- United States

- /

- Commercial Services

- /

- NYSE:MEG

Montrose Environmental Group (MEG): Losses Narrow, But Slower Revenue Growth Reinforces Market Skepticism

Reviewed by Simply Wall St

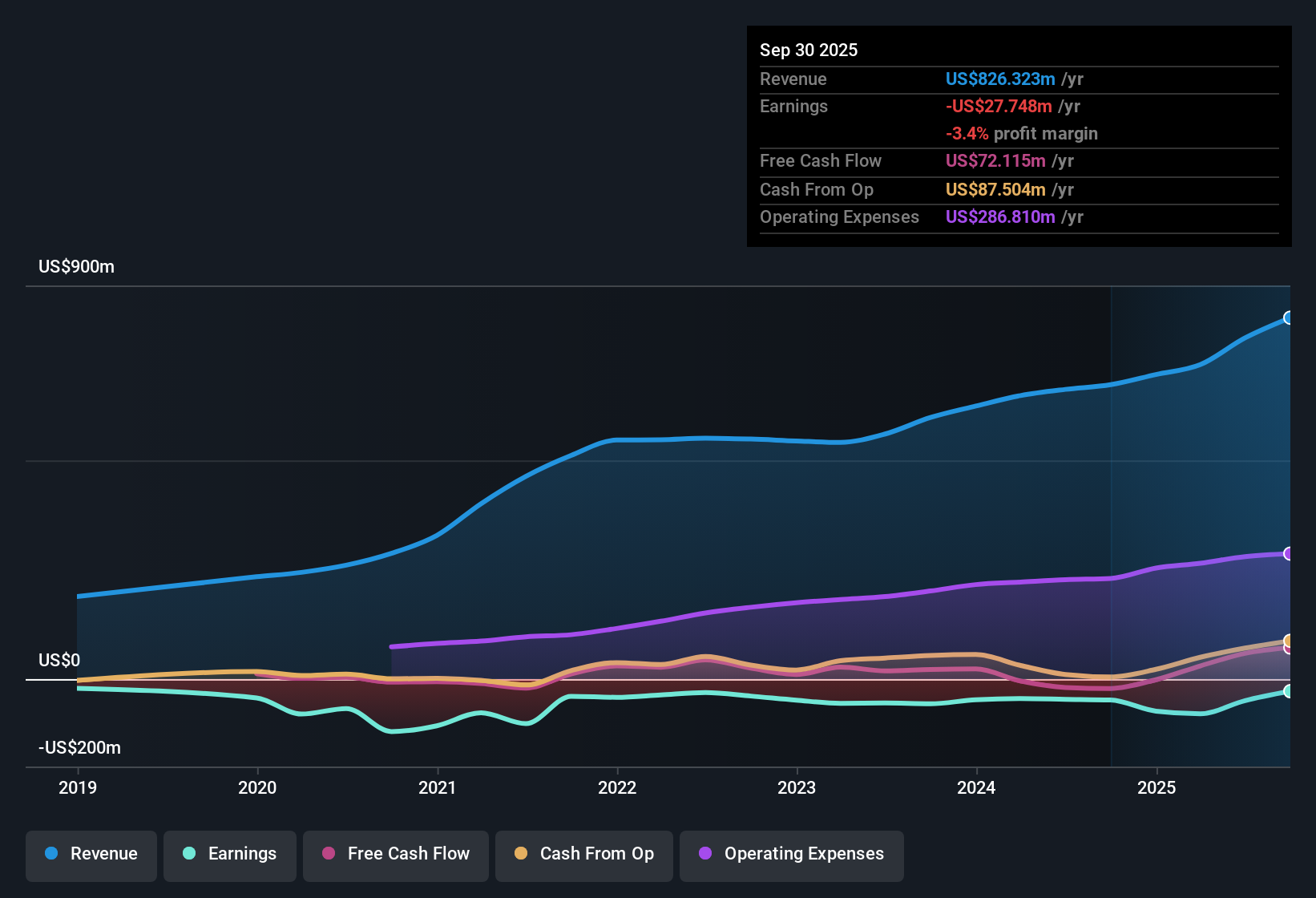

Montrose Environmental Group (MEG) is forecasting revenue growth of 5.5% per year, trailing the wider US market’s expected 10.5% pace. The company remains in the red, but it has trimmed annual losses by an average of 11.1% over the past five years. While profitability remains elusive, investors are weighing the steady narrowing of losses against slower sales expansion and a premium Price-To-Sales Ratio.

See our full analysis for Montrose Environmental Group.Now, let’s see how these latest numbers measure up to the prevailing market and community narratives. Some assumptions may hold, while others could be up for debate.

See what the community is saying about Montrose Environmental Group

Margin Expansion Driven by Proprietary Technology

- Montrose’s recent margin improvement stems from expanding proprietary environmental technologies, with profit margin guidance projected to rise to the US Commercial Services industry average of 7.2% by 2028, up from the current -6.3%.

- Analysts' consensus view sees technology-driven gains strengthening the investment case in several ways:

- A growing addressable market through patented solutions in PFAS and industrial water treatment supports higher-margin, differentiated service delivery. This is a direct response to rising industry and client demands.

- Margins are also supported by high client retention rates above 96%, indicating earnings visibility even as competition intensifies and the operating environment evolves.

Episodic Revenue Surges Add Volatility

- Heavy reliance on emergency response projects, which are one-off and not guaranteed to recur at the same scale, may introduce volatility in future revenue and margin streams.

- Analysts' consensus narrative highlights future uncertainty for bears in several respects:

- Earnings growth has been supported by short-term disaster response work, and management’s pause on acquisitions has removed a key growth driver that previously helped smooth results.

- The company’s U.S.-centric client base, especially in private industry, can make results more sensitive to macroeconomic slowdowns or regulatory shifts, increasing unpredictability in recurring revenues.

Valuation: Premium to Peers, Discount to Fair Value

- Montrose trades at a Price-To-Sales Ratio of 1.2x, above peers (1x) and the industry (1.1x), yet with a current share price of $25.97, the stock is priced 20.1% below DCF fair value ($32.47) and 25.9% below the consensus analyst price target of $32.67.

- Analysts’ consensus view highlights a tension between the expensive peer valuation and perceived long-term upside in the following ways:

- Although the stock commands a valuation premium due to its technology and recurring contracts, the current discount to both DCF fair value and analyst targets suggests the market is pricing in execution and profit risk ahead of expected 2028 margin recovery.

- The modest 3.6% gap between the latest analyst price target and share price also signals a belief that shares are fairly priced overall, despite wider risk factors.

Consensus analysts see scalable tech and high retention fueling margin upside, but caution that earnings volatility and valuation disconnects remain pivotal to watch. Read the full consensus narrative for a deep dive into competing viewpoints and how the numbers stack up. 📊 Read the full Montrose Environmental Group Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Montrose Environmental Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Shape your viewpoint in minutes and craft a unique story behind the results. Do it your way

A great starting point for your Montrose Environmental Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Montrose’s heavy reliance on episodic emergency response projects and less consistent sales makes its future earnings growth more volatile and unpredictable.

If steady, reliable performance is more your style, check out stable growth stocks screener (2074 results) to uncover companies with track records of stable growth and resilience across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MEG

Montrose Environmental Group

Operates as an environmental services company in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives