- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (TTEK): Valuation Spotlight After Securing Portsmouth Water Infrastructure Contract in UK

Reviewed by Simply Wall St

Tetra Tech (TTEK) has been chosen by Portsmouth Water to lead engineering design, technical support, and strategic advisory services for essential water infrastructure projects serving Southern England. This latest contract highlights Tetra Tech’s expertise in digital water solutions and international operations.

See our latest analysis for Tetra Tech.

While the Portsmouth Water partnership signals continued trust in Tetra Tech’s expertise, investors have had a bumpy ride this year. The stock’s share price declined 19.3% year-to-date, with a total return of -33.7% over the past year. Its five-year total shareholder return still stands at a solid 49%. Short-term momentum remains under pressure, but Tetra Tech’s longer-term record suggests the company knows how to deliver for its stakeholders when it counts.

If you’re interested in uncovering more opportunities beyond the usual suspects, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Tetra Tech’s shares trading at a meaningful discount to analyst targets, investors may be wondering whether the recent weakness presents a window for value-seeking investors or if the current price already reflects expectations for future growth.

Most Popular Narrative: 24.5% Undervalued

Compared to its last close of $32.18, the most widely followed narrative sees Tetra Tech as meaningfully undervalued, with a fair value target of $42.60. This sharp gap has investors asking: what is driving such a bullish view on future earnings?

Ongoing expansion of advanced digital automation and analytics offerings, catalyzed by rising adoption of AI and recent strategic acquisitions, positions Tetra Tech for higher-margin, tech-driven consulting services and recurring revenue streams. This supports long-term net margin and earnings growth.

Curious how this high-conviction valuation could play out? One key driver behind the number is a major forecast leap in profitability. The full narrative spells out bold financial assumptions and a dramatic profit margin transformation. Don’t miss the inside story. The critical numbers behind Tetra Tech’s projected surge are just a click away.

Result: Fair Value of $42.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowed commercial demand and the loss of key government contracts could undermine earnings momentum and challenge analysts' bullish forecasts for Tetra Tech.

Find out about the key risks to this Tetra Tech narrative.

Another View: Looking Through the Lens of Multiples

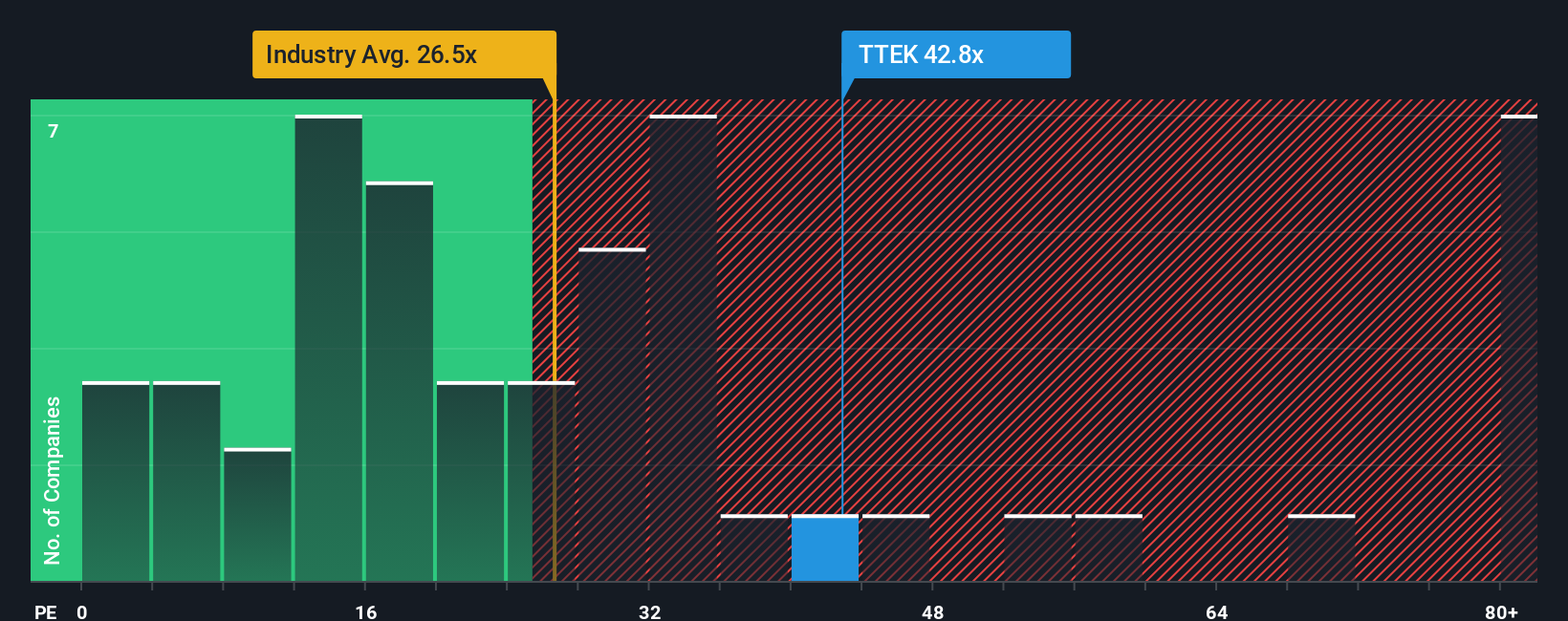

While the most-followed narrative points to Tetra Tech being undervalued, comparing its price-to-earnings ratio at 39.1x to the industry average of 23.2x and a fair ratio of 36.8x tells a different story. The stock trades at a significant premium, suggesting investors are paying up for future growth. This valuation raises the question of whether there is enough margin for upside, or if downside risk could be amplified if expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tetra Tech Narrative

If you’d rather draw your own conclusions, dive into the numbers yourself and piece together a Tetra Tech story that fits your perspective. Get started in just a few minutes with Do it your way.

A great starting point for your Tetra Tech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let’s make sure you never settle for average returns when next-level opportunities are within reach. Confidently expand your watchlist with fresh angles and future-ready themes.

- Supercharge your portfolio with reliable yields by checking out these 24 dividend stocks with yields > 3%, which consistently outperform ordinary income stocks.

- Tap into the AI wave and see which innovators are leading transformation in tech by starting with these 26 AI penny stocks.

- Ride the surge of digital finance and see how these 81 cryptocurrency and blockchain stocks are changing the game in payments, security, and decentralized systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services that focuses on water, environment, and sustainable infrastructure.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives