- United States

- /

- Commercial Services

- /

- NYSE:BCO

Brink's (BCO): Margin Improvement Reinforces Bull Case Despite Slower Earnings Growth

Reviewed by Simply Wall St

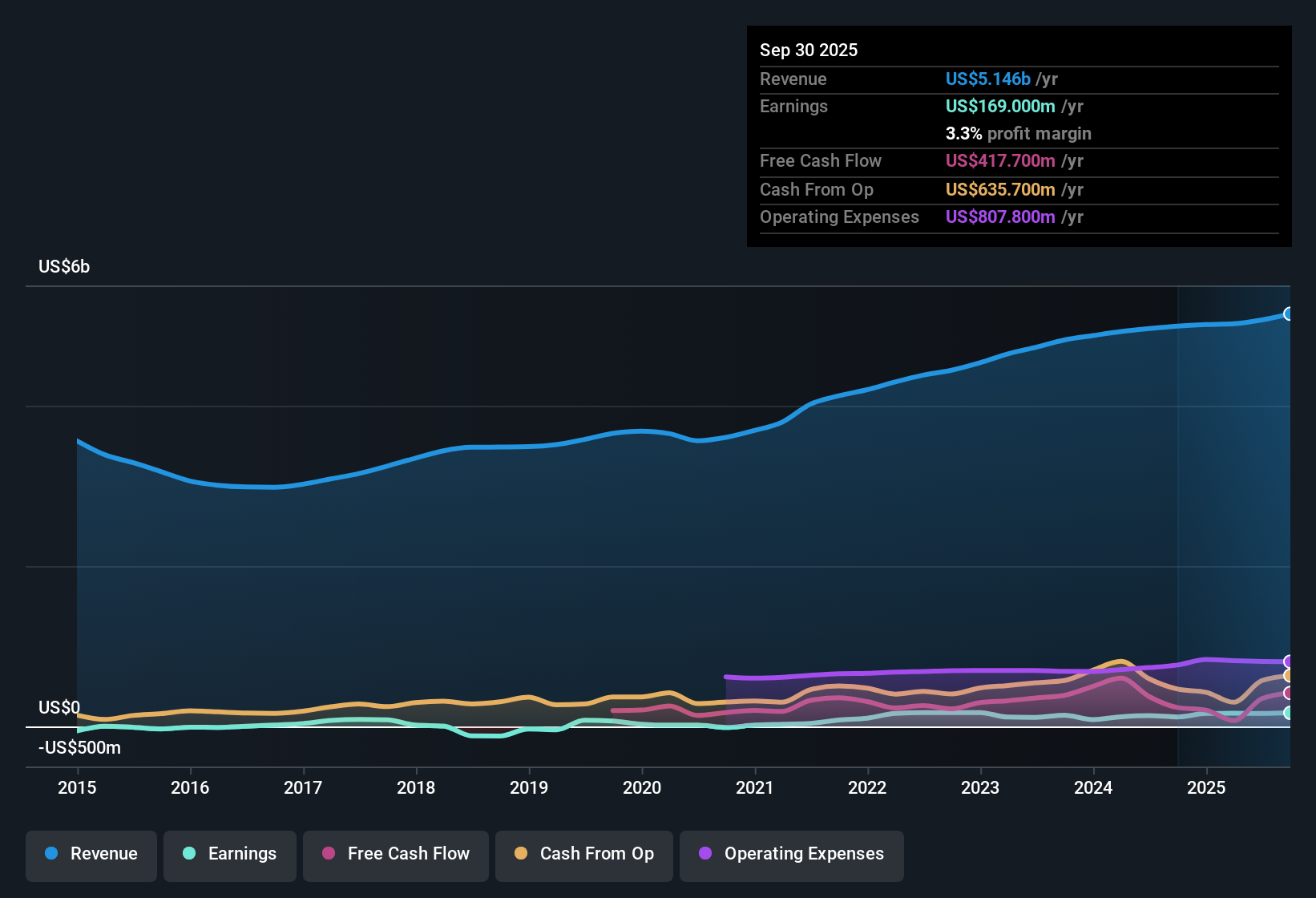

Brink’s (BCO) recorded a 22.9% annual earnings increase over the past five years, with earnings up another 19.7% in the last twelve months. Net profit margin now stands at 3.2%, up from 2.7% a year ago. The current share price of $113.86 lags behind the estimated fair value of $171.76 according to discounted cash flow calculations. While profit growth and margin expansion suggest the company is delivering consistent results, investors may weigh this against a premium price-to-earnings ratio of 29.3x versus peers, as well as a minor risk tied to Brink’s financial position.

See our full analysis for Brink's.The real test now is how these numbers stack up against the most talked-about narratives in the market. Some long-held beliefs could be reinforced, while others might get upended.

See what the community is saying about Brink's

AMS and Digital Solutions Fuel Diversification

- Analysts project Brink’s revenue will grow by 5.5% annually over the next three years, with double-digit organic growth expected from AMS (ATM Managed Services) and DRS (Digital Retail Solutions) segments, unlocking access to higher-margin, less capital-intensive opportunities.

- The consensus narrative emphasizes that accelerating AMS and digital solution momentum is broadening Brink’s addressable market and driving operating margin gains.

- Rapid expansion in international regions, where cash payments remain crucial and GDP is rising, is supporting steady revenue diversification beyond legacy cash-in-transit operations.

- Investments in automation, route optimization, and AI-powered analytics have contributed to the net profit margin rising from 2.7% to 3.2%, reinforcing the view that digital initiatives are directly impacting earnings quality and free cash flow.

Share Buybacks Boost Per-Share Growth

- Brink's is forecast to reduce its shares outstanding by 4.54% per year over the next three years, with more than half of free cash flow targeted for share repurchases.

- The consensus narrative points out that disciplined capital allocation, notably aggressive buybacks and select M&A, could amplify EPS and compound future earnings.

- By concentrating remaining earnings among a smaller share base, management may boost future EPS growth. Analysts expect earnings to reach $755.1 million and $18.46 per share by 2028, up from $161.7 million today.

- Balance sheet flexibility from improved free cash flow conversion is expected to support both buybacks and continued investment in digital expansion.

Premium Valuation Despite Fair Value Gap

- Brink’s price-to-earnings ratio stands at 29.3x, above the industry average of 22.4x and peer average of 21.7x, yet the share price of $113.86 trades below both analyst target ($128.50) and DCF fair value ($171.76).

- According to the analysts' consensus view, this valuation tension reflects confidence in Brink’s margin expansion but invites debate around whether premium multiples are justified as growth slows and digital disruption looms.

- Analysts expect profit margins to improve from 3.2% to 12.7% over three years, potentially validating the valuation if efficiency and digital upgrades deliver as promised.

- However, heavy cash-based service reliance and rising competition from fintechs may challenge long-term earnings, keeping some investors skeptical even at a discount to fair value.

Bulls and skeptics are debating if modernization momentum can outpace industry headwinds. See the full Consensus Narrative for how both sides are framing Brink's future. 📊 Read the full Brink's Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Brink's on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others may have missed? Share your unique insights by crafting your own narrative in just a few minutes. Do it your way.

A great starting point for your Brink's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Brink’s faces justified skepticism over its premium valuation, heavy reliance on cash-based services, and mounting competition from fintech disruptors.

If a more attractive entry point or strong value is what you want, check out these 850 undervalued stocks based on cash flows for a lineup of stocks trading below fair value with compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brink's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BCO

Brink's

Provides cash and valuables management, digital retail solutions, and automated teller machines (ATM) managed services in North America, Latin America, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives