- United States

- /

- Professional Services

- /

- NasdaqGS:HSII

Heidrick & Struggles (HSII): Examining Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Heidrick & Struggles International (HSII) has been on investors’ radars lately, particularly as its stock has posted a 19% gain over the past three months. With revenue and net income showing annual growth, there is renewed curiosity about its valuation.

See our latest analysis for Heidrick & Struggles International.

Momentum appears to be building for Heidrick & Struggles International, with shares climbing 18.6% over the past three months and a robust 33.4% year-to-date share price return. The company’s strong three-year total shareholder return of 116% signals longer-term performance that has outpaced many peers, hinting at both renewed investor optimism and fundamental execution.

If you’re interested in expanding your search beyond the usual suspects, consider checking out fast growing stocks with high insider ownership.

This recent surge raises a pivotal question for investors: is Heidrick & Struggles International still trading at a bargain given its growth, or has the market already factored in all its future potential?

Most Popular Narrative: 30% Undervalued

Heidrick & Struggles International's most widely followed valuation narrative sees its fair value at $59 per share, about 30% above the last close of $58.80. This suggests analysts and market watchers still see headroom, even after the recent share price gains and announced acquisition price.

The company's expansion into consulting, interim/on-demand talent, and leadership development services is diversifying its revenue base beyond traditional executive search. This should reduce cyclicality in earnings and support durable long-term EBITDA growth. Management's focus on scaling consultant headcount and leveraging digital tools increases operational productivity. This enables broader market coverage and servicing untapped white space opportunities, with a likely positive impact on top-line growth and operating leverage.

Want to see how bold bets on consulting and digital tools drive this high valuation? The narrative’s assumptions rest on dramatic gains in profitability and top-line growth, with financial targets that could surprise even seasoned followers. Ready to find out which aggressive financial forecasts are behind this eye-catching fair value? Go deeper for the story the numbers tell.

Result: Fair Value of $59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic uncertainty or challenges Heidrick & Struggles faces in differentiating its digital services could still impact the company’s ambitious growth narrative.

Find out about the key risks to this Heidrick & Struggles International narrative.

Another View: Multiples Tell a Different Story

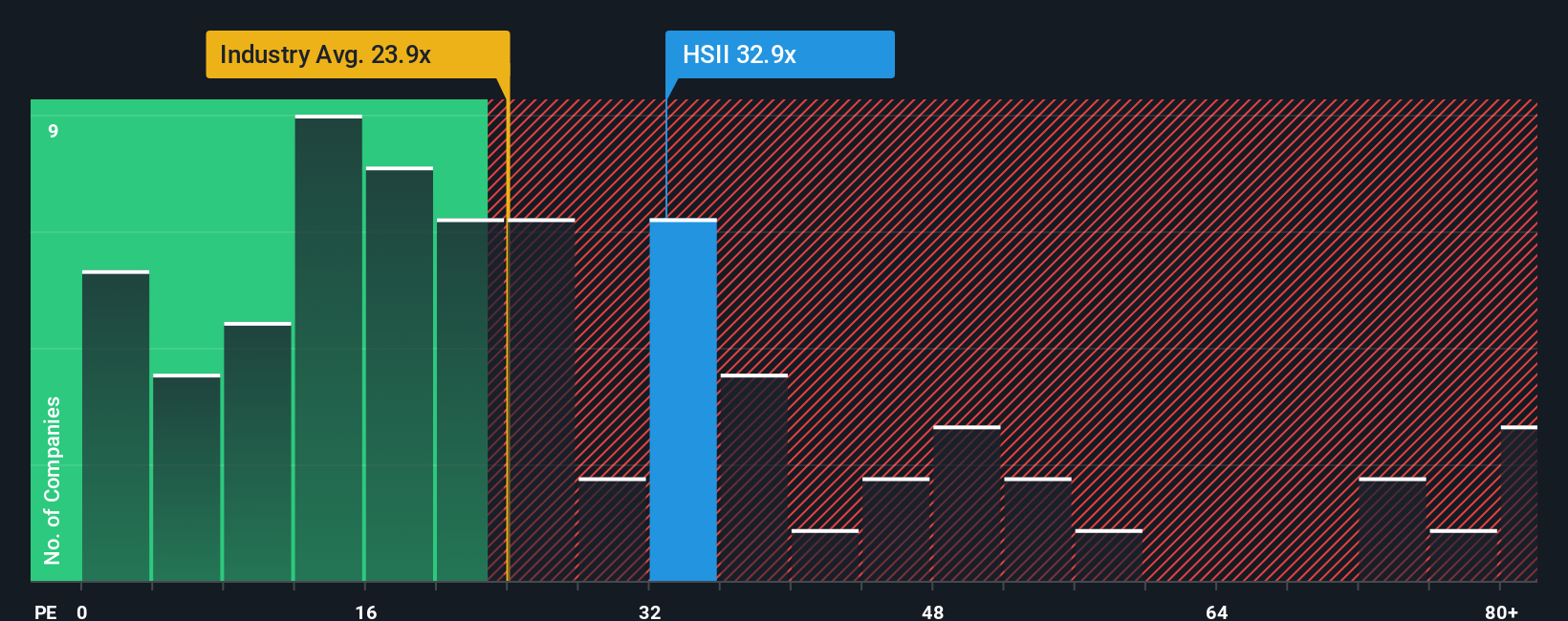

Looking at Heidrick & Struggles International through the lens of the price-to-earnings ratio paints a less optimistic picture. Shares currently trade at 33 times earnings, well above both the industry average of 24.5x and the fair ratio estimate of 26.5x. This suggests investors may be paying a premium and raises the risk that the stock could face valuation pressure if future growth does not materialize as strongly as expected. Is this optimism deserved, or are markets getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heidrick & Struggles International Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own valuation narrative in just a few minutes. Do it your way.

A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment opportunities?

Why settle for just one stock when there is an entire universe of potential winners available? Take action now to spot the companies making waves in the markets before everyone else does.

- Tap into the power of passive income and pursue financial freedom with these 15 dividend stocks with yields > 3%, where you’ll find companies offering strong yields and resilient payout histories.

- Accelerate your portfolio’s future by jumping into these 27 quantum computing stocks and meet innovators pioneering breakthroughs in computing power and transforming global industries.

- Ride the next major financial trend as you get ahead with these 82 cryptocurrency and blockchain stocks, highlighting businesses at the forefront of blockchain and digital asset evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidrick & Struggles International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSII

Heidrick & Struggles International

Provides executive search, consulting, and on-demand talent services to businesses and business leaders worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives