- United States

- /

- Professional Services

- /

- NYSE:BR

Broadridge Financial Solutions (NYSE:BR) Has A Pretty Healthy Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Broadridge Financial Solutions, Inc. (NYSE:BR) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Broadridge Financial Solutions

What Is Broadridge Financial Solutions's Net Debt?

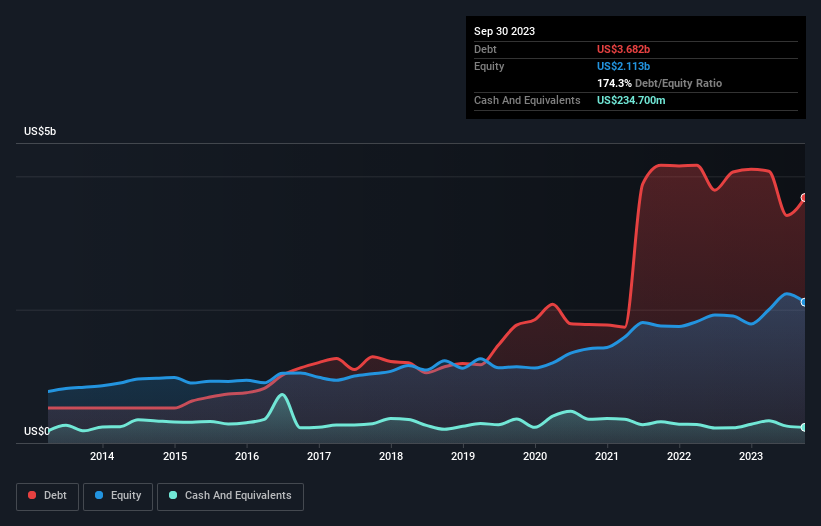

As you can see below, Broadridge Financial Solutions had US$3.68b of debt at September 2023, down from US$4.06b a year prior. However, it does have US$234.7m in cash offsetting this, leading to net debt of about US$3.45b.

How Strong Is Broadridge Financial Solutions' Balance Sheet?

According to the last reported balance sheet, Broadridge Financial Solutions had liabilities of US$924.0m due within 12 months, and liabilities of US$5.03b due beyond 12 months. Offsetting these obligations, it had cash of US$234.7m as well as receivables valued at US$916.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.81b.

While this might seem like a lot, it is not so bad since Broadridge Financial Solutions has a huge market capitalization of US$23.5b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Broadridge Financial Solutions's net debt of 2.4 times EBITDA suggests graceful use of debt. And the fact that its trailing twelve months of EBIT was 7.0 times its interest expenses harmonizes with that theme. Importantly, Broadridge Financial Solutions grew its EBIT by 34% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Broadridge Financial Solutions can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Broadridge Financial Solutions produced sturdy free cash flow equating to 67% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Broadridge Financial Solutions's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its net debt to EBITDA does undermine this impression a bit. Taking all this data into account, it seems to us that Broadridge Financial Solutions takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Broadridge Financial Solutions , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry.

Established dividend payer with mediocre balance sheet.