- United States

- /

- Consumer Services

- /

- NYSE:ADT

We Wouldn't Be Too Quick To Buy ADT Inc. (NYSE:ADT) Before It Goes Ex-Dividend

It looks like ADT Inc. (NYSE:ADT) is about to go ex-dividend in the next 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase ADT's shares on or after the 15th of December will not receive the dividend, which will be paid on the 4th of January.

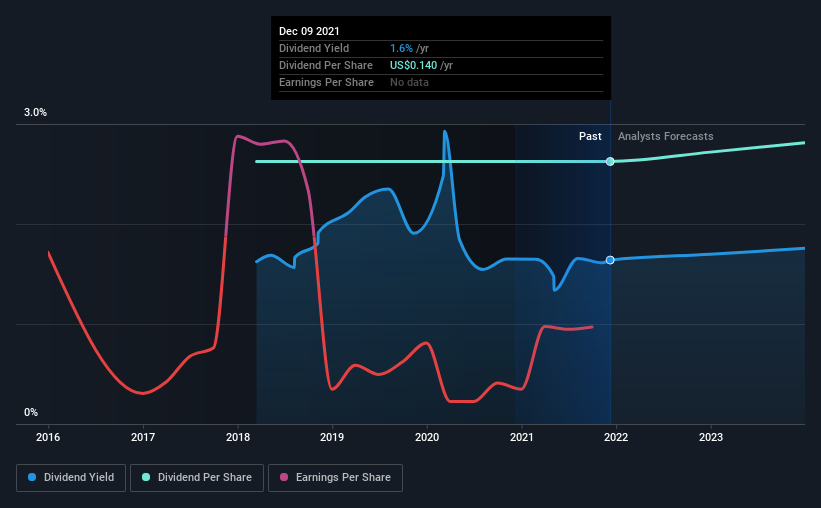

The company's next dividend payment will be US$0.035 per share, on the back of last year when the company paid a total of US$0.14 to shareholders. Looking at the last 12 months of distributions, ADT has a trailing yield of approximately 1.6% on its current stock price of $8.54. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for ADT

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. ADT lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Over the past year it paid out 179% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. ADT reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. ADT's dividend payments are broadly unchanged compared to where they were four years ago. When earnings are declining yet the dividends are flat, typically the company is either paying out a higher portion of its earnings, or paying out of cash or debt on the balance sheet, neither of which is ideal.

Remember, you can always get a snapshot of ADT's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

Is ADT an attractive dividend stock, or better left on the shelf? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Second, the dividend was not well covered by cash flow." Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with ADT. In terms of investment risks, we've identified 1 warning sign with ADT and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ADT

ADT

Provides security, interactive, and smart home solutions in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives