- United States

- /

- Food

- /

- NasdaqGS:SENE.A

US Market Undiscovered Gems To Watch In November 2025

Reviewed by Simply Wall St

As the U.S. stock market rebounds with optimism surrounding a potential resolution to the government shutdown, small-cap stocks are gaining attention amid broader economic shifts. In this environment, discerning investors may find opportunities in lesser-known companies that demonstrate resilience and potential for growth despite current uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 3.81% | 3.17% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Willdan Group (WLDN)

Simply Wall St Value Rating: ★★★★★★

Overview: Willdan Group, Inc. offers professional, technical, and consulting services primarily in the United States with a market cap of approximately $1.39 billion.

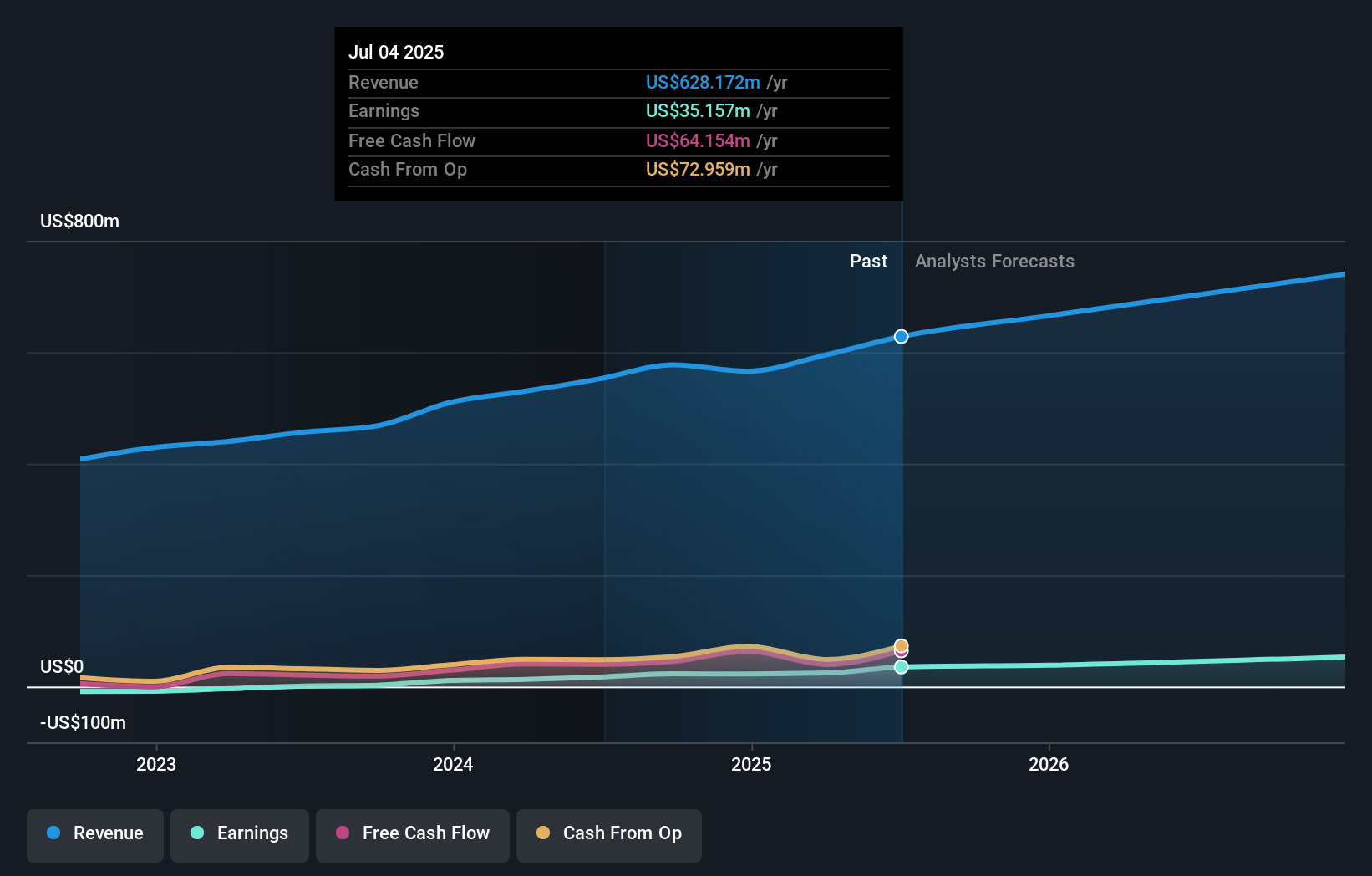

Operations: Willdan Group generates revenue primarily from its Energy segment, contributing $548.42 million, and its Engineering & Consulting segment, which adds $103.50 million.

Willdan Group, a player in the professional services industry, showcases promising growth with earnings surging 81.4% last year, outpacing industry averages. The company's net debt to equity ratio stands at a satisfactory 5.6%, reflecting financial prudence as it reduced from 68.5% over five years. Recent results highlight strong performance with Q3 sales jumping to US$182 million and net income reaching US$13.72 million, compared to US$7.35 million previously. Despite significant insider selling recently, Willdan's strategic contracts and technology advancements position it well for future growth amid grid modernization efforts across the U.S., although challenges remain in policy reliance and cost management.

Mission Produce (AVO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mission Produce, Inc. specializes in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both in the United States and internationally with a market cap of approximately $872.15 million.

Operations: Mission Produce generates revenue primarily from its Marketing & Distribution segment, which accounts for $1.32 billion, followed by International Farming at $96.60 million and Blueberries at $88.20 million. The company experiences intercompany eliminations amounting to -$80.20 million in its financials.

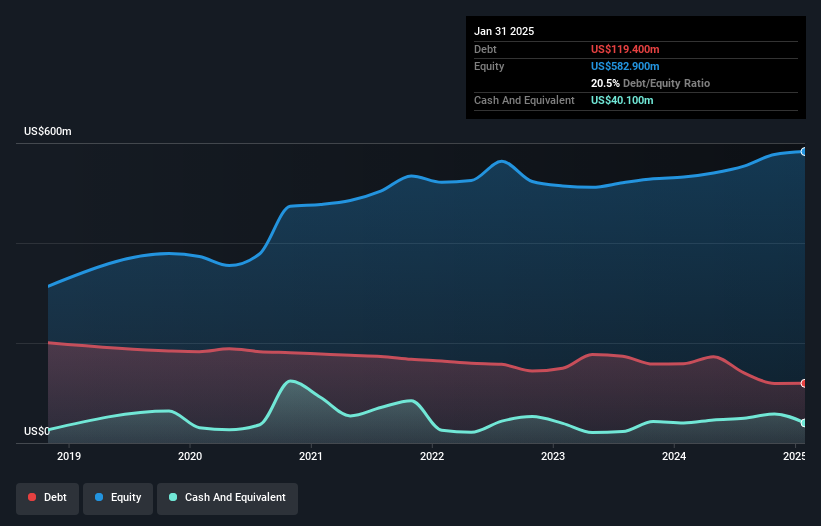

Mission Produce has been making waves with its strategic focus on international expansion and vertical integration, which seem to bolster its revenue streams and profit margins. Over the past year, earnings surged by 66.7%, outpacing the food industry's growth of 14.5%. Trading at 25% below estimated fair value, it offers potential upside for investors. The company’s debt-to-equity ratio improved from 48.2% to a more satisfactory 22.6% over five years, indicating better financial health. Recent reports show sales rising to US$357 million in Q3 compared to US$324 million previously, while net income increased to US$14.7 million from US$12.4 million last year—a promising sign despite challenges like climate risks and competitive pressures in the industry landscape.

Seneca Foods (SENE.A)

Simply Wall St Value Rating: ★★★★★☆

Overview: Seneca Foods Corporation operates in the packaged fruits and vegetables industry, serving both domestic and international markets, with a market cap of $776.63 million.

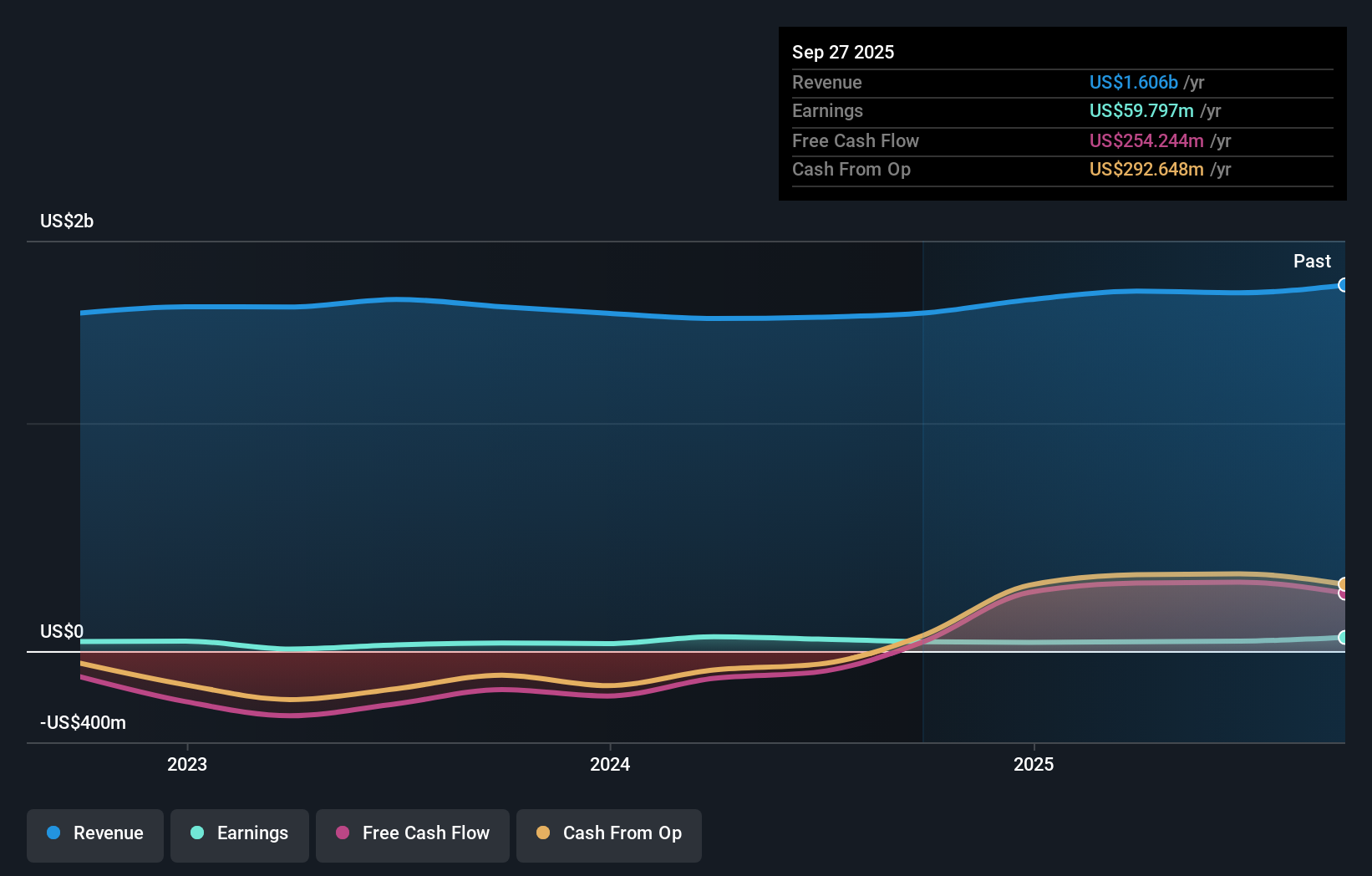

Operations: Revenue primarily comes from the Vegetable segment at $1.46 billion, followed by the Fruit and Snack segment at $108.67 million.

Seneca Foods, a player in the food industry, has shown significant strides with its recent earnings report. The company reported net income of US$29.74 million for the second quarter, a notable increase from US$13.3 million last year, reflecting strong performance with basic earnings per share jumping to US$4.33 from US$1.92. Despite past challenges with an average annual earnings decline of 23.8% over five years, recent growth of 44.3% outpaces the industry's 14.5%. With a satisfactory net debt to equity ratio at 38.9%, Seneca seems well-positioned financially and trades at an attractive valuation below its estimated fair value by 98.9%.

- Take a closer look at Seneca Foods' potential here in our health report.

Gain insights into Seneca Foods' past trends and performance with our Past report.

Turning Ideas Into Actions

- Reveal the 297 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SENE.A

Seneca Foods

Provides packaged fruits and vegetables in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives