- United States

- /

- Professional Services

- /

- NYSE:AMTM

Amentum Holdings (NYSE:AMTM) Valuation in Focus After Securing $1.9 Billion Sellafield Nuclear Contract

Reviewed by Simply Wall St

Amentum Holdings (NYSE:AMTM) just landed a major win with its selection for key roles in the 15-year Decommissioning and Nuclear Waste Partnership at the Sellafield nuclear site in the United Kingdom. This contract, which could be valued at up to $1.9 billion for Amentum’s share, elevates the company’s presence in nuclear decommissioning and technical solutions overseas.

See our latest analysis for Amentum Holdings.

This high-profile contract win comes after a challenging period for Amentum Holdings, with the company posting a one-year total shareholder return of -32.9%. While the stock saw a modest 3.46% year-to-date share price return, momentum remains mixed as investors weigh the longer-term growth potential signaled by moves like the Sellafield partnership in light of recent volatility.

If major contracts in complex sectors catch your attention, it can be rewarding to broaden your investing toolkit and discover See the full list for free.

With shares still trading at a notable discount to analyst price targets and recent contract wins boosting long-term prospects, is Amentum Holdings now an undervalued play, or is all this future growth already priced in?

Price-to-Earnings of 104.9x: Is it justified?

Amentum Holdings trades at a steep price-to-earnings multiple of 104.9x, far above both its peers and the wider US market, with shares most recently closing at $22.41. This suggests the market is expecting unusually strong future results relative to current earnings.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings and is key in mature sectors like professional services. A high P/E can signal conviction in a company’s future profit potential but also points to high expectations that leave less margin for error.

With the US Professional Services industry averaging a P/E of just 24.5x, Amentum’s 104.9x ratio stands out as richly priced. Compared to an estimated “fair” P/E of 40.9x, the stock appears even more expensive, suggesting substantial optimism is already reflected in the price and that the stock price could face pressure if growth does not materialize as anticipated.

Explore the SWS fair ratio for Amentum Holdings

Result: Price-to-Earnings of 104.9x (OVERVALUED)

However, investors should note risks such as challenges in executing new contracts, as well as reliance on continued strong revenue and net income growth.

Find out about the key risks to this Amentum Holdings narrative.

Another View: Is the DCF Telling a Different Story?

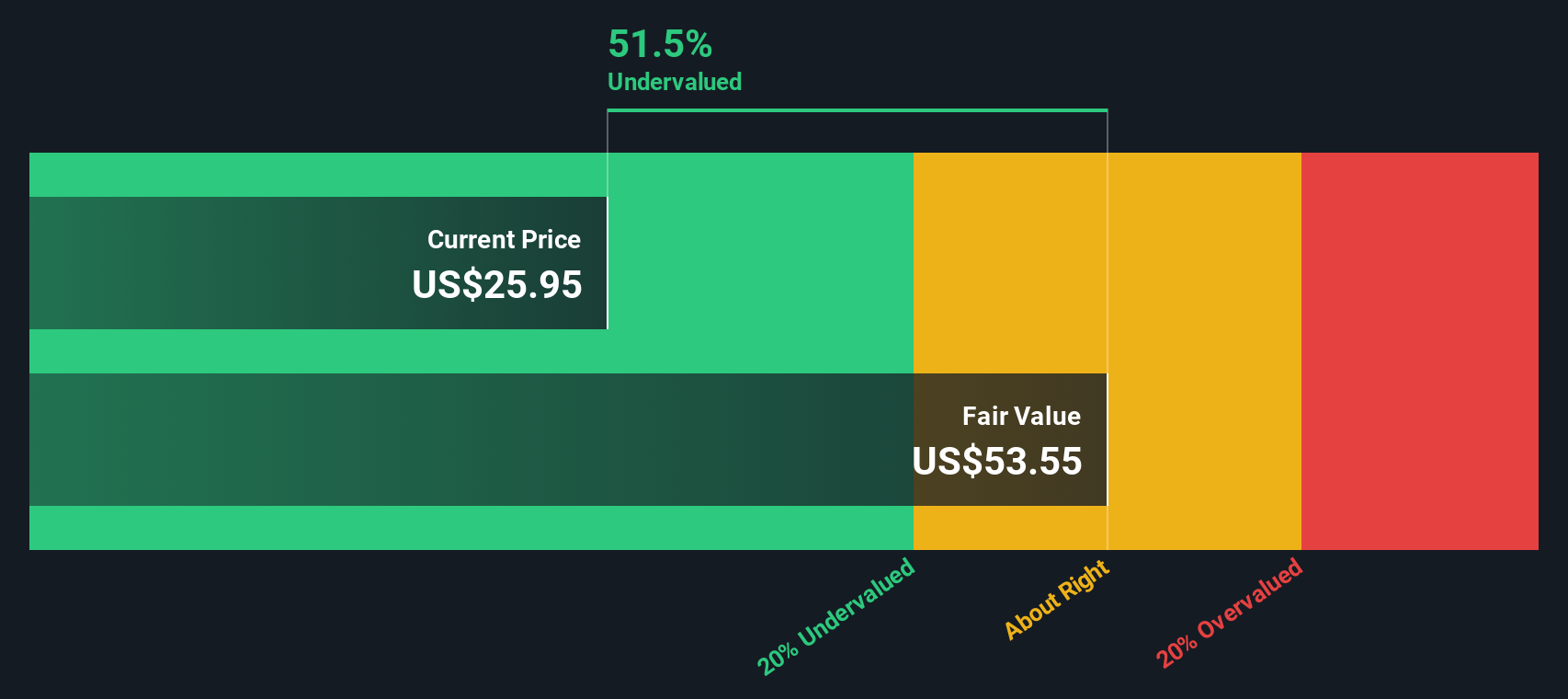

While Amentum Holdings looks expensive on earnings multiples, our DCF model presents a different perspective. It suggests the shares could be trading at a 56.5% discount to fair value, which implies the market might be too pessimistic about future cash flows. Is the upside potential as significant as it appears, or does risk still outweigh reward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amentum Holdings Narrative

If you see the numbers differently, or want to dive deeper on your own terms, it only takes a few minutes to shape your own view and Do it your way

A great starting point for your Amentum Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Seize the chance to uncover smart opportunities matched to your goals, using the tools trusted by investors worldwide.

- Tap into hidden potential with these 876 undervalued stocks based on cash flows to spot companies whose share prices lag behind their real growth opportunities.

- Capture powerful trends by checking out these 25 AI penny stocks that are shaping the next wave of intelligent automation and digital transformation.

- Boost your portfolio’s income with these 16 dividend stocks with yields > 3% for access to higher-than-average yields and companies with robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives