- United States

- /

- Commercial Services

- /

- NasdaqCM:PESI

Revenues Not Telling The Story For Perma-Fix Environmental Services, Inc. (NASDAQ:PESI) After Shares Rise 42%

Perma-Fix Environmental Services, Inc. (NASDAQ:PESI) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

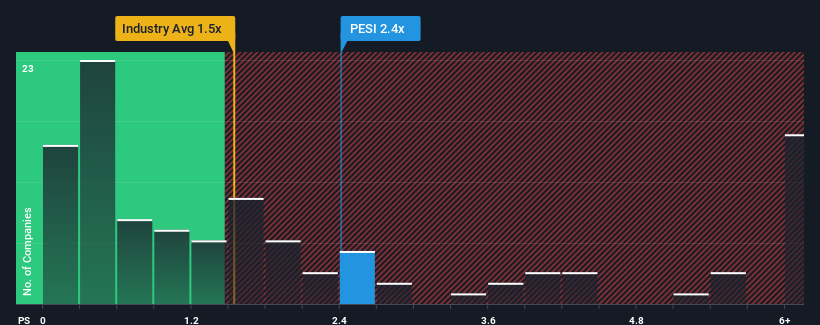

Since its price has surged higher, you could be forgiven for thinking Perma-Fix Environmental Services is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in the United States' Commercial Services industry have P/S ratios below 1.5x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Perma-Fix Environmental Services

How Perma-Fix Environmental Services Has Been Performing

Perma-Fix Environmental Services' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Perma-Fix Environmental Services will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Perma-Fix Environmental Services' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Still, lamentably revenue has fallen 20% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 4.2% over the next year. With the industry predicted to deliver 9.2% growth, that's a disappointing outcome.

With this information, we find it concerning that Perma-Fix Environmental Services is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Final Word

Perma-Fix Environmental Services shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Perma-Fix Environmental Services' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Perma-Fix Environmental Services that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PESI

Perma-Fix Environmental Services

Through its subsidiaries, operates as an environmental and technology know-how company in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives