research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Veralto’s growth is limited by weak performance in China, exposure to slower-growth mature markets, and pressure on margins due to integration costs and input prices.

If you want to prioritize consistent, reliable expansion instead, use stable growth stocks screener (2126 results) to spot companies that keep delivering steady sales and profit growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLTO

Veralto

Provides water analytics, water treatment, marking and coding, and packaging and color solutions worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives