- United States

- /

- Commercial Services

- /

- NYSE:CLH

A Fresh Look at Clean Harbors (CLH) Valuation After Softer Earnings and Rising Cost Pressures

Reviewed by Simply Wall St

Clean Harbors (NYSE:CLH) released its latest quarterly earnings, which came in a bit softer than expected. The company pointed to slower activity in field and industrial services, along with higher employee healthcare expenses, as primary headwinds.

See our latest analysis for Clean Harbors.

Shares of Clean Harbors have shown some volatility in recent months, with a 30-day share price return of -11.1% following softer quarterly results and cautious news about rising expenses. While momentum appears to be fading in the short term, it is worth noting that long-term holders have still seen a robust 79.9% total shareholder return over three years and an impressive 191% over five years.

If you are curious what other companies are delivering strong growth and catching insider attention, this is a great moment to discover fast growing stocks with high insider ownership

With shares now trading at a significant discount to analyst targets and recent volatility reflecting investor caution, the question remains: is Clean Harbors undervalued, or has the market already accounted for its future growth potential?

Most Popular Narrative: 19% Undervalued

The narrative sets a fair value for Clean Harbors significantly above its latest closing price. This gap draws attention to how bullish assumptions and near-term business drivers may be influencing analyst optimism.

The growing urgency and evolving regulatory landscape around PFAS and hazardous waste management is expected to create a multibillion-dollar opportunity. Clean Harbors' unique position as the only company with end-to-end PFAS destruction capabilities positions it to capture significant long-term revenue and margin growth as new government and corporate standards take effect.

Want to know the secret sauce behind this bullish outlook? One powerful trend is driving both the fair value calculation and confidence in future margins. The numbers shaping this consensus forecast reveal bold expectations that only a deep dive will uncover. Ready to see which assumptions analysts are betting on?

Result: Fair Value of $256.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing advances in waste reduction and tighter regulatory hurdles could dampen Clean Harbors' growth story more quickly than analysts currently forecast.

Find out about the key risks to this Clean Harbors narrative.

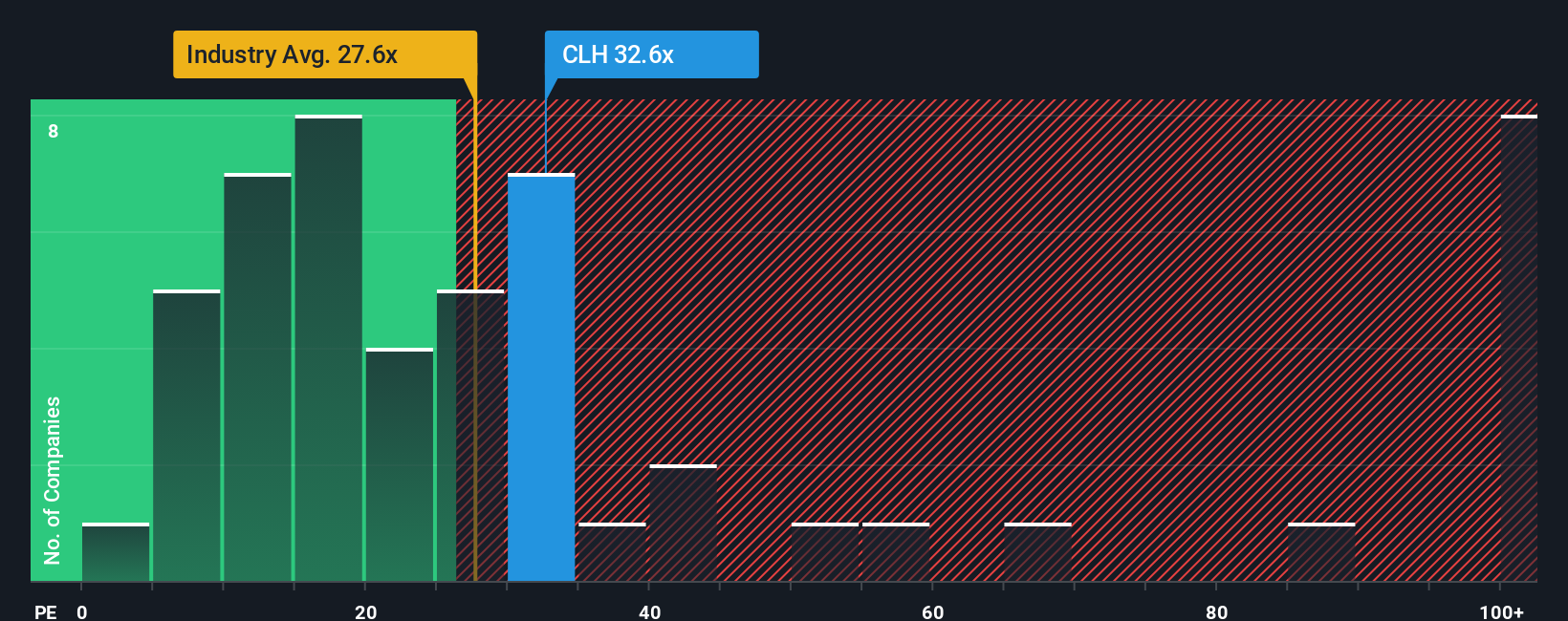

Another View: Price-to-Earnings Perspective

Stepping away from analyst forecasts, the company’s price-to-earnings ratio stands at 28.6x, which is notably higher than both the US Commercial Services industry average of 22.2x and the fair ratio estimate of 24.9x. This suggests Clean Harbors is relatively pricey by this measure, which could limit upside if the market revises its expectations. Is this premium truly justified, or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Harbors Narrative

If you see things differently or want to dig into the numbers yourself, you can put together your own take in just a few minutes. So why not Do it your way?

A great starting point for your Clean Harbors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by checking out our handpicked lists that highlight major trends and unique opportunities you do not want to overlook.

- Accelerate your income strategy with these 16 dividend stocks with yields > 3%, offering solid yields and stable long-term returns.

- Ride the AI wave and spot trailblazing businesses at the frontlines by checking out these 25 AI penny stocks.

- Ready to seize untapped value? Uncover hidden market gems with these 874 undervalued stocks based on cash flows, boasting strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLH

Clean Harbors

Provides environmental and industrial services in the United States and Canada.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives