Stock Analysis

- United States

- /

- Professional Services

- /

- NYSE:DAY

Dayforce (NYSE:DAY investor three-year losses grow to 34% as the stock sheds US$297m this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Dayforce Inc. (NYSE:DAY) shareholders, since the share price is down 34% in the last three years, falling well short of the market return of around 17%. Even worse, it's down 8.2% in about a month, which isn't fun at all.

With the stock having lost 3.1% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Dayforce

Given that Dayforce only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Dayforce grew revenue at 20% per year. That's well above most other pre-profit companies. The share price drop of 10% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It's possible that the prior share price assumed unrealistically high future growth. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

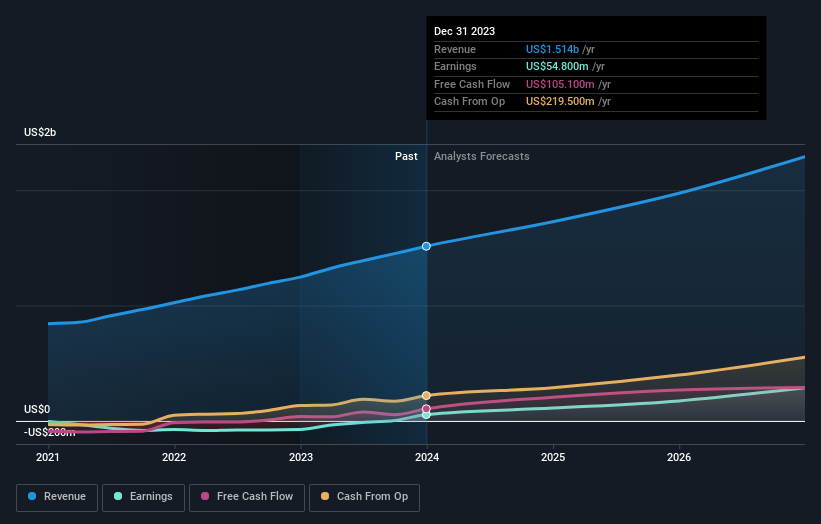

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Dayforce is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Dayforce will earn in the future (free analyst consensus estimates)

A Different Perspective

Investors in Dayforce had a tough year, with a total loss of 12%, against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Dayforce it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Dayforce is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DAY

Dayforce

Dayforce Inc., together with its subsidiaries, operates as a human capital management (HCM) software company in the United States, Canada, and internationally.

Reasonable growth potential with adequate balance sheet.