- United States

- /

- Commercial Services

- /

- NYSE:PBI

Pitney Bowes (PBI): $117.8M One-Off Loss Challenges Bullish Margin and Growth Narratives

Reviewed by Simply Wall St

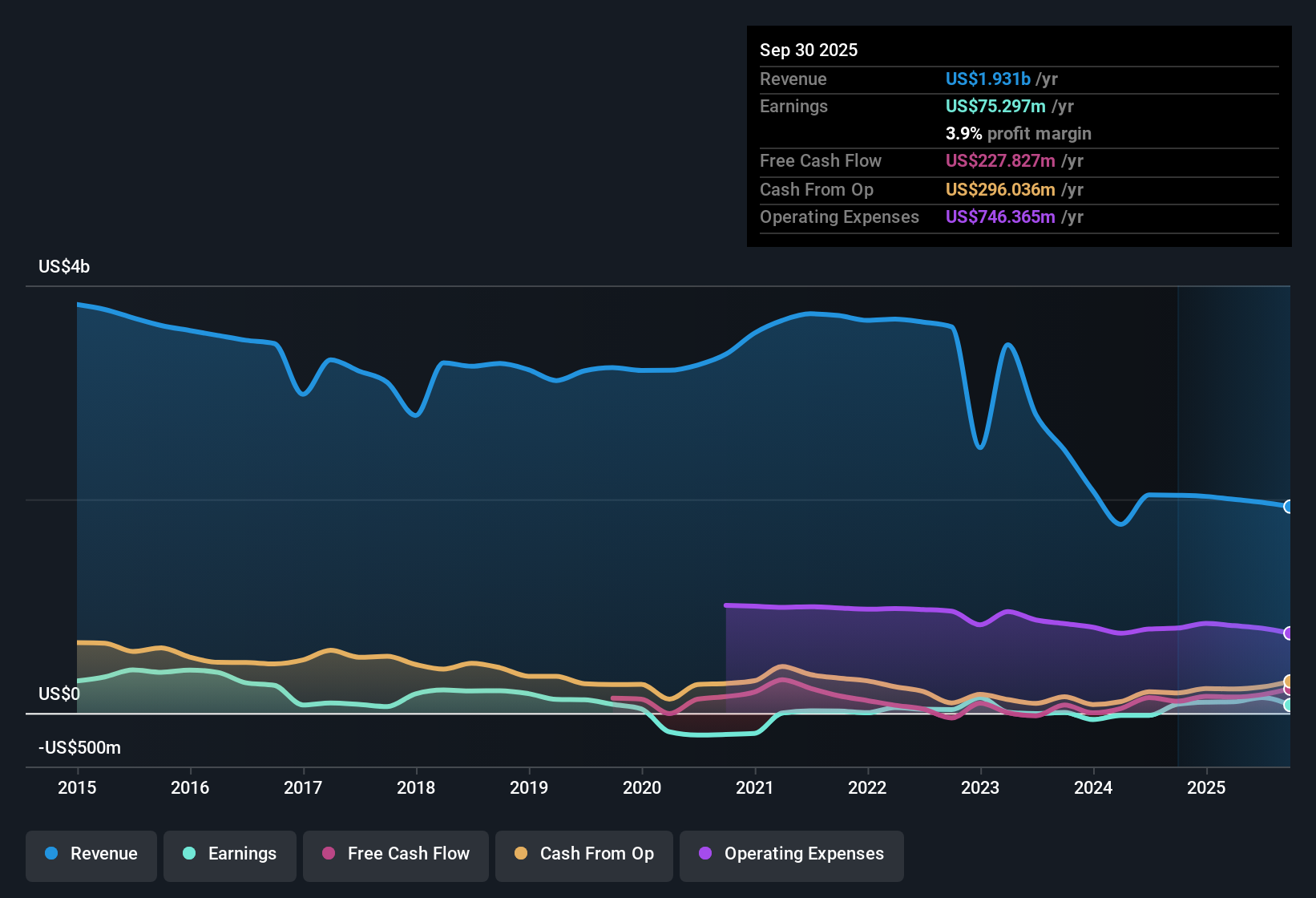

Pitney Bowes (PBI) reported net profit margins of 3.9% for the most recent twelve months, slightly lower than last year’s 4.1%, after accounting for a significant one-off loss of $117.8 million. While earnings are forecast to grow 31.8% per year over the next three years, revenue is expected to decline by 1.3% per year. This highlights a diverging trend between profitability and top-line performance. Investors face a mixed bag, weighing robust earnings growth potential against margin pressure and the impact of non-recurring items on the quality of reported results.

See our full analysis for Pitney Bowes.Up next, we will see how these latest results compare to the prevailing market narratives and whether the numbers reinforce or challenge what everyone has been saying.

See what the community is saying about Pitney Bowes

Market Trades Below DCF Fair Value

- With Pitney Bowes’ shares at $9.88, the price trades at a 74% discount to its DCF fair value of $38.41 and 42% below the analyst target price of $17.00.

- Analysts' consensus view highlights that this discount positions the stock attractively compared to projected 31.8% annual earnings growth. Investors must weigh this, however, against forecasts for a 1.3% decline in revenue per year.

- The consensus expects profit margins to rise considerably, from 7.4% today to 18.8% in three years. This supports the argument that operational improvements could justify a higher valuation.

- Ongoing headwinds in mail digitization and potential pitfalls from high leverage, as outlined in the consensus narrative, create real tension with this bullish argument.

- Investors curious whether the valuation gap closes should see how consensus expectations stack up against the company's strategic transformation. 📊 Read the full Pitney Bowes Consensus Narrative.

Shrinking Sales, Expanding Margins

- Even as analysts anticipate a 2.1% annual decline in revenue over the next three years, they forecast that profit margins could climb by more than 11 percentage points, from 7.4% today to 18.8% by 2028.

- The consensus narrative notes that the SaaS shipping segment grew 17% year-over-year, and ongoing investments in digital transformation may continue to drive recurring revenues and help offset shrinking traditional mail business.

- Cross-selling between business lines is seen as a lever for market share growth, especially given global e-commerce momentum.

- Analyst agreement on margin expansion stands out despite topline pressure, challenging the notion that revenue declines must always lead to lower profitability.

One-Off Losses Challenge Earnings Quality

- A non-recurring $117.8 million loss weighed heavily on the most recent twelve months, distorting reported net profit margin to 3.9% from 4.1% last year.

- The consensus narrative emphasizes that structural headwinds from mail digitization and competition, combined with high debt and frequent operational restructuring, pose continuing risks to both earnings quality and margin stability.

- Critics highlight the need for new business lines to scale fast enough to offset legacy pressures, an area where success is not yet guaranteed.

- Substantial debt refinancing requirements amplify risk if Pitney Bowes cannot achieve ongoing cost reductions or secure credit improvements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pitney Bowes on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your unique take and help shape the story in just a few minutes with your own analysis. Do it your way

A great starting point for your Pitney Bowes research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Pitney Bowes continues to face persistent revenue declines and high debt burdens. This raises questions about long-term financial resilience, even as the company achieves margin expansion.

If stable growth and a stronger financial footing matter to you, discover companies with healthier balance sheets and steadier performance through solid balance sheet and fundamentals stocks screener (1982 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBI

Pitney Bowes

Operates as a technology-driven company that provides SaaS shipping solutions, mailing innovation, and financial services to small businesses, large enterprises, and government entities around the world.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives