- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

A Look at Healthcare Services Group's (HCSG) Valuation After Strong Q3 2025 Growth and Investor Optimism

Reviewed by Simply Wall St

Healthcare Services Group (HCSG) has caught the attention of investors following its third quarter 2025 report, which highlighted impressive revenue growth and a sharp rise in net income compared to the previous year.

See our latest analysis for Healthcare Services Group.

The strong third quarter results have not gone unnoticed by the market. Healthcare Services Group's share price has surged for much of the year, with a 59.8% year-to-date return and a striking 40.1% gain over the past three months. Momentum has clearly shifted in the company’s favor, reflected in the one-year total shareholder return of nearly 67%, even as the stock still sits below five-year highs. Recent buybacks and talk of targeted acquisitions have also added to the sense that HCSG’s growth story is gaining traction.

If the turnaround at Healthcare Services Group sparks your curiosity, you can compare its momentum to other sector leaders with our Healthcare Stocks Discovery: See the full list for free.

After such a dramatic surge in performance, investors are left wondering whether recent gains reflect the company's true value, or if there is still room for upside. Is this a genuine buying opportunity? Alternatively, has the market already priced in Healthcare Services Group's future growth?

Most Popular Narrative: 14.2% Undervalued

With a fair value estimate of $21.33 per share, the most popular narrative places Healthcare Services Group at a substantial premium to its last close price of $18.31. This gap sets the tone for a forward-looking valuation shaped by strong conviction in future growth and operational execution.

The company is positioned to benefit from a multi-decade increase in demand for long-term and post-acute care services as the demographic shift of the aging U.S. population accelerates, supporting continued sequential revenue growth and a larger addressable market. With rising healthcare expenditures and an expanding focus on facility stewardship and compliance, the need for outsourced housekeeping and dietary services is increasing, giving HCSG more opportunities for new contracts and higher retention, translating into sustained top-line revenue growth.

Ever wondered what’s driving this premium valuation? There is a bold projection about future revenue streams and margins, plus a future profit multiple that may surprise even seasoned investors. Want to see what assumptions are fueling that number? Take a closer look at the full narrative to uncover the precise engine behind HCSG’s fair value story.

Result: Fair Value of $21.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant client concentration and ongoing labor market pressures could quickly undermine the bullish case if not managed carefully.

Find out about the key risks to this Healthcare Services Group narrative.

Another View: Is the Current Price Justified?

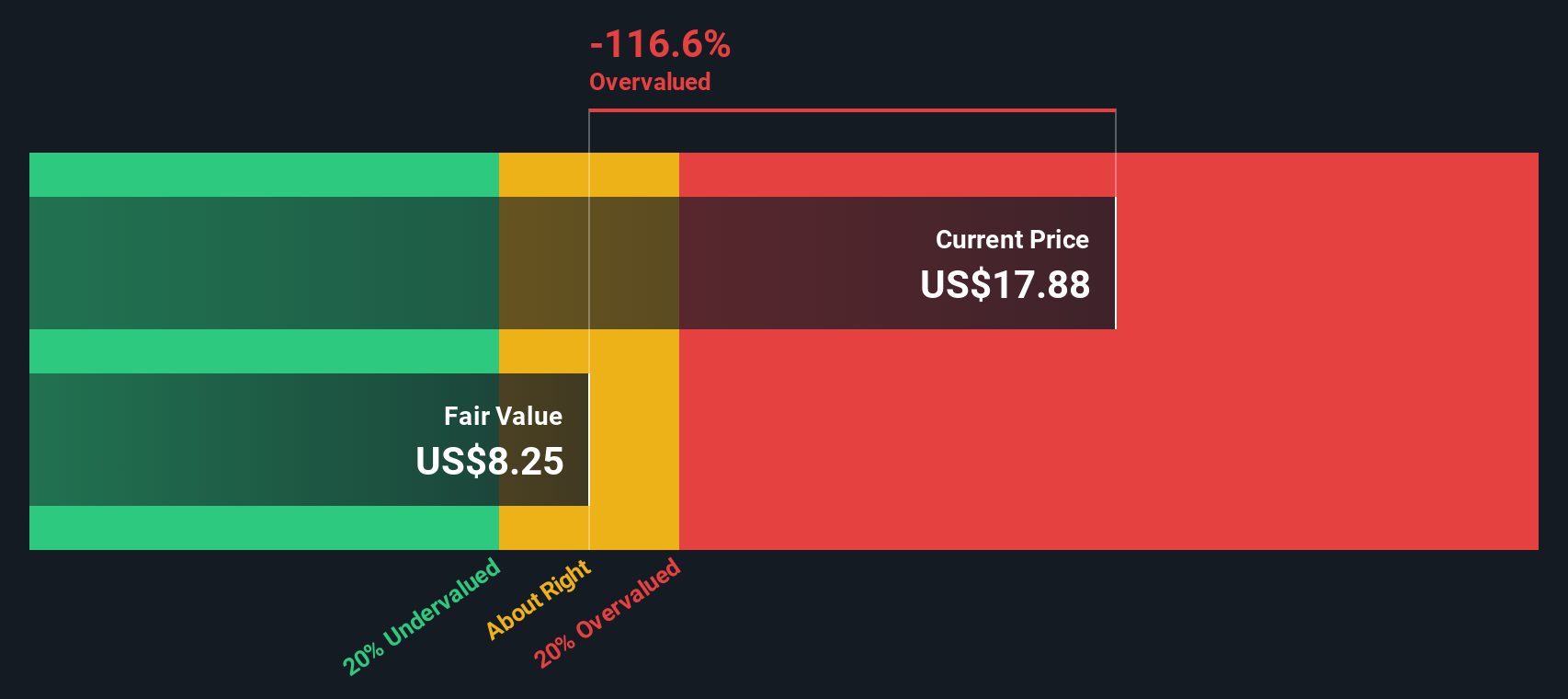

Looking at things from a different angle, our SWS DCF model values Healthcare Services Group shares at just $8.28, which is well below the recent market price of $18.31. This result suggests the current optimism reflected in the stock may be running ahead of the company’s fundamentals. Does this raise a red flag, or is the DCF missing something crucial in the HCSG story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Healthcare Services Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 834 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Healthcare Services Group Narrative

If you see the story differently or want to dig into the details yourself, crafting a custom narrative takes less than three minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Healthcare Services Group.

Looking for More Investment Ideas?

Seize this opportunity to power up your portfolio. Uncover compelling stocks and emerging opportunities. Other investors are already on the hunt for what’s next. Don’t miss your advantage.

- Start earning while you sleep with reliable returns from these 24 dividend stocks with yields > 3% offering yields above 3% for steady income.

- Ride the future of artificial intelligence by checking out these 26 AI penny stocks making waves in everything from automation to next-gen security.

- Be among the first to spot value gems with these 834 undervalued stocks based on cash flows based on robust cash flow metrics before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives