- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Assessing Verra Mobility’s Valuation After Strong Q3 Results and Upgraded Growth Outlook

Reviewed by Simply Wall St

Verra Mobility posted stronger-than-expected third quarter earnings, supported by a spike in automated enforcement projects and fresh contract wins in New York City. Management’s move to lift full-year revenue guidance signals ongoing momentum for the company.

See our latest analysis for Verra Mobility.

Despite a robust quarter and brighter revenue guidance, Verra Mobility’s recent price momentum has yet to fully reflect that optimism. The stock recorded a modest 1-year total shareholder return of -2.7% and a current price of $22.81. Investors with a long-term view have seen significant rewards, as the company boasts a 59% total return over three years and nearly 91% over five years. This may indicate that momentum is regrouping for its next leg higher.

If you’re curious about what other standout performers might be waiting in the wings, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With earnings outpacing forecasts and management raising guidance, investors are left to wonder whether Verra Mobility stock remains undervalued or if the market is already anticipating future growth and pricing it in. Is this a buying opportunity, or not?

Most Popular Narrative: 23.5% Undervalued

Verra Mobility's widely followed fair value narrative points to a clear gap between its estimated fair value and the latest closing share price. The stage is set for a closer look at what sets these projections apart.

Demand for automated enforcement solutions is accelerating, with $60M in new annual recurring revenue contracted over the past year, high win rates in competitive bids, and continued expansion into cities adopting new traffic safety programs. This supports predictable, high-margin, SaaS-like service revenue and long-term earnings growth.

Curious how a steady drumbeat of new contracts, sticky recurring revenue, and major margin acceleration could justify such a bullish fair value? There is one bold set of growth assumptions that underpins it all. Uncover the numbers and the story shaping this intriguing valuation outlook.

Result: Fair Value of $29.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if renewed macroeconomic headwinds or unexpected contract disruption in key markets affect revenue growth or margins more than anticipated.

Find out about the key risks to this Verra Mobility narrative.

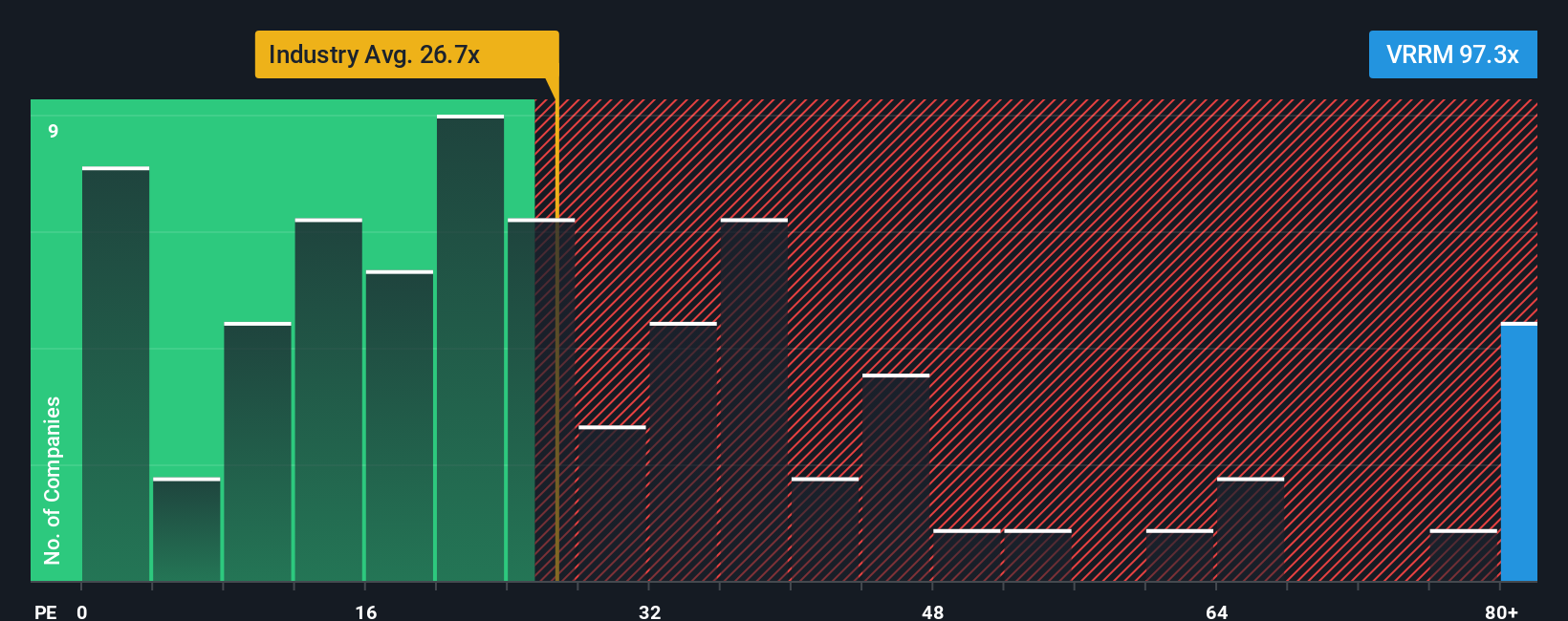

Another View: Valuing by Price-to-Earnings

While the fair value narrative suggests Verra Mobility is undervalued, an examination of its price-to-earnings ratio presents a different perspective. Shares are currently trading at 71.2x earnings, which is significantly above the fair ratio of 32.5x and much higher than both the industry average (24.4x) and peer average (20.1x). This premium indicates that investors may be paying for future growth that might not fully materialize, raising the risk of a correction if expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verra Mobility Narrative

If you want a different take or have insights of your own, you can quickly craft your own narrative in just a few minutes using Do it your way

A great starting point for your Verra Mobility research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Capitalize on untapped potential by checking out other compelling opportunities. Don’t let your next big win pass you by. These hand-picked ideas are attracting attention right now.

- Lock in steady income potential by evaluating these 16 dividend stocks with yields > 3% offering strong yields and robust business fundamentals.

- Accelerate your growth portfolio with breakthrough companies. Start with these 25 AI penny stocks at the forefront of artificial intelligence.

- Stay ahead in the digital evolution by reviewing these 82 cryptocurrency and blockchain stocks designed for exposure to blockchain innovation and cryptocurrency infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives