- United States

- /

- Commercial Services

- /

- NYSE:PBI

Will Pitney Bowes (PBI) Debt Buyback Reveal Shifts in Long-Term Financial Strategy?

Reviewed by Sasha Jovanovic

- Pitney Bowes announced a cash tender offer to purchase up to US$75 million of its outstanding 6.70% Notes due 2043 and 5.250% Notes due 2037, with the offers expiring on December 19, 2025, unless extended.

- This move reflects an effort to proactively manage debt obligations, and aligns with recent market optimism following signals from the Federal Reserve about possible interest rate cuts.

- We'll examine how Pitney Bowes's targeted debt reduction could alter the company's investment narrative and financial flexibility going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Pitney Bowes Investment Narrative Recap

Being a Pitney Bowes shareholder means believing in the company’s shift from traditional mail toward technology-driven logistics, with SaaS shipping capabilities as the main driver of future earnings. The recent cash tender offer to repurchase up to US$75 million of long-term notes is a step to reduce leverage, but does not fundamentally alter the short-term catalyst of boosting recurring revenues from technology-led business lines or the major risk of a shrinking mail market; the operative risks and opportunities remain unchanged for now.

Among recent developments, the US$279.77 million share buyback completed in October stands out as highly relevant. This action supports the company’s focus on capital return and optimizing its capital structure, which relates directly to the balance between debt reduction and maintaining financial flexibility as a key near-term catalyst.

Yet, against this focus on innovation and financial engineering, investors should not overlook the risk that ongoing digitization and reduced mail usage could...

Read the full narrative on Pitney Bowes (it's free!)

Pitney Bowes' narrative projects $1.9 billion revenue and $348.2 million earnings by 2028. This requires a 2.1% annual revenue decline and a $202.3 million increase in earnings from $145.9 million currently.

Uncover how Pitney Bowes' forecasts yield a $14.00 fair value, a 45% upside to its current price.

Exploring Other Perspectives

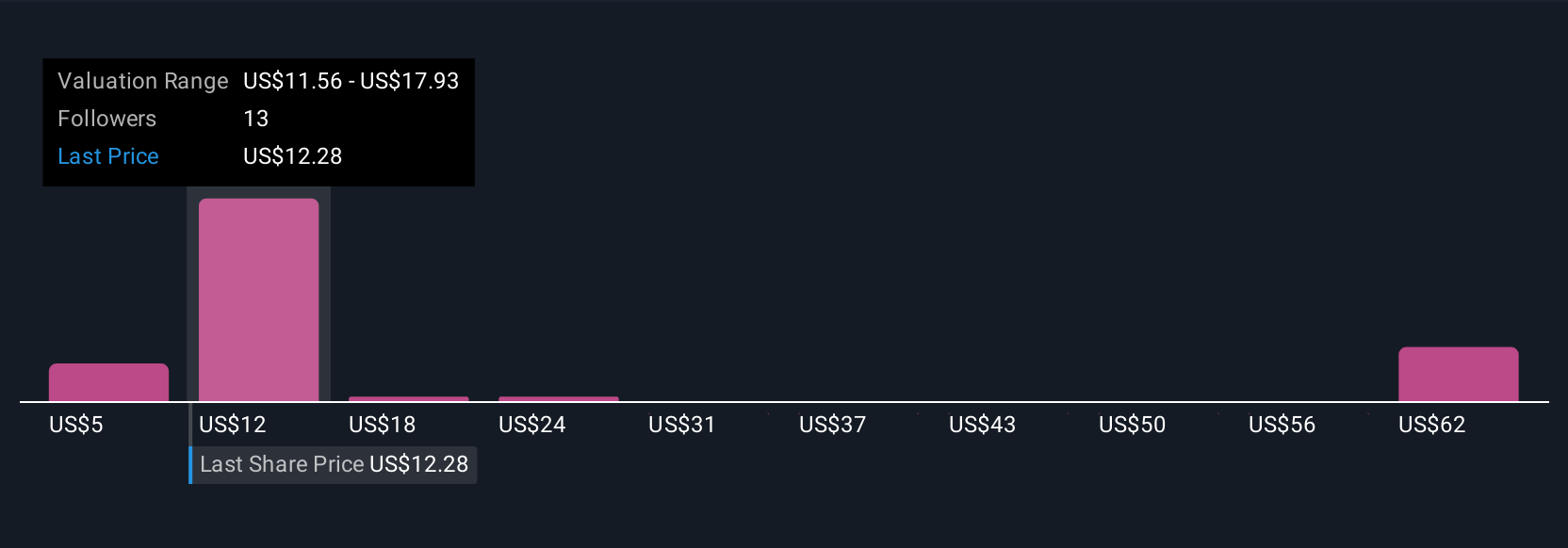

Eleven Simply Wall St Community members estimate Pitney Bowes’s fair value anywhere from US$5.20 up to US$39.02 per share. While optimism surrounds earnings growth in SaaS logistics, ongoing declines in legacy revenue streams could temper results, making it vital to understand why these viewpoints diverge so much.

Explore 11 other fair value estimates on Pitney Bowes - why the stock might be worth over 4x more than the current price!

Build Your Own Pitney Bowes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pitney Bowes research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pitney Bowes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pitney Bowes' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBI

Pitney Bowes

Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives