- United States

- /

- Commercial Services

- /

- NYSE:HNI

Why HNI (HNI) Is Up 6.9% After Fed Signals Possible Interest Rate Cuts

Reviewed by Sasha Jovanovic

- HNI, a leading office and commercial furniture company, recently saw its stock rise after public comments from New York Federal Reserve president John Williams suggested possible interest rate cuts to support employment.

- This development has sparked optimism in sectors that benefit from lower borrowing costs, potentially influencing future business spending decisions in the workplace furnishings industry.

- We'll examine how the potential for interest rate cuts may impact HNI's demand outlook and broader investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

HNI Investment Narrative Recap

To be a shareholder in HNI, you need to believe that corporate investment in office space and furnishings will recover and remain resilient, despite the ongoing shift to hybrid work. The recent commentary from the New York Federal Reserve, hinting at interest rate cuts, adds some short-term optimism; however, HNI’s most important catalyst, demand for office upgrades, remains primarily tied to broader macro and workplace occupancy trends. Major ongoing risks include uncertainty in traditional workplace demand, which isn't materially resolved by potential rate moves alone.

Against this backdrop, HNI’s October guidance for high-single-digit sales growth in Q4 2025 directly ties into the heightened focus on business spending following central bank signals. While lower borrowing costs may support this outlook, sustained growth will depend on tangible improvements in end-market demand, especially given recent earnings volatility and muted growth in traditional segments.

In contrast, investors should also consider the persistent threat that hybrid and remote work trends pose to HNI’s long-term revenue base…

Read the full narrative on HNI (it's free!)

HNI's narrative projects $2.9 billion in revenue and $234.7 million in earnings by 2028. This requires 4.2% yearly revenue growth and a $86.7 million increase in earnings from $148.0 million today.

Uncover how HNI's forecasts yield a $66.75 fair value, a 63% upside to its current price.

Exploring Other Perspectives

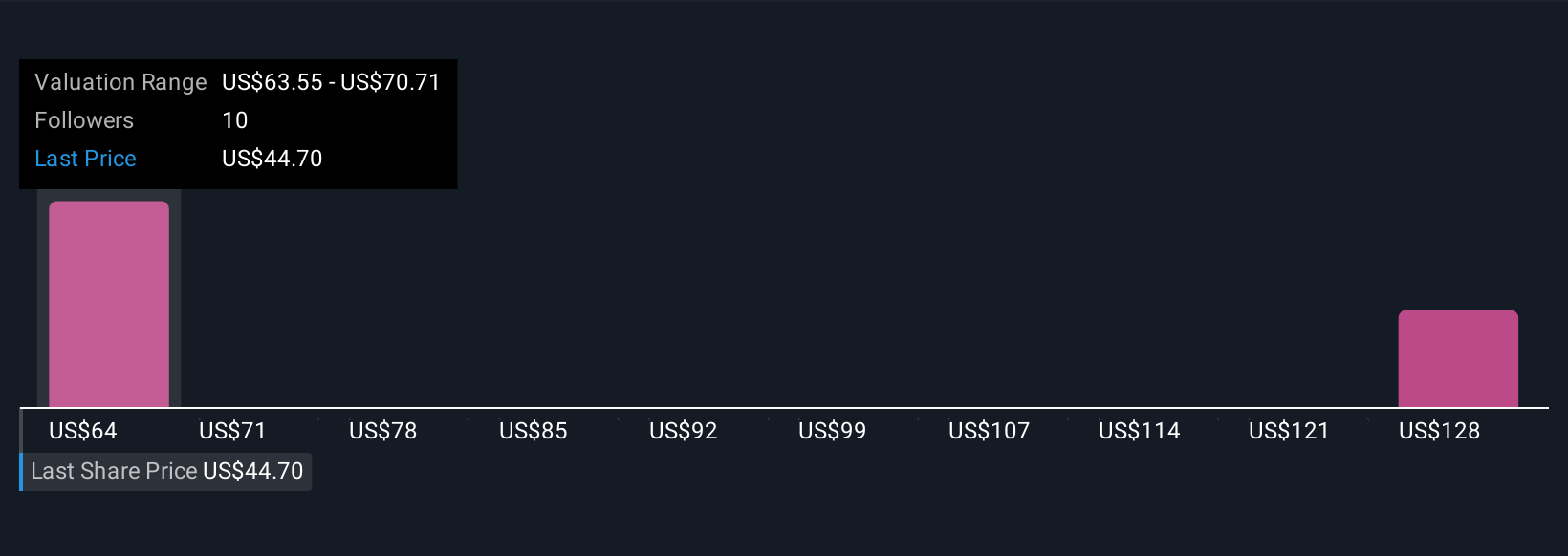

Three members of the Simply Wall St Community estimated HNI's fair value between US$63.55 and US$140.79 per share, a wide band compared to its current price. While some see deep value, others remain cautious as ongoing uncertainty around office demand could keep volatility elevated, compare these views before deciding where you stand.

Explore 3 other fair value estimates on HNI - why the stock might be worth over 3x more than the current price!

Build Your Own HNI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HNI research is our analysis highlighting 6 key rewards that could impact your investment decision.

- Our free HNI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HNI's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HNI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNI

HNI

Engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives