- United States

- /

- Professional Services

- /

- NYSE:BAH

Does Booz Allen’s AI-Powered 6G Wireless Role With NVIDIA Reshape the Bull Case for BAH?

Reviewed by Sasha Jovanovic

- In October 2025, NVIDIA announced America’s first AI-native wireless stack for 6G, partnering with Booz Allen Hamilton, Cisco, MITRE, ODC, and T-Mobile to build a complete AI-powered network and develop new applications advancing next-generation wireless technology.

- Booz Allen’s contribution to breakthrough ISAC applications, combining radio-frequency sensing and camera vision for real-time, low-visibility object tracking, highlights its expanding role in AI-driven connectivity and critical sensing for public safety and national security.

- We'll examine how Booz Allen's leap into AI-native 6G wireless and advanced sensing shapes its long-term investment narrative and opportunities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Booz Allen Hamilton Holding Investment Narrative Recap

To own shares in Booz Allen Hamilton today, you’d need to believe the company can convert its deepening investments in advanced AI technologies, like next-generation 6G wireless and integrated sensing, into sustainable contract wins and margin growth, despite recent earnings pressure and ongoing dependence on government budgets. While the October AI-native wireless announcement strengthens Booz Allen’s positioning in future tech, it does not resolve the pressing near-term risk of revenue uncertainty driven by slow U.S. government procurement cycles.

The recent $1.58 billion weapons-of-mass-destruction intelligence contract showcases Booz Allen’s continued traction in defense and intelligence, sectors likely to shape the company’s backlog conversion and near-term growth. In the context of new opportunities around 6G and AI-powered connectivity, where early productization remains unproven, how and when these strategic wins drive earnings momentum is still evolving.

However, even as Booz Allen advances in high-tech initiatives, investors must not overlook the ongoing impact of government funding delays and...

Read the full narrative on Booz Allen Hamilton Holding (it's free!)

Booz Allen Hamilton Holding is projected to reach $13.5 billion in revenue and $775.2 million in earnings by 2028. This outlook assumes annual revenue growth of 4.1%, but a decrease in earnings of $224.8 million from the current $1.0 billion.

Uncover how Booz Allen Hamilton Holding's forecasts yield a $101.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

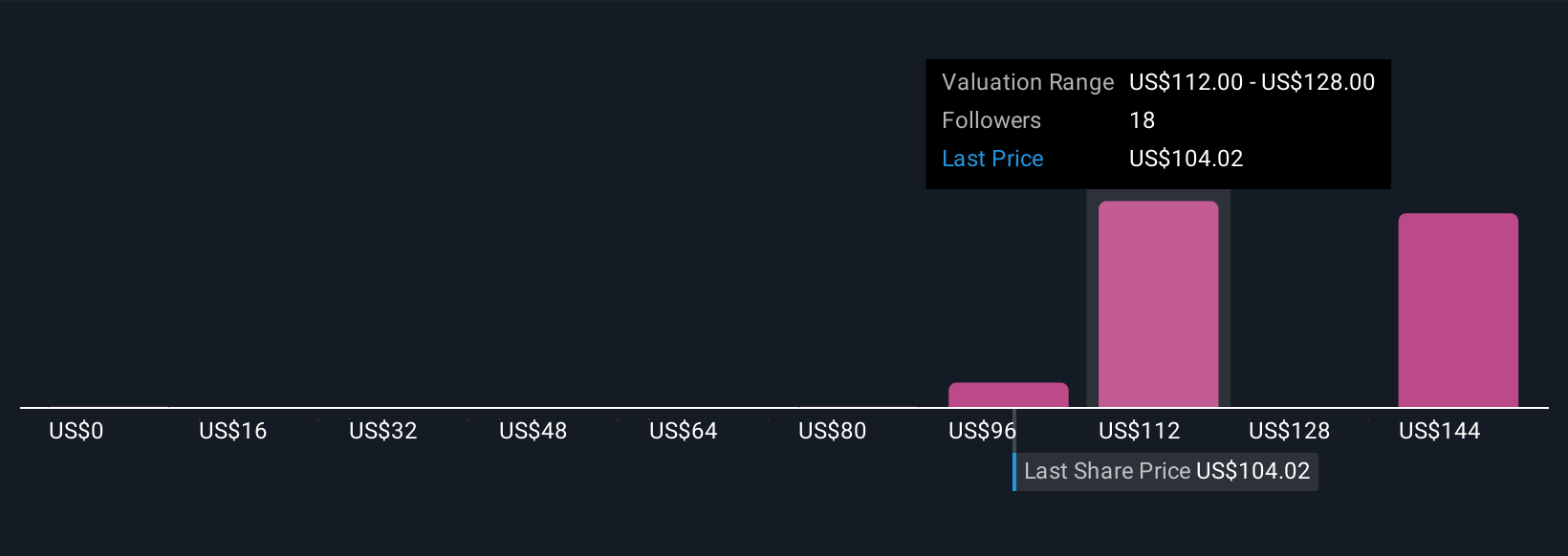

Simply Wall St Community members offered 9 separate fair value estimates for Booz Allen Hamilton, spanning from just US$16.86 to US$168.65 per share. While these opinions show striking differences, awareness of the company’s reliance on federal contracts remains central to understanding future return potential, be sure to consider how each viewpoint weighs recurring revenue risks before deciding for yourself.

Explore 9 other fair value estimates on Booz Allen Hamilton Holding - why the stock might be worth less than half the current price!

Build Your Own Booz Allen Hamilton Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Booz Allen Hamilton Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Booz Allen Hamilton Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Booz Allen Hamilton Holding's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BAH

Booz Allen Hamilton Holding

A technology company, provides technology solutions using artificial intelligence, cyber, and other technologies for government’s cabinet-level departments and commercial customers in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives