- United States

- /

- Commercial Services

- /

- NYSE:ABM

Will ABM Industries' (ABM) New Board Appointment Shape Its Strategic and Financial Direction?

Reviewed by Sasha Jovanovic

- ABM Industries recently announced the appointment of Barry Hytinen, Executive Vice President and CFO of Iron Mountain, to its Board of Directors.

- This addition brings significant expertise in corporate finance and strategic transformation, potentially strengthening ABM’s board leadership as it advances its long-term plans.

- We’ll now examine how Barry Hytinen’s appointment brings financial insight that could inform ABM’s approach to growth and operational strategy.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ABM Industries Investment Narrative Recap

For those considering ABM Industries, the investment thesis centers on the company’s ability to defend margins and maintain revenue stability, as it faces ongoing cost pressures in competitive commercial markets. The recent appointment of Barry Hytinen to the Board may boost ABM’s financial and strategic oversight, but the most significant short-term catalyst, margin improvement from cost-saving initiatives, remains largely dependent on execution rather than board changes. The biggest immediate risk, margin compression driven by pricing concessions, is largely unaffected by this news.

One recent announcement that stands out is ABM’s share repurchase activity; the company bought back 1.1 million shares for US$50.1 million. This could enhance per-share metrics and potentially support the share price if margin improvements materialize as expected, aligning closely with the company’s focus on operational leverage and cost efficiencies as key short-term catalysts.

But while board appointments suggest a focus on governance and financial insight, investors should be aware that margin pressures from pricing concessions continue to...

Read the full narrative on ABM Industries (it's free!)

ABM Industries' outlook anticipates $9.5 billion in revenue and $370.4 million in earnings by 2028. This scenario assumes a 3.2% annual revenue growth and a $254.5 million increase in earnings from the current $115.9 million.

Uncover how ABM Industries' forecasts yield a $58.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

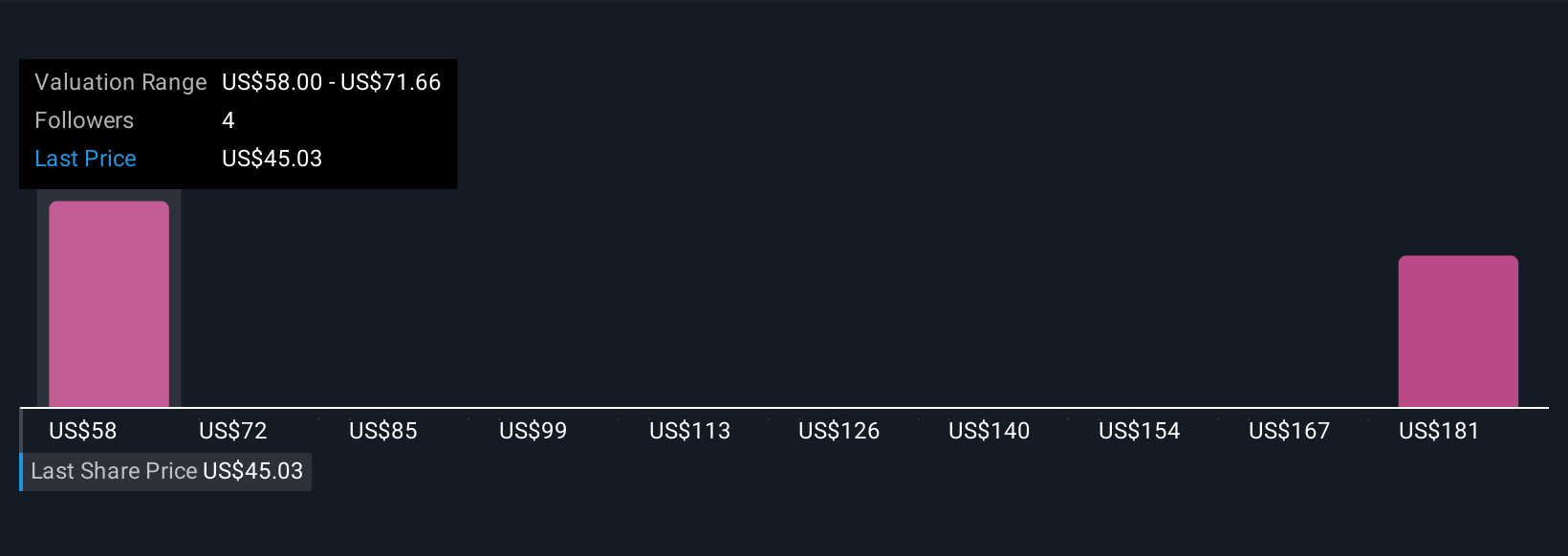

Community members have estimated ABM’s fair value between US$58 and US$195.46, based on two independent views. Amid such broad estimates, margin compression from strategic pricing presents a critical issue for future profit stability that every shareholder should consider.

Explore 2 other fair value estimates on ABM Industries - why the stock might be worth over 4x more than the current price!

Build Your Own ABM Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABM Industries research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ABM Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABM Industries' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABM

ABM Industries

Through its subsidiaries, engages in the provision of integrated facility, infrastructure, and mobility solutions in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives