- United States

- /

- Professional Services

- /

- NYSE:AMTM

Sellafield Nuclear Contract Win Might Change The Case For Investing In Amentum Holdings (AMTM)

Reviewed by Sasha Jovanovic

- Sellafield Ltd. recently announced that Amentum Holdings has secured key positions on a multi-billion-pound, 15-year framework to deliver decommissioning and hazardous waste retrieval solutions at the Sellafield nuclear site in Cumbria, England.

- The partnership not only highlights Amentum’s technical capabilities, such as AI-driven knowledge management and robotics, but also underscores its growing presence in the UK’s nuclear remediation sector.

- We’ll explore how Amentum’s advanced use of robotics and AI shapes its investment narrative after this significant contract award.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Amentum Holdings' Investment Narrative?

For anyone sizing up Amentum Holdings, the central narrative revolves around whether this company can convert its solid pipeline of high-value contracts, such as the new £1.4 billion Sellafield framework, into sustained earnings growth and improved balance sheet strength. The Sellafield award is among the largest in Amentum’s recent history, providing a visible boost to future revenue potential and addressing a prior risk of contract concentration. In the short term, this new deal reinforces confidence in the firm’s nuclear and hazardous waste expertise, and could improve near-term earnings visibility just as the company prepares to report Q4 results. However, the surge in large government and defense work brings its own challenges, particularly with Amentum’s high price-to-earnings ratio and unseasoned board. Shifting contract mix and execution risk are now even more relevant catalysts and risks as the company enters a more complex, high-stakes phase of growth.

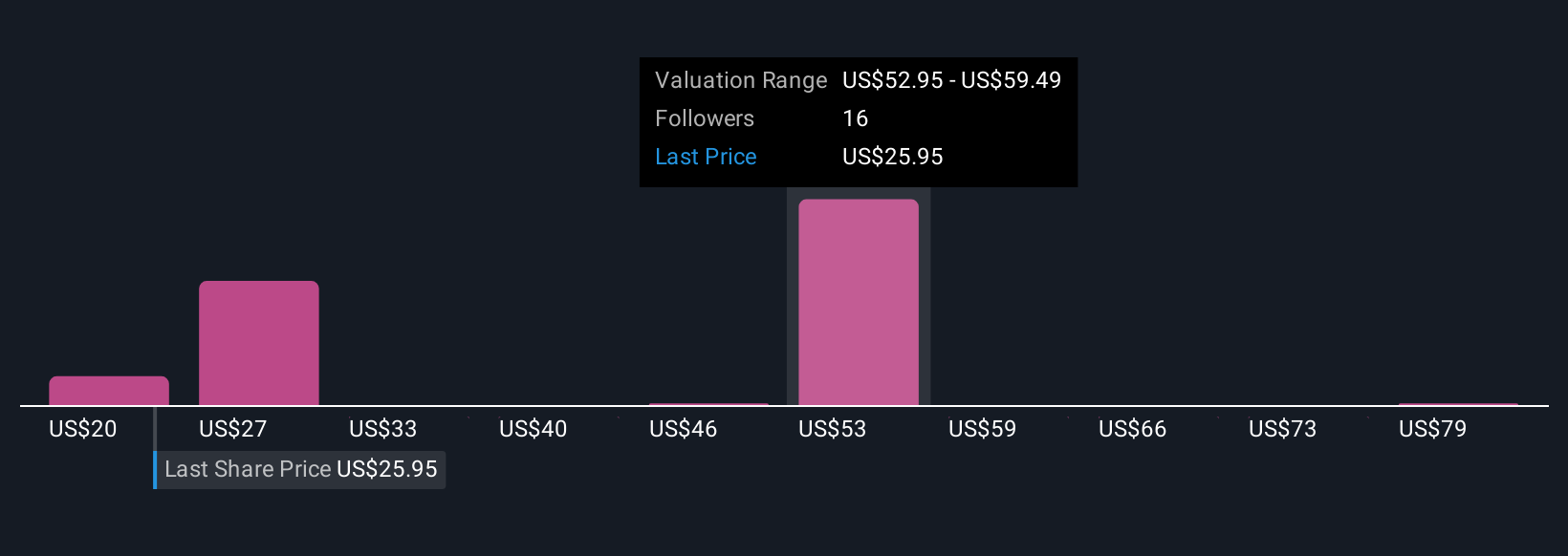

But contract wins of this size also highlight the importance of experienced leadership, something investors should consider. Amentum Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 7 other fair value estimates on Amentum Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Amentum Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amentum Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amentum Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives