- United States

- /

- Commercial Services

- /

- NYSE:BCO

Does Strong ATM and Digital Growth Make Brink’s (BCO) Guidance Upgrade a Game Changer?

Reviewed by Sasha Jovanovic

- In the past week, The Brink’s Company reported quarterly earnings that exceeded expectations and raised its guidance, citing broad-based organic revenue growth, higher profitability, and accelerating free cash flow.

- Management outlined ongoing momentum through expansion in ATM Managed Services and Digital Retail Solutions, technology investments, and continued share repurchases as central to its future growth plans.

- We'll explore how Brink's revised guidance and strength in digital and ATM services could influence its investment narrative moving forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Brink's Investment Narrative Recap

To be a shareholder in Brink's, you need confidence in its ability to grow earnings through its expanding digital and ATM services, while managing risks from the ongoing shift toward cashless payments. The recent earnings surprise and raised guidance reinforce short-term momentum, but do not eliminate the company's exposure to pressure on traditional cash handling if digital payment adoption accelerates materially.

Among recent announcements, the ongoing share repurchase program stands out, with Brink's having bought back nearly 3.8 million shares under its current plan. This capital allocation choice closely ties in with short-term catalysts, as it supports earnings per share and signals management’s confidence, though it may limit funds available for technology upgrades or geographic expansion.

By contrast, investors should be aware of how rapid adoption of cashless technologies could...

Read the full narrative on Brink's (it's free!)

Brink's narrative projects $6.0 billion in revenue and $755.1 million in earnings by 2028. This requires 5.5% yearly revenue growth and a $593.4 million increase in earnings from the current $161.7 million level.

Uncover how Brink's forecasts yield a $133.50 fair value, a 18% upside to its current price.

Exploring Other Perspectives

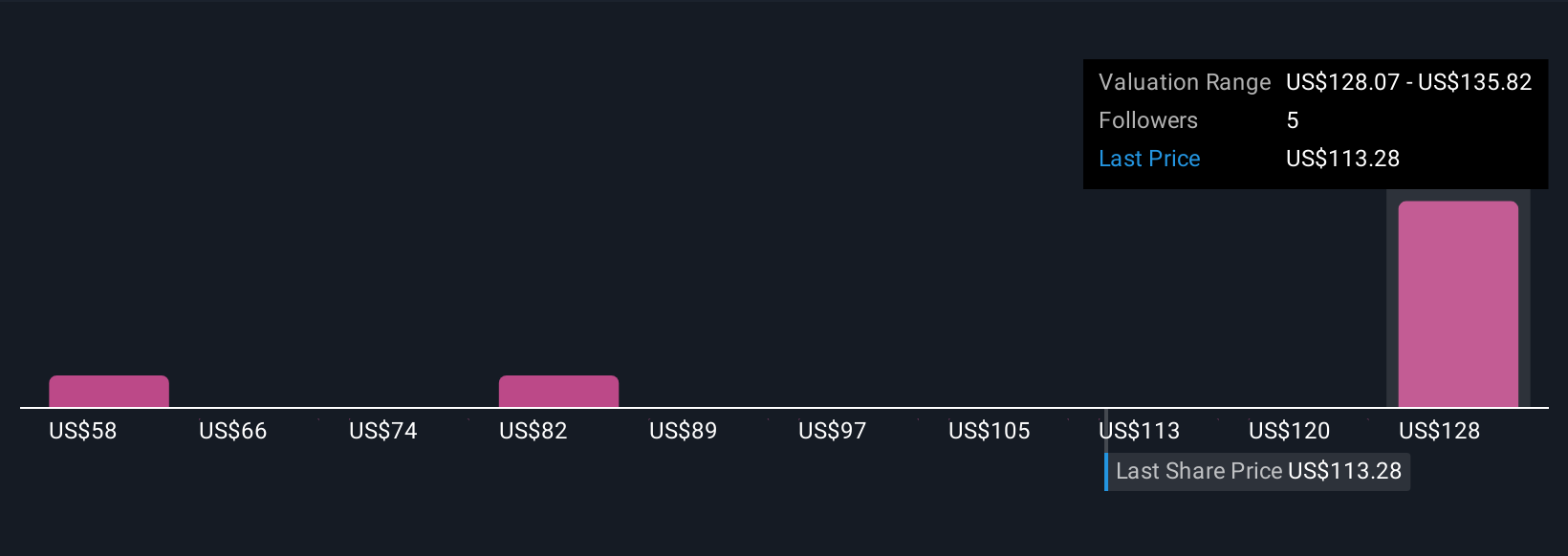

Fair value estimates from the Simply Wall St Community range widely, from US$58.27 to US$214.29, based on five individual analyses. Many see potential in Brink's digital and ATM business momentum, but market views differ significantly on risks tied to a shift away from cash; consider reviewing several perspectives if you want the full picture.

Explore 5 other fair value estimates on Brink's - why the stock might be worth as much as 90% more than the current price!

Build Your Own Brink's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026