- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

Why Is Willdan Group (WLDN) Up After Strong Q3 Earnings and Raised Outlook?

Reviewed by Sasha Jovanovic

- Willdan Group reported third quarter 2025 earnings, posting US$182.01 million in sales and US$13.72 million net income, both up meaningfully from the prior year, and increased its full-year outlook following the positive impact of recent acquisitions like APG.

- This performance highlights how recent acquisitions are supporting both revenue growth and margin improvements, reinforcing the company’s evolving approach to larger and more complex projects.

- We’ll explore how Willdan’s improved earnings outlook and the effects of its acquisitions may influence its investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Willdan Group Investment Narrative Recap

For someone considering Willdan Group, the core belief is in its ability to grow earnings and margins by expanding its reach through acquisitions and capturing the rising demand for energy efficiency services. The strong third-quarter results and increased full-year outlook underscore management’s focus on scaling projects, but the biggest short-term catalyst, winning major contracts with utilities and government agencies, remains closely tied to external funding and policy. The most significant risk still centers on potential policy shifts impacting its utility and government-funded client base, which could affect revenue predictability, although these latest results do not change that risk in a material way.

Among recent announcements, Willdan’s new partnership with National Grid to deliver energy efficiency services to Massachusetts small businesses stands out, given its relevance to the company’s key revenue stream and contract-driven growth. Such agreements are central to supporting the company’s near-term outlook and form a tangible link between its project backlog and the improved earnings guidance highlighted in the most recent results.

But while the headlines may signal momentum, investors should be aware of the company’s heavy reliance on government and utility contracts, which leaves it exposed if...

Read the full narrative on Willdan Group (it's free!)

Willdan Group's narrative projects $867.2 million revenue and $76.9 million earnings by 2028. This requires 11.3% yearly revenue growth and a $41.7 million earnings increase from $35.2 million today.

Uncover how Willdan Group's forecasts yield a $132.50 fair value, a 55% upside to its current price.

Exploring Other Perspectives

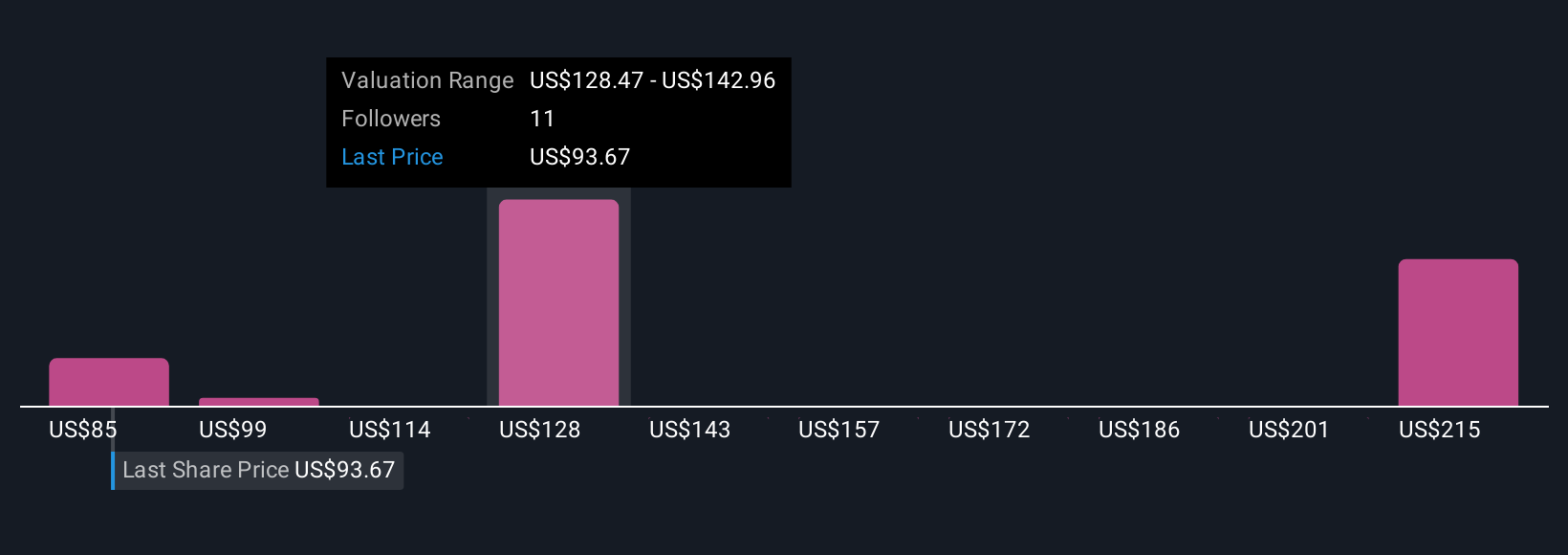

Four community fair value estimates for Willdan Group range from US$85 to US$231, with some seeing steep undervaluation. These multiple perspectives highlight how revenue linked to public-sector contracts can shape expectations for both risk and reward.

Explore 4 other fair value estimates on Willdan Group - why the stock might be worth over 2x more than the current price!

Build Your Own Willdan Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Willdan Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willdan Group's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives