- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Healthcare Services Group (HCSG) Is Up 9.7% After Earnings Beat and Analyst Optimism on Growth Potential – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Healthcare Services Group recently reported strong third-quarter results, with earnings per share of US$0.59 that surpassed analysts’ expectations, driven by new client acquisitions and high retention rates.

- Fresh analyst commentary has emphasized the company’s potential for expanded revenue streams through cross-selling and entry into the “Campus opportunity,” reinforcing confidence in its industry outlook.

- We’ll explore how the company’s earnings beat and analyst optimism could influence its long-term growth outlook and valuation assumptions.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Healthcare Services Group Investment Narrative Recap

Investors in Healthcare Services Group need to believe in the company’s ability to sustain profit growth by securing new clients and retaining existing ones, particularly in long-term and post-acute care. The latest earnings beat may reinforce confidence in revenue growth and client retention as key short-term catalysts, but ongoing client concentration risk, especially with exposure to troubled customers, remains a pressing concern that has not been directly resolved by the recent results.

The Q3 2025 earnings announcement stands out as the most relevant recent news, showing stronger sales and net income largely attributed to improved client acquisition and retention. While performance has improved, the risk from customer concentration and industry restructuring continues to loom over stability and future margin expansion.

On the other hand, investors should be aware that continued uncertainty around recovering receivables from large, financially distressed clients, such as...

Read the full narrative on Healthcare Services Group (it's free!)

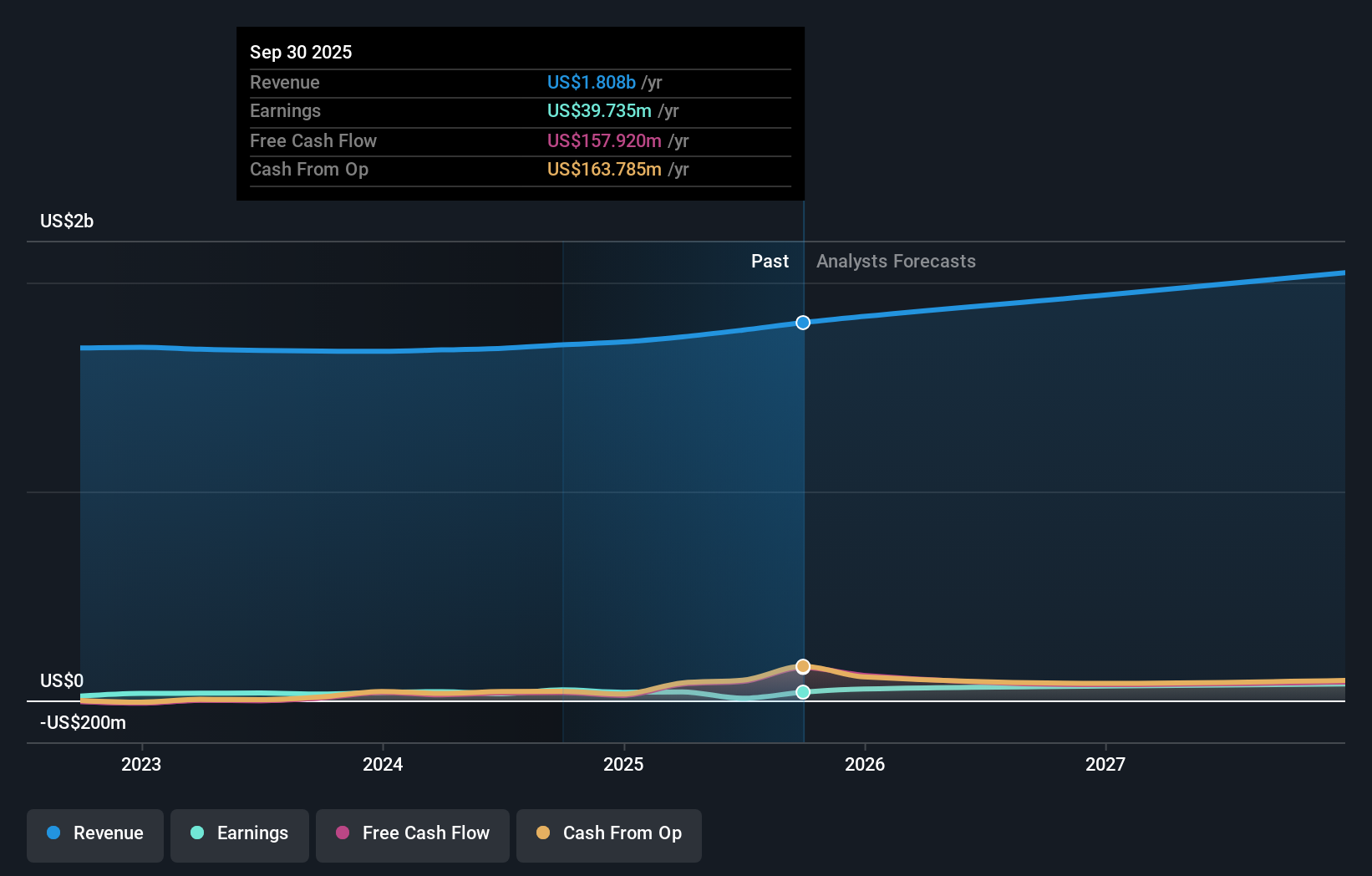

Healthcare Services Group's outlook forecasts $2.1 billion in revenue and $123.0 million in earnings by 2028. Achieving these figures would require 5.9% annual revenue growth and a $112.2 million increase in earnings from the current $10.8 million.

Uncover how Healthcare Services Group's forecasts yield a $21.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted two fair value estimates ranging from US$17.10 to US$21.50 per share. With client concentration still a risk, these differing outlooks show just how widely your own expectations for Healthcare Services Group can vary.

Explore 2 other fair value estimates on Healthcare Services Group - why the stock might be worth 9% less than the current price!

Build Your Own Healthcare Services Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Healthcare Services Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Healthcare Services Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Healthcare Services Group's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success