- United States

- /

- Professional Services

- /

- NYSE:TBI

Further weakness as TrueBlue (NYSE:TBI) drops 10% this week, taking five-year losses to 56%

Statistically speaking, long term investing is a profitable endeavour. But along the way some stocks are going to perform badly. For example, after five long years the TrueBlue, Inc. (NYSE:TBI) share price is a whole 56% lower. That is extremely sub-optimal, to say the least. We also note that the stock has performed poorly over the last year, with the share price down 40%. The falls have accelerated recently, with the share price down 23% in the last three months.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for TrueBlue

TrueBlue isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade TrueBlue reduced its trailing twelve month revenue by 3.2% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

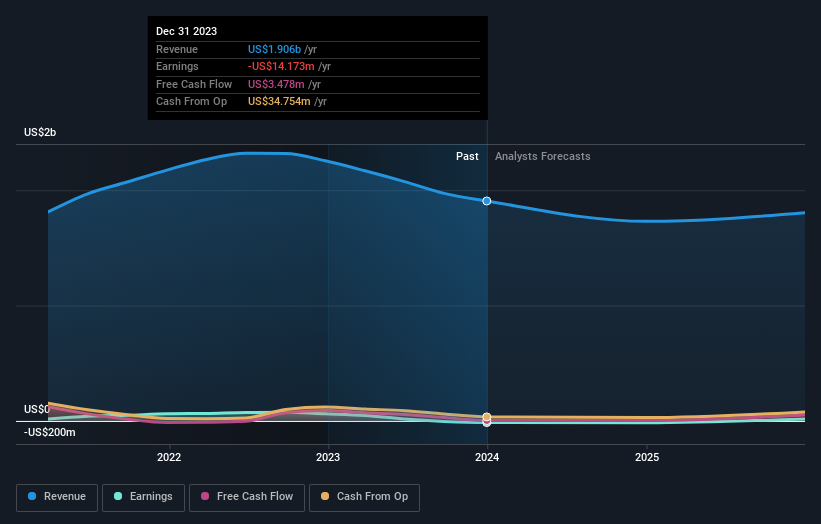

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on TrueBlue

A Different Perspective

Investors in TrueBlue had a tough year, with a total loss of 40%, against a market gain of about 27%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

TrueBlue is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if TrueBlue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TBI

TrueBlue

Provides specialized workforce solutions in the United States, Canada, the United Kingdom, Australia, and Puerto Rico.

Very undervalued with flawless balance sheet.