- United States

- /

- Commercial Services

- /

- NYSE:BCO

Is Brink's Recent 8% Drop a Long-Term Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Brink's is truly a bargain or if recent buzz is just noise? Let’s cut through the headlines and get straight into what matters for value-focused investors.

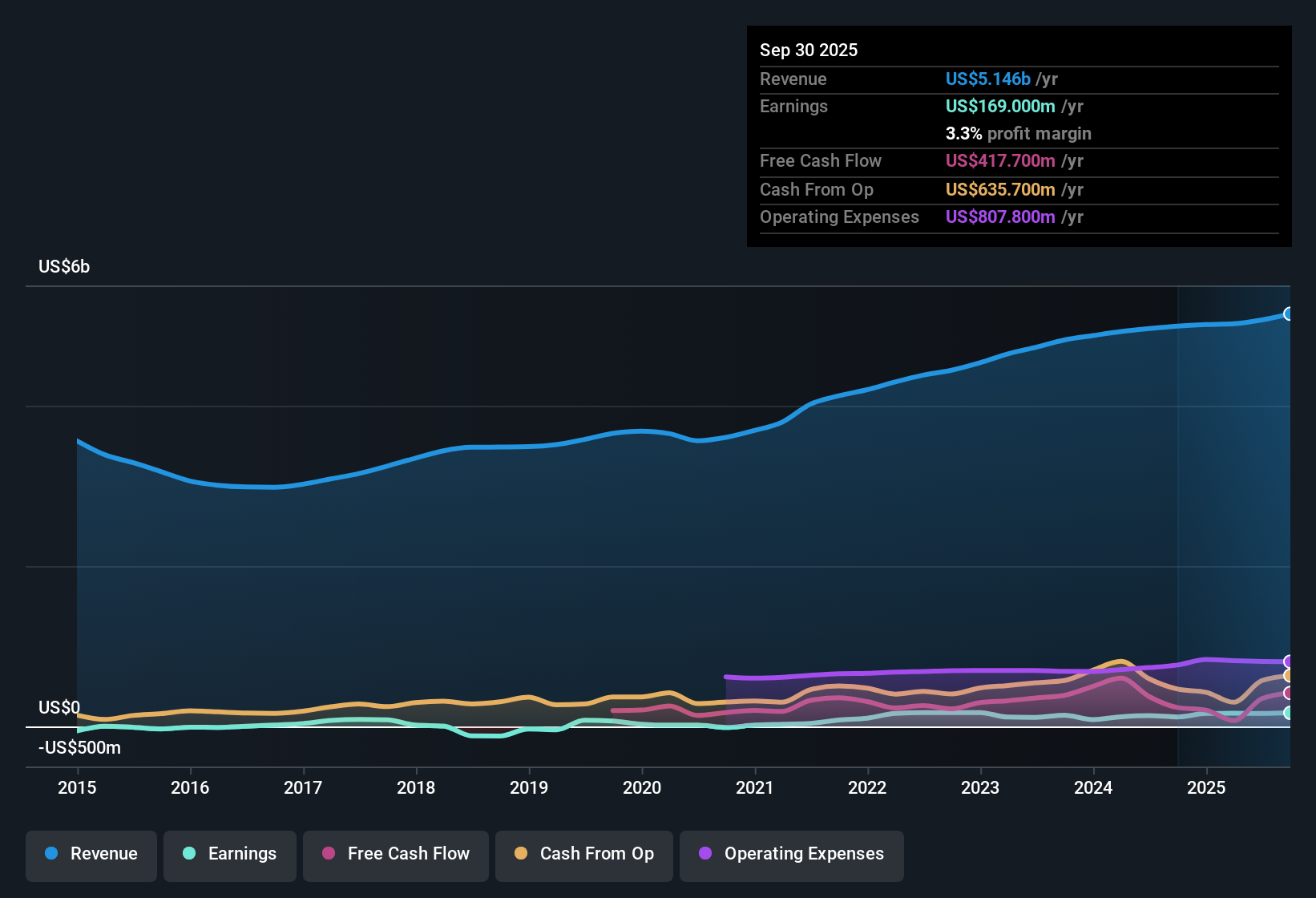

- After a sharp drop of 8.2% in the past week and a 7.8% dip over the past month, Brink's still boasts long-term gains, up 14.6% year-to-date and 107.6% over five years.

- Much of this recent volatility tracks broader market swings and reactions to industry-wide security developments. Investor sentiment has shifted in response to regulatory discussions and new contract opportunities in the cash management space.

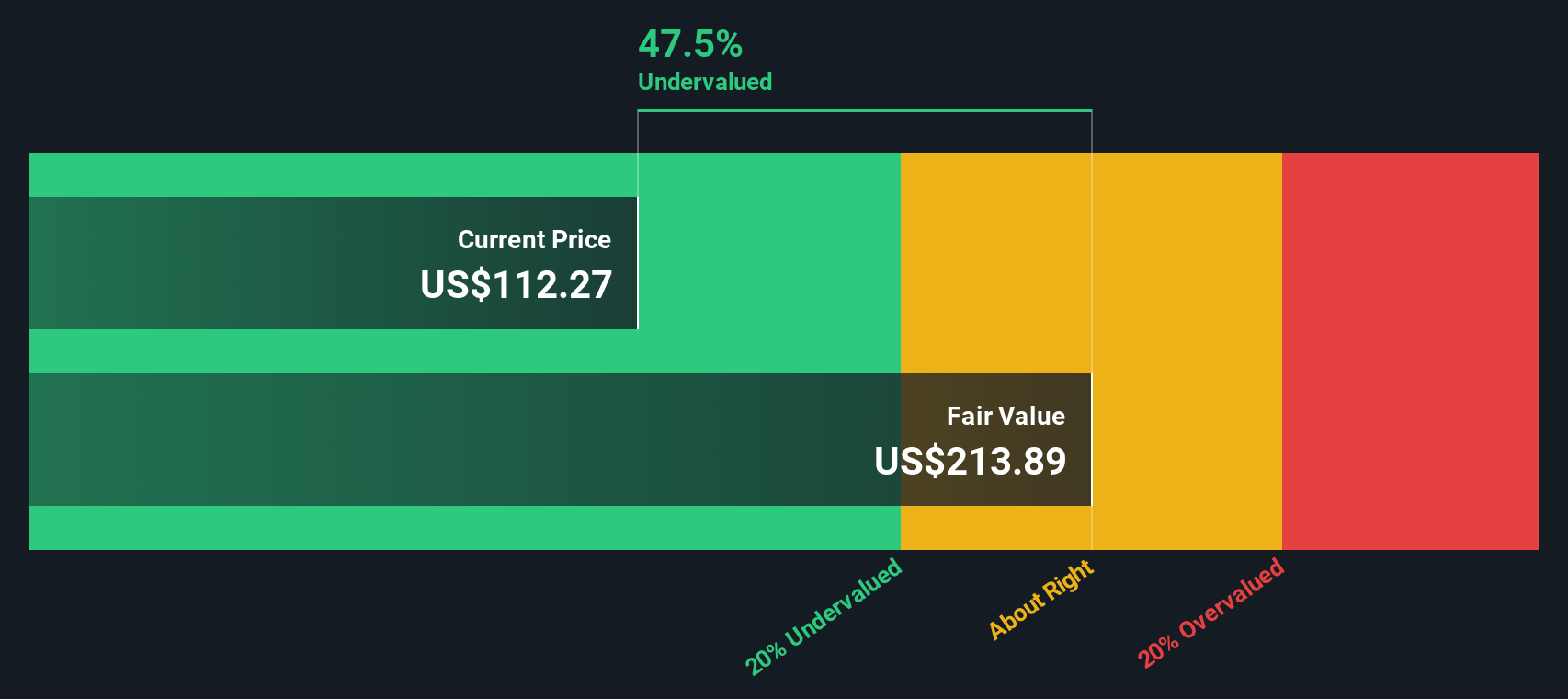

- Currently, Brink's has a valuation score of 3 out of 6, which suggests there are both undervalued and fairly valued aspects to the stock. We will break down what goes into that score by looking at a few classic valuation tools, and finish with a fresh approach to understanding a company’s real worth.

Approach 1: Brink's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today’s value. This estimates what the business is really worth in today’s dollars. This approach aims to look beyond short-term noise and instead anchor the valuation in expected financial performance over time.

For Brink's, the current Free Cash Flow stands at $353.9 million. Analysts estimate that Free Cash Flow will remain stable over the next five years, with slight annual decreases and modest upticks projected out to 2035. By 2035, the model extrapolates Free Cash Flow reaching $383.1 million, built from a series of cautious annual changes. All values are provided in US dollars, and longer-range figures combine analyst estimates with further projections by the model.

Using this two-stage DCF approach, the intrinsic value per share is calculated at $133.79. This implies the stock is 20.9% undervalued compared to recent market pricing.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brink's is undervalued by 20.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

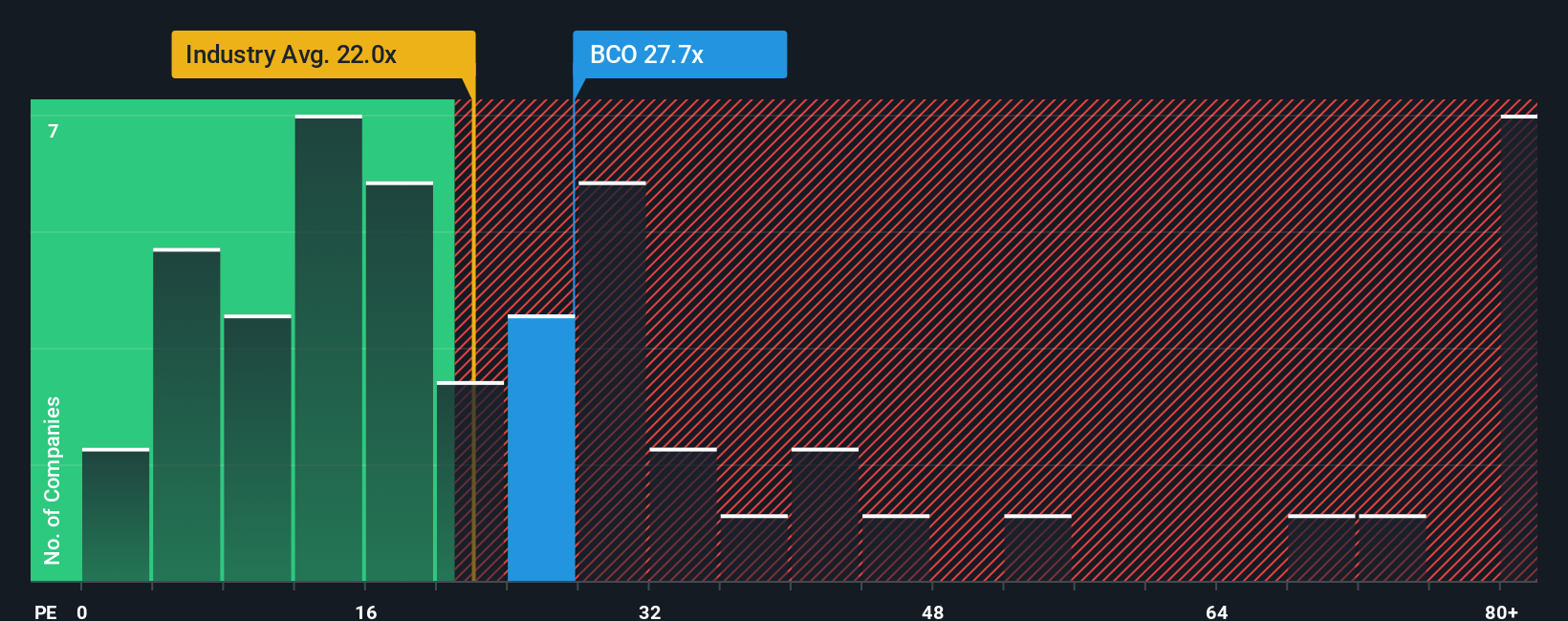

Approach 2: Brink's Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic metric for valuing profitable companies, since it relates a company's share price to its per-share earnings. For investors, PE is especially helpful in determining how much the market is willing to pay for each dollar of profit. It is widely used because it quickly signals how a company’s current valuation stacks up against its earnings power.

Of course, what qualifies as a “normal” or “fair” PE ratio depends on growth expectations and risk. Faster-growing or lower-risk companies typically attract higher PEs, as investors are willing to pay a premium for growth and stability. In contrast, slower-growing or more volatile businesses often command lower multiples.

Brink’s is currently trading at a PE of 27.3x. For context, this is above the Commercial Services industry average of 22.4x, and also higher than the average of its direct peers at 21.4x. However, Simply Wall St’s Fair Ratio, a proprietary measure that factors in Brink’s specific growth profile, risks, margins, size, and industry, suggests the fair PE for Brink’s is actually 41.7x. This Fair Ratio provides a more tailored benchmark than peer or industry comparisons, since it incorporates nuances like expected growth rates, profit margins, risk levels, and market cap, rather than just relying on broad averages.

With Brink’s PE ratio sitting noticeably below the Fair Ratio, the stock appears undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brink's Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique, evidence-based story about a company, where you connect your view of its future (like expected revenue, earnings, or profit margins) with a financial forecast and a resulting fair value estimate, all in one place. Instead of just relying on ratios or forecasts, Narratives let you put your perspective behind the numbers, explain the logic, and see how that story compares to the market’s current price.

On Simply Wall St’s Community page, millions of investors use Narratives as a fast, approachable way to visualize and share their conviction. This helps them decide when to buy or sell by seeing if their fair value is above or below today’s price. Narratives are not just static predictions; they update dynamically as new information like earnings results or major news comes in, keeping your thesis current and actionable no matter how the story evolves.

For example, some investors see Brink’s future boosted by accelerating high-margin growth in its AMS and digital solutions, supporting a fair value around $128.50. Others are more cautious, expecting secular risks from digital payments and slower earnings growth, which could justify a lower value. With Narratives, you can easily compare your assumptions with others, sense check consensus, and make smarter, more personalized investment decisions.

Do you think there's more to the story for Brink's? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives